- Key Point 1

- Key Point 2

- Key Point 3

Sol Strategies Inc., known for its blockchain innovation, announced a $500 million convertible note agreement with ATW Partners to expand its Solana token holdings and develop a staking platform.

The deal, the largest in Solana’s ecosystem, highlights the growing interest in institutional staking. Increased holdings are likely to enhance network security and liquidity.

Sol Strategies’ $500M Deal with ATW Partners

SOL Strategies Inc. has reached a financing agreement with ATW Partners to enhance its SOL holdings and develop its institutional staking platform. The initial tranche of $20 million will kickstart operations, with up to $480 million in additional funds subject to conditions.

CEO Leah Wald expressed that this financing structure, directly tied to staking yield, will be accretive to the company’s balance sheet and scalable validator business. This setup marries capital markets with proof-of-stake networks. “This is the largest financing facility of its kind in the Solana ecosystem—and the first ever directly tied to staking yield. Every dollar deployed is immediately accretive to our balance sheet and validator business. This structure is not only innovative—it is highly scalable.”

The financing drew attention across the crypto community, with institutional partners like Neptune Digital Assets expressing confidence in Sol Strategies’ infrastructure for its staking needs. This sentiment underscores a broader validation and demand for Solana staking.

Solana’s Market Position Amid Record Funding

Did you know? The structure of this $500 million financing is similar to MicroStrategy’s Bitcoin investments but is unique in tying directly to staking yield, marking a potential new trend in PoS network funding.

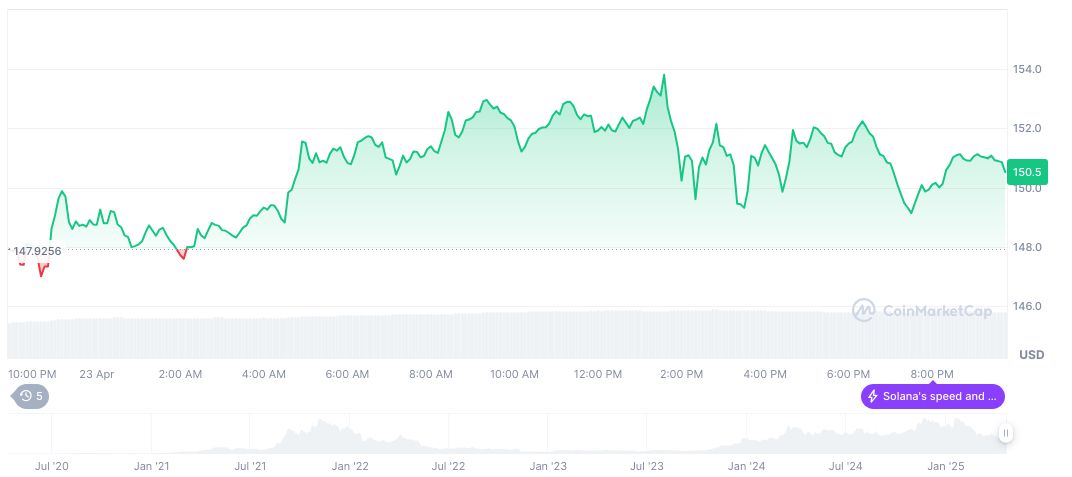

According to CoinMarketCap, Solana’s current price stands at $148.35, with a market cap of $76.74 billion. It dominates 2.65% of the market, and recent price changes have shown fluctuations, including a 11.38% increase over the past week. Daily trading volumes reached $4.44 billion, exhibiting a slight decrease.

The Coincu research team notes that this unprecedented deal could lead to increased financial strategies focusing on validator returns. Enhanced security and sustainability within the Solana ecosystem appear viable, positioning SOL for further adoption and potentially stabilizing market fluctuations. Recent reports highlight that Solana’s revenue has plummeted 93% as memecoin fades, raising questions about the sustainability of its market performance.