- Coinbase plans to list ZORA, potentially increasing token market visibility.

- ZORA has backing from Coinbase Ventures.

- Prior Coinbase listings have led to significant market impacts.

Coinbase has officially announced it will include ZORA in its listing roadmap, effective as of April 25th. This decision could enhance ZORA’s market exposure, possibly affecting its price and adoption rates. Market analysts anticipate increased interest and potential trading volume for ZORA once it becomes available on Coinbase.

ZORA’s inclusion could potentially spur price and adoption changes, as history suggests that new listings on major exchanges often increase market access and visibility. The ZORA community is likely to react positively, expecting increased liquidity and trading opportunities.

ZORA’s Strategic Entry and Financial Implications

Coinbase, one of the largest cryptocurrency exchanges, has added ZORA to its listing roadmap. This decision follows strategic funding from investors like Coinbase Ventures, which previously raised $60 million for ZORA.

“We are excited for our upcoming listing on Coinbase, which marks a significant milestone for Zora and its community.” – Zora Team Representative, Zora

Price Movements and Expert Predictions

Did you know? Past token listings on Coinbase typically result in price surges, illustrating the significant impact of such strategic moves on market dynamics.

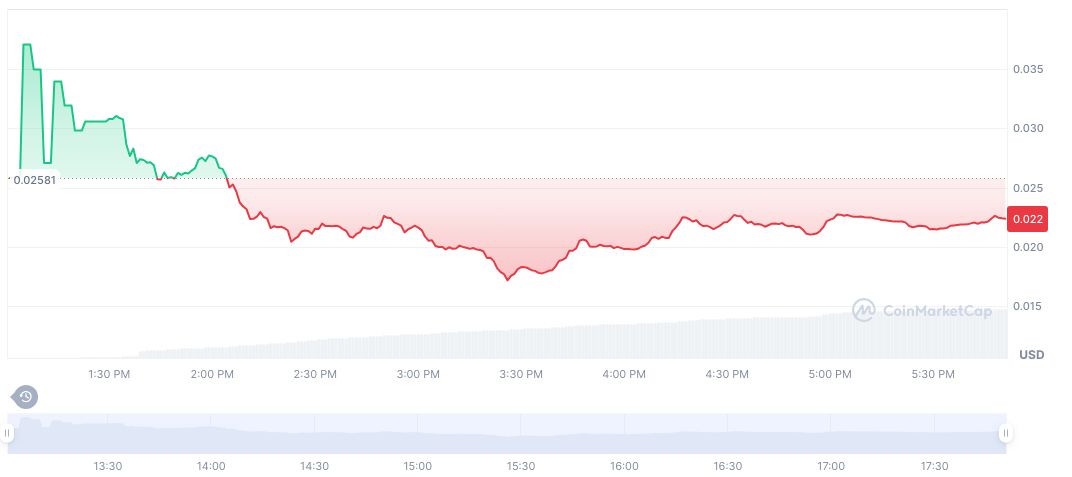

According to CoinMarketCap, ZORA is currently priced at $0.03, with a fully diluted market cap of $253.80 million. Despite the zero circulating supply figures, its 24-hour trading volume surged by 79.02%, reaching $123.54 million. The price has increased by 14.62% over the last 24 hours but declined by 1.66% over longer durations.

The Coincu research team suggests that ZORA’s entry into Coinbase’s ecosystem points to potential financial advantages. However, market impacts remain uncertain, as liquidity and regulatory factors evolve with its anticipated broader market adoption.