- Market boosts following U.S. Bitcoin reserve speculation and potential financial policy shifts.

- Market anticipation fuels Bitcoin’s recent rebound.

- Federal Reserve independence comments influence Bitcoin positively.

Trump’s suspected executive order to establish a national-level Bitcoin reserve continues to stir curiosity as the deadline for the treasury report nears.

The report could redefine national cryptocurrency strategy and impact financial markets amid ongoing discussions on Federal Reserve independence.

Trump’s Potential Order and Market Speculation

The uncertain situation surrounding a possible U.S. executive order on Bitcoin reserves has sparked heightened speculation. Market rumors suggest Trump’s administration may have initiated plans for a national-level Bitcoin reserve. Government and financial insiders remain tight-lipped as the deadline for the Treasury’s report approaches.

Bitcoin prices have seen an increase as speculators bet on the potential outcomes of such a plan. The upcoming assessment report is expected to provide clues on the feasibility and implications of a U.S. Bitcoin reserve.

“Our Series D funding will help us build the safe source for all open-source projects,” said the CEO of Chainguard. (source)

Economic Indicators and Blockchain Integration

Did you know? The last major Bitcoin boom was driven by speculations of institutional investment and regulatory shifts, echoing today’s market dynamics.

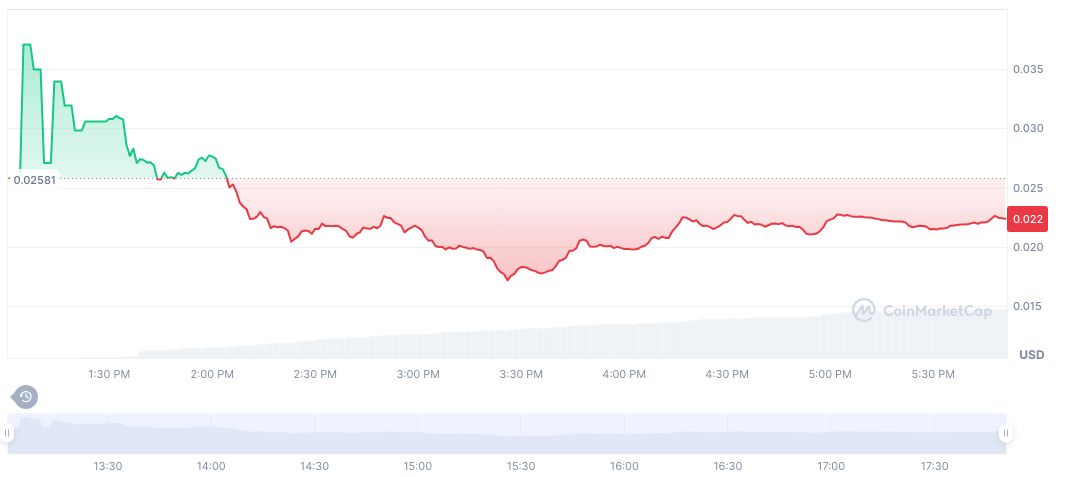

Last updated at 18:47 UTC on April 23, 2025, CoinMarketCap reports ZORA’s price at $0.02. The token has a market dominance of 0.00% and a fully diluted market cap of $235.94 million. Over 24 hours, trading volume reached $78.11 million with substantial fluctuations.

The Coincu research team notes current economic indicators imply a mixed potential for cryptocurrency integration into national reserves. Regulatory hurdles abound, yet technological advancements advance the case for asset diversification. Proponents argue for a strategic embrace of blockchain technologies.