Did Celsius Just Repay $120M to DeFi Protocol Maker?

Although Celsius is not totally confirmed to be the payor, it appears that it has paid Maker, the DeFi protocol that powers the Dai stablecoin, $120 million of its debt.

On June 13, Celsius initially stopped all withdrawals, exchanges, and swaps. The company now appears to be paying down its debt in an effort to restore liquidity.

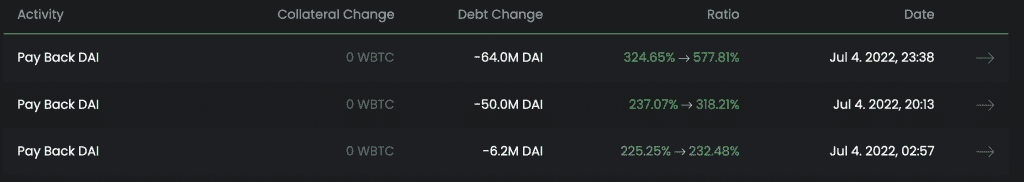

Data indicates that on July 3 and July 4, 2022, three major repayments were made to the multi-collateral Dai vault #25977.

64 million, 50 million, and 6.2 million DAI were exchanged in the transactions. The entire amount of such transactions, which are connected to the value of the dollar, is almost $120 million.

In addition, the vault received $22.6 million on July 1 and $53.7 million between June 14 and June 16.

These kinds of massive debt repayments might help Celsius in regaining its solvency and permit withdrawals once more.

Given that Celsius invests in a variety of crypto and DeFi contracts to provide income for its consumers, these Maker debts probably represent just a portion of the company’s overall obligations.

Even still, these payments have decreased the liquidation cost of Vault #25977 and the probability of a forced liquidation.

Wrapped Bitcoin (WBTC) is the collateral used by Vault #25977, and as such, it will be liquidated if the price of Bitcoin drops below a specific level. The liquidation price of the vault on June 13 was. $16,852, which was dangerously close to the monthly average June price of $20,000 for Bitcoin.

The vault’s liquidation price is now $4,966, with considerably more opportunity for price variation following the last month’s payments.

Both the ownership of the contested vault and the payment of these payments have not been confirmed by Celsius.

MCD vault #25977, on the other hand, is thought to belong to Celsius as it is controlled by an Ethereum address starting with 0x87a6. One of the Ethereum addresses linked to Celsius that Larry Cermak of The Block found in June is that one.

A Friday update from Celsius tells very little about the company’s DeFi investments. Instead, it implies that in order to reclaim solvency and reopen withdrawals, the company is considering strategic transactions and liabilities restructuring.

According to other reports from Sunday, the company fired a quarter of its workforce as a result of its liquidity issue.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Hazel

CoinCu News