- The Federal Reserve holds rates steady amid economic concerns.

- Market expects a cautious Fed stance.

- Bitcoin and Ethereum prices remain sensitive to Fed actions.

The Federal Reserve held interest rates steady at 4.25%-4.50% on May 8, 2025, amid growing economic uncertainties linked to tariffs.

The pause in rate changes reflects the Fed’s focus on economic stability, with investors and markets responding cautiously to economic implications.

Fed Holds Rates With Inflation and Tariffs in Focus

The Federal Reserve, led by Jerome Powell, kept interest rates stable within the 4.25%-4.50% range. This marks the third consecutive rate hold, consistent with market predictions amid economic uncertainties related to tariffs. Powell acknowledged the Fed’s dual concerns: inflation and unemployment, highlighting the potential impact of tariffs.

The ongoing tariff issues could affect inflation and economic growth. Maintaining stable rates signals a cautious approach as the Fed navigates rising risks. Markets reacted by stabilizing interest rates on loans and mortgages, although sentiment remains tentative given potential inflation. Jerome Powell noted, “If the large increases in tariffs that have been announced are sustained, they’re likely to generate a rise in inflation, a slowdown in economic growth and an increase in unemployment.”

Market reactions highlighted the Fed’s warning of simultaneous inflation and unemployment threats. Bitcoin and Ethereum, sensitive to such policy stances, exhibited minor fluctuations. Powell’s emphasis on tariff impacts likely influences future decisions, leaving investors alert to potential actions.

Crypto Markets Adjust to Federal Rate Strategies

Did you know? Current Federal Reserve policies contrast with 2020-2021’s low rate period, which significantly boosted crypto markets.

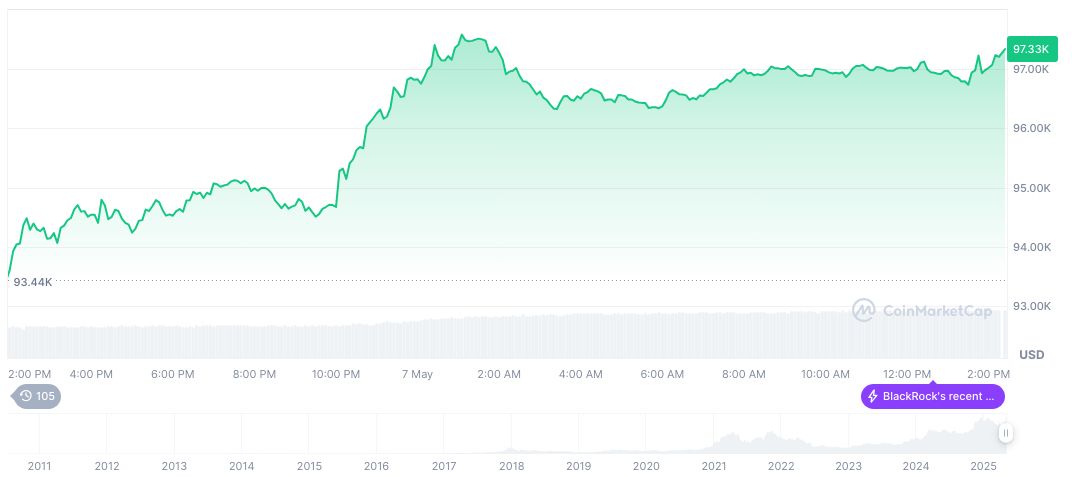

Bitcoin’s price stands at $97,217.35 with a market cap of $1.93 trillion. Its 24-hour trading volume increased by 214.83% to $77.91 billion. Bitcoin’s price rose 1.16% over 24 hours, 3.30% in a week, and 21.74% over 30 days, signaling fluctuating investor interest despite economic uncertainties (CoinMarketCap).

Coincu research suggests potential growth in crypto as investors seek alternatives amidst uncertain monetary policy. Speculative assets like Bitcoin and Ethereum might gain appeal, with market sentiment closely tied to future Fed actions. Historical data indicates shifts in crypto activity following similar economic events.