Lagrange Labs Launches LA Token Airdrop for Turing Roulette Participants

- LA airdrop targets Turing Roulette participants on EigenLayer.

- Recent funding led by Founders Fund underscores confidence.

- LA tokens to be native payment for ZK proof fees.

Lagrange Labs plans to initiate the registration for its LA token airdrop on May 28th, 2025, specifically targeting participants of its Turing Roulette game on the EigenLayer platform.

The airdrop is part of Lagrange Labs’ strategic roadmap, underpinned by a recent funding round of $13.2 million led by Founders Fund, to integrate LA tokens deeply within its proof ecosystem. Peter Thiel from Founders Fund remarked about the robust institutional confidence in Lagrange’s technological pursuits and future plans.

Trading Insights and Market Projections for LA Token

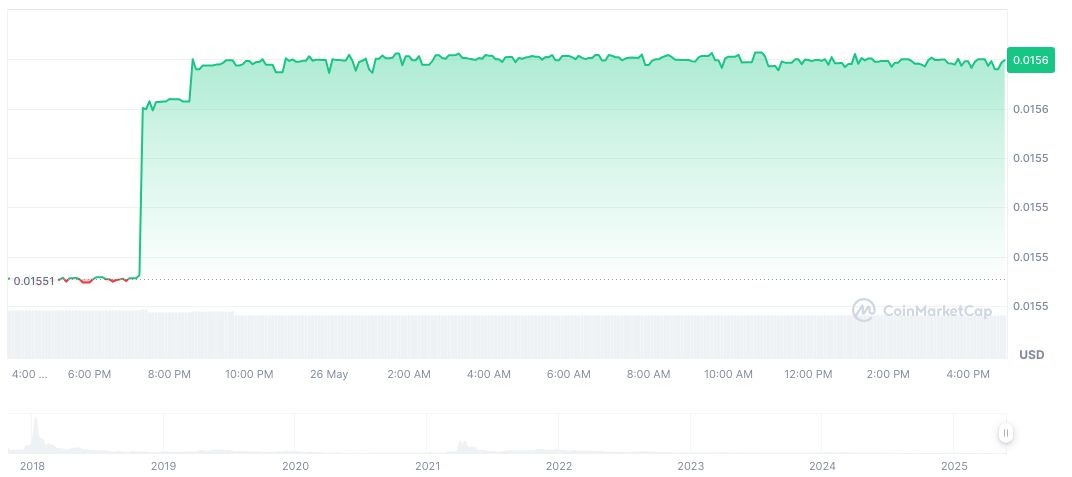

According to CoinMarketCap, the LATOKEN currently trades at $0.02, with a circulating supply of 380,105,462, contributing to a market cap of approximately $5.94 million. Recent trading figures indicate minimal volatility, reflected by a slight 0.73% increase over 24 hours, but a longer-term downward trend is visible with a 7.98% decline over 60 days. Insights from Coincu’s research suggest the potential for LA’s integration to bolster the ZK proof sector, though technological and market variables remain key influencing factors.

The future of the LA Token is promising, as Lagrange Labs emphasizes its role as the native payment system for ZK proof fees. As stated on the Lagrange Labs Official Project Website, “LA tokens will be the native payment system for ZK proof fees and for mortgages, central to driving its proof economic model and ecosystem growth.”

Lagrange Labs Future Prospects

Did you know? The implementation of tokens like LA in ZK protocols often parallels surges in user engagement and adoption, reminiscent of past trends observed in major airdrops like StarkWare and zkSync.

According to CoinMarketCap, the LATOKEN currently trades at $0.02, with a circulating supply of 380,105,462, contributing to a market cap of approximately $5.94 million.

Recent trading figures indicate minimal volatility, reflected by a slight 0.73% increase over 24 hours, but a longer-term downward trend is visible with a 7.98% decline over 60 days.