- VanEck launches NODE ETF focusing on blockchain and digital assets.

- Official trading starts May 14, 2025.

- SEC approval indicates regulatory openness to crypto investments.

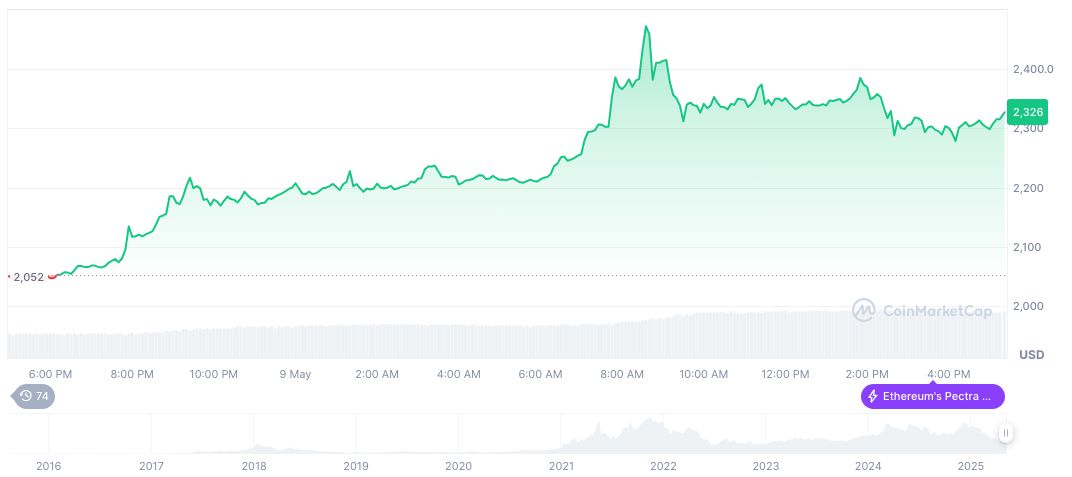

Ethereum (ETH), according to CoinMarketCap, is priced at $2,336.37 with a market cap of $282.07 billion. Ethereum’s 24-hour trading volume is $42.02 billion, showing a rise of 5.08% over the last day. The 7-day and 30-day price changes are 27.13% and 45.20%, respectively, despite a 12.85% decline over 90 days.

Analysts from Coincu suggest that institutional involvement is likely to increase as regulatory frameworks continue to evolve. The historical inclusion of crypto-related equities in investment portfolios could drive demand for associated assets such as Ethereum and Bitcoin.

VanEck NODE ETF Targets Blockchain and Digital Assets

VanEck will debut the NODE ETF, which will invest in companies across sectors such as crypto exchanges, data centers, and blockchain infrastructure. Managed by the fund aims to offer equity exposure to the blockchain sector through public market equities.

The NODE ETF will allocate funds to crypto-linked exchange-traded products, ensuring compliance with U.S. tax laws. It targets a broad range of contributory companies, making it a diversification move for VanEck.

Market analysts note the ETF’s SEC approval as a critical regulatory milestone. Matthew Sigel highlighted the fund’s commitment to delivering a diversified portfolio. “Our goal with the NODE ETF is to provide investors with diversified exposure to the emerging digital asset economy while complying with U.S. tax regulations,” noted Sigel. Industry stakeholders view it as an opportunity for broader institutional entry into the blockchain space.

Ethereum’s Price Reaction and Institutional Interest

Did you know? VanEck’s NODE ETF launch joins a series of crypto-related equity ETFs that historically trigger initial trading volume spikes, contributing to the sector’s mainstream financial integration over time.

Ethereum (ETH), according to CoinMarketCap, is priced at $2,336.37 with a market cap of $282.07 billion. Ethereum’s 24-hour trading volume is $42.02 billion, showing a rise of 5.08% over the last day. The 7-day and 30-day price changes are 27.13% and 45.20%, respectively, despite a 12.85% decline over 90 days.

Analysts from Coincu suggest that institutional involvement is likely to increase as regulatory frameworks continue to evolve. The historical inclusion of crypto-related equities in investment portfolios could drive demand for associated assets such as Ethereum and Bitcoin.