- Ondo Finance discusses tokenized securities compliance with the SEC.

- Focus on regulatory frameworks and sandbox options.

- Potential impact on Ondo’s offerings and industry standards.

Ondo Finance held talks with the SEC on April 24, focusing on tokenized securities compliance for U.S. markets. The meeting may shape future regulatory landscapes for tokenized securities, affecting compliance and market dynamics.

Ondo Finance and legal representatives engaged with the SEC’s Crypto Asset Task Force to explore a compliance framework for tokenized securities in the U.S. market. Key topics included registration and broker requirements, financial crimes compliance, and the potential for a regulatory sandbox. Crypto Asset Task Force. Davis Polk & Wardwell provided legal support to Ondo.

Ondo’s Regulatory Move Could Set Industry Precedents

Regulatory sandboxes have been previously effective in the fintech sector, helping entities navigate compliance while advancing innovation in digital finance frameworks.

Ondo Finance seeks regulatory clarity for issuing tokenized versions of U.S. publicly traded securities. Seeking a sandbox could promote innovation by allowing experimentation under regulatory supervision, potentially accelerating market acceptance of these instruments.

Nathan Allman, Founder and CEO of Ondo Finance, stated, “Our proposed agenda is as follows: Introduction to Ondo Finance; Tokenized securities structuring models; Considerations for tokenizing securities, such as those related to: Registration requirements, Broker-dealer requirements and rules, Various market structure regulations, Financial crimes compliance, State corporate laws; Approaches to tokenization to address core considerations; Sandbox or other relief.” SEC Meeting Memorandum

Reactions from the crypto community and mainstream financial markets were limited as the meeting focused on foundational regulatory frameworks. No immediate market impact or major statements from crypto influencers were recorded, highlighting the preliminary nature of the discussions.

Market Data and Insights

Did you know? Regulatory sandboxes have been instrumental in fostering innovation in various sectors by allowing companies to test new products under regulatory oversight.

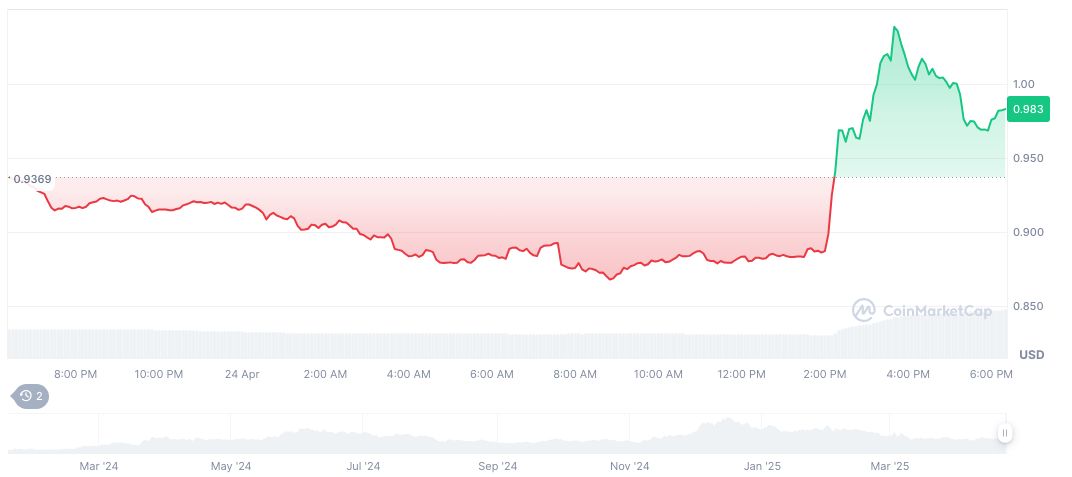

According to CoinMarketCap, Ondo (symbol: ONDO) is currently priced at $0.99, with a market capitalization of $3,112,173,483 billion, reflecting a 5.17% increase over 24 hours. Circulating supply stands at 3,159,107,529, and the 24-hour trading volume is $405,549,268—a 65.30% change.

Experts indicate the meeting’s outcome could serve as a precedent for blockchain-based securities in U.S. markets. If regulatory clarity is achieved, it may lead to increased institutional participation and influence future technological developments in the tokenization ecosystem.