Every four years, the amount of Bitcoin awarded to miners is halved, an event known as the Bitcoin halving. How does this affect the price of Bitcoin?

To understand bitcoin’s halving, it’s important to first know the cryptocurrency’s limited supply. The inventor of Bitcoin, Satoshi Nakamoto, believed that scarcity could create value where there was none before. After all, there’s only one Mona Lisa, only so many Picassos, a limited supply of gold on Earth.

Bitcoin was revolutionary in that it could, for the first time, make a digital product scarce – there will only ever be 21 million Bitcoin. Satoshi Nakamoto got this idea because he realized that the devaluation of fiat money could have disastrous effects.

What is the Bitcoin halving?

Embedded in the Bitcoin code is the hard cap of 21 million coins. New Bitcoin is released through mining.

However, about every four years, the reward for mining is halved, and each halving reduces the rate at which new Bitcoin enters the supply – a process that likely will last until 2140.

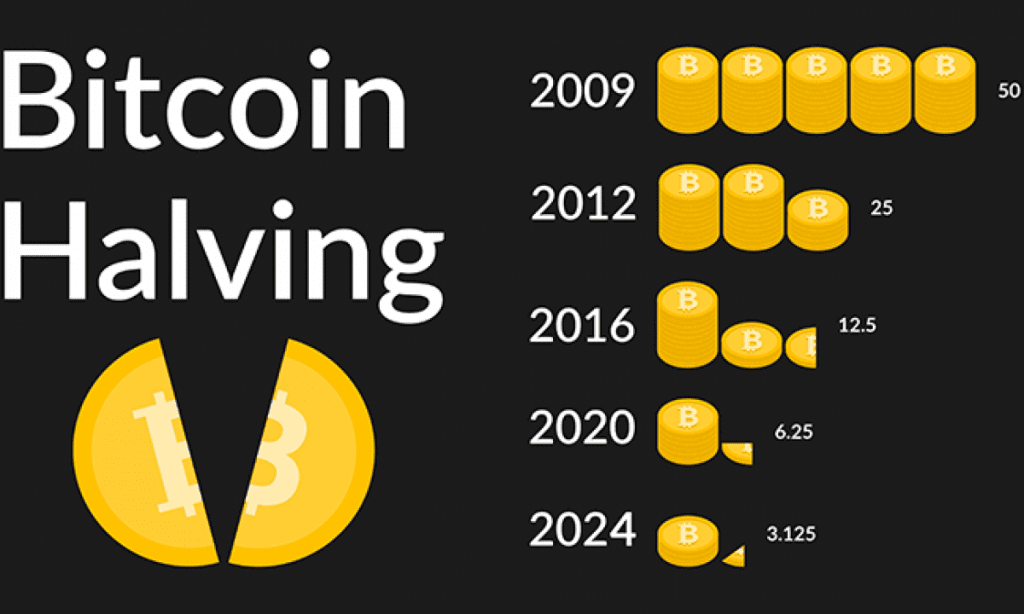

Historically, this event has gone through 4 times:

- 2009 – Bitcoin mining rewards start at 50 BTC per block.

- 2012 – The first Bitcoin halving reduces mining rewards to 25 BTC.

- 2016 – In the second halving, mining rewards go down to 12.5 BTC.

- 2020 – In the third halving, mining rewards drop to 6.25 BTC.

2140 – The 64th and last Bitcoin halving occurs and no new Bitcoin are created.

What’s so special?

If a person, group, or government is trusted to set up the money supply, they must also be trusted to not mess with it. Bitcoin is supposed to be decentralized.

By writing a total supply and halving event into the Bitcoin code, the monetary system of Bitcoin is essentially set in stone and practically impossible to change. This “hard cap” means Bitcoin is a kind of “hard money” like gold, the supply of which is practically impossible to change.

Price impact

The argument over whether the price of Bitcoin is affected by price halvings or if they are already “priced in” is still raging.

The rules of supply and demand dictate that when the supply of Bitcoin decreases, there should be an increase in demand, which would raise the price of Bitcoin. The stock-to-flow model, one idea, determines a ratio based on the amount of Bitcoin already in circulation and the amount that is being added to it, with each halving (unsurprisingly) having an effect on that ratio. Others, however, have contested the underlying premises that underlie the notion.

Prior halving events have historically resulted in an increase in the price of Bitcoin, though not right once and with other factors also coming into play.

The price of Bitcoin was approximately $660 at the time of the June 2016 halving; after the halving, it continued to trade horizontally until the end of the month before dropping as low as $533 in August. But then, by the end of the year, Bitcoin’s price had soared 2,916 percent to reach its then-record high of nearly $20,000.

The price of Bitcoin grew after the 2020 halving from little over $9,000 to over $27,000 by the end of the year, but it didn’t surpass $10,000 in the first two months. It’s also crucial to keep in mind that additional factors, including rising institutional investment from companies like MicroStrategy and PayPal’s decision to allow users to buy and store Bitcoin, contributed to Bitcoin’s bull run in 2020.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Foxy

Coincu News