- Key Point 1

- Key Point 2

- Key Point 3

Coinbase has unveiled its Q1 2025 financial strategy focusing on expanding on-chain transaction capabilities. The company aims to leverage decentralized exchanges for future growth, as stated during its recent earnings call.

This strategic move aims to position Coinbase strongly against increasing competition from traditional financial institutions, benefiting from a projected shift in trading patterns.

Coinbase Bets Big on DEX with $10B Deribit Acquisition

CEO Brian Armstrong expects decentralized exchanges (DEX) to eventually surpass centralized exchanges (CEX) in trading volume. Coinbase is investing heavily in this space, highlighting its intent to enhance its DEX capabilities and plans to enable front-end trading via Coinbase Wallet. The acquisition of Deribit for $10 billion further underscores this shift, allowing Coinbase to broaden its reach into derivatives and bolster its financial offerings.

By pursuing on-chain transactions and expanding globally, Coinbase aims to tap into new opportunities. Additionally, its products like USDC are anticipated to benefit. As part of this international expansion, the company secured a license in Argentina and completed regulatory processes in India, paving the way for deeper market penetration.

Community and market reactions have been varied, with some lauding the foresight into the future of exchanges, while others express skepticism due to the inherent risks of DEXs. Coinbase is undeterred, emphasizing that the diversification aligns with their long-term vision.

Global Expansion and Regulatory Milestones

Did you know? In 2019, decentralized exchanges accounted for only 10% of the total trading volume, illustrating the rapid growth and emerging dominance anticipated by Coinbase’s leadership in the coming years.

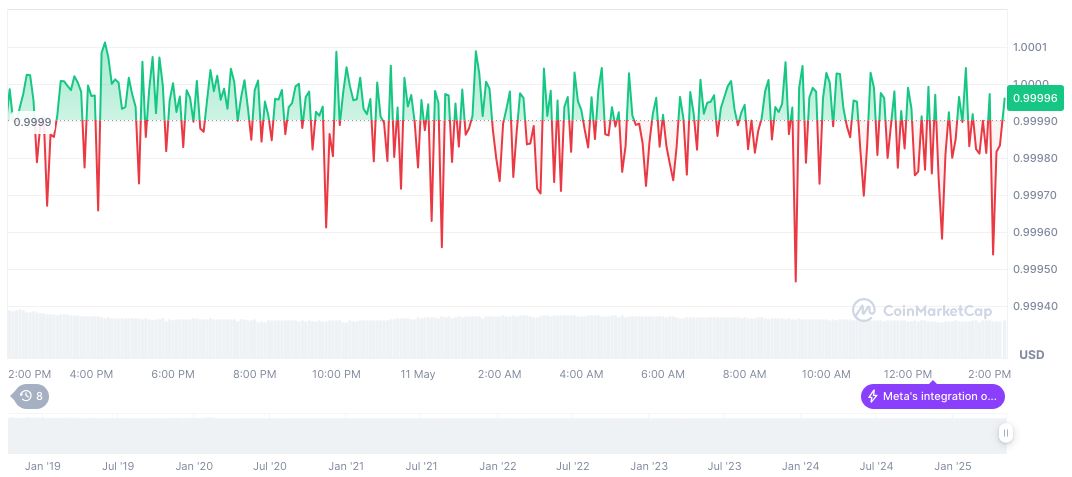

USDC (USDC) currently trades at $1.00, with a market cap of $60.79 billion, according to CoinMarketCap. Despite minor price adjustments over the past few months, USDC’s 24-hour trading volume remains robust at $10.35 billion. The stablecoin maintains a market dominance of 1.83%, reflecting stable performance amidst market volatility.

Experts from the Coincu research team suggest that Coinbase’s aggressive DEX and international expansion strategy can yield significant financial and technological benefits over time. However, they caution that regulatory challenges must be navigated carefully to maintain growth momentum.