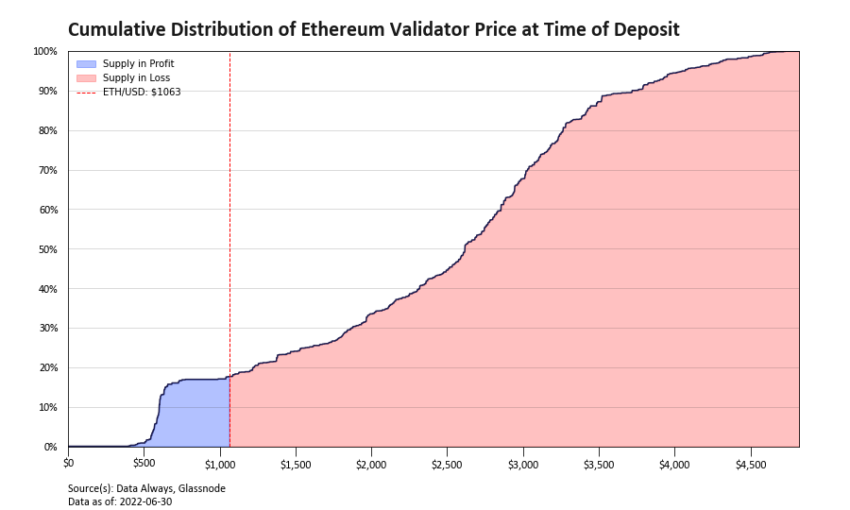

Only a handful of investors staking Ethereum on the Beacon Chain are still making a profit as the asset’s price continues to fall. According to research by the founder of Parsec Finance, Will Sheehan, up to 83% of Ethereum stakers are currently at a loss. That number could add up quickly if ETH drops to triple digits.

On July 1, Sheehan posted a chart revealing that only 17% of Ethereum stakers are profitable, meaning they stake when the price is below current levels. The majority stake while the largest altcoin is priced between $2,500 and $3,500 according to the chart.

The chart only shows the staking price and does not take into account the additional reward in ETH, currently at around 4.2% APY.

A Glassnode chart from June 30 confirms that non-genesis stakers are currently losing money. However, the chart only shows the ETH price at the time of staking and not at the time of purchase, so those figures may be somewhat misleading.

When the Beacon Chain went live in early December 2020, Ethereum was worth over $600. At the end of the month, it hit $750 and reached its current level of around $1,050 on Jan 5. Therefore, only coins staked between December 1, 2020, and January 5, 2021, are profitable at the moment.

A final capitulation could push Ethereum down to a level where all stakers are in the red. Daniel Cheung, the co-founder of Pangea Fund Management, has just predicted the ETH price will remain around $500 in the next 2 months as CoinCu reported. At the time of writing, there are 13.6 million ETH staked on the Beacon Chain. At current prices, this is estimated at $14.2 billion and represents 11.2% of the total circulating supply.

According to tracker Ultrasound.Money, a total of 2.5 million ETH (currently worth $2.6 million) has been burned since the introduction of EIP-1559 in early August 2021. Burn rates are now low due to reduced block space demand, reducing average gas to around $3.

At the time of writing, ETH is trading at $1,072 after sliding 1% over the past 24 hours. The asset is down 43% for the month and is now 79% below its all-time high in November 2021.

However, there could be more pain, as ETH’s decline in the previous bear market lasted nearly 93% and the final exit was not unexpected by some analysts.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News