- Garrett Jin’s BTC-to-ETH swap raises cash flow concerns.

- Major BTC outflows, ETH inflows impact liquidity.

- Industry debates exchange practices and leverage issues.

On October 14, Garrett Jin’s $4.23 billion switch from Bitcoin to Ethereum, with critiques on crypto liquidity, spotlighted in PANews’ recent updates.

Jin’s massive trade and comments emphasize the crucial liquidity issues facing Bitcoin and Ethereum, raising concerns about market sustainability and exchange practices.

Garrett Jin’s $4.23B Swap Alters Crypto Liquidity

This move has increased scrutiny on Bitcoin outflows and corresponding Ethereum inflows, suggesting a shift in whale strategies. Jin emphasized that exchanges should revise listing standards to ensure the market’s long-term health, potentially affecting how tokens are launched and traded.

Responses from industry leaders, such as Binance’s Changpeng Zhao, were notable. Zhao amplified discussions around Jin’s trade by sharing analysis of his large positions. “If exchanges continue offering extreme leverage, they should at least implement a stabilization fund-like mechanism, similar to U.S. equities.”

The community debate centers on the need for responsible exchange behavior and enhanced listing protocol oversight.

Crypto Industry Faces Cash Flow and Exchange Challenges

Did you know? Previous shifts from Bitcoin to altcoins often precipitate market liquidity challenges, as seen in early 2022 and post-LUNA events.

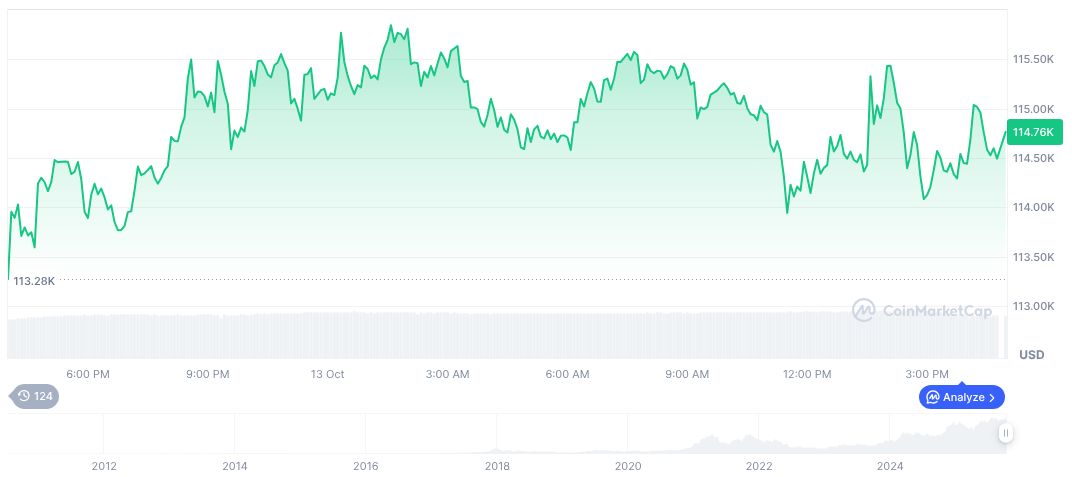

According to CoinMarketCap, Bitcoin currently trades at $111956.09, holding a market cap of approximately $2.23 trillion. With a 24-hour trading volume of $74.80 billion, Bitcoin’s market dominance stands at 58.72%. Recent data shows a 24-hour price decrease of 3.08%.

Insights from the Coincu research team suggest that Garrett Jin’s actions could accelerate a shift in market preference toward Ethereum, fostering debates on cash flow models. The research underscores the importance of regulatory focus on high-leverage exchanges and achieving a balance between liquidity and growth in the sector.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |