Tornado Cash, a coin mixing mechanism for hiding blockchain transaction history, was rejected in a vote to diversify its treasury assets into ether. This comes as many governance platforms continue to grapple with the fact that their treasuries are rapidly dwindling.

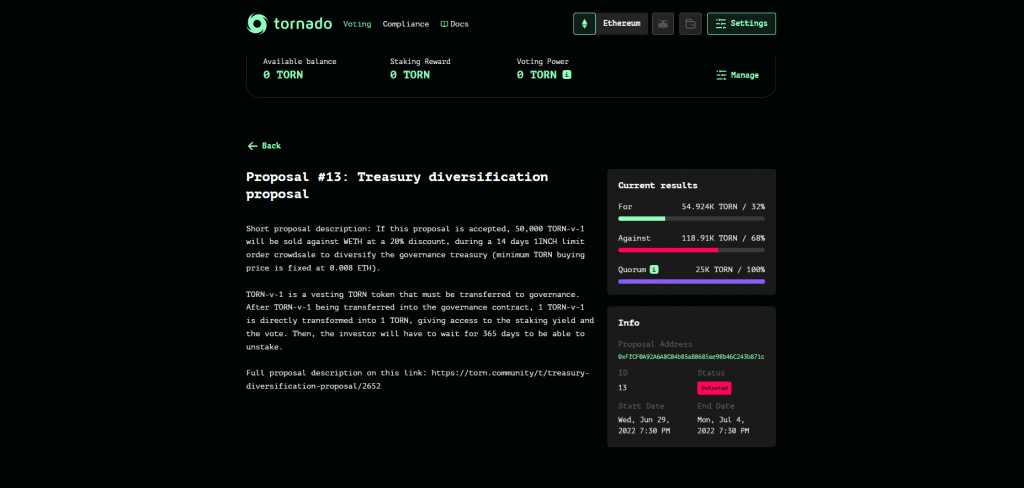

The proposal for the governance vote, which ended on July 4, was to sell 50,000 of its vested native tokens (TORN-v-1) for ETH via a two-week limit order crowdsale on the decentralized exchange aggregator 1inch. This crowdsale would have cost at least 0.008 ETH per coin. As a result, if the vote had been successful, the platform would have raised at least $480,000.

The tokens cannot be sold because they have been vested, but they can be used to vote on governance issues. As a result, bidders in their sale would have been able to participate in the governance process.

These tokens would have been locked up in governance for one year before being exchanged for TORN coins at a 1:1 ratio. Buyers would have also earned the benefits of staking during the vesting period.

According to the voting page, 68% of those who voted were against the vote. Voter engagement in the process was about seven times the number required to create a quorum on Tornado Cash DAO, indicating that a sizable number of people weighed in (or ones with deep pockets). According to the coin mixing platform, voter participation in the proposal was over 200%, more than in the previous governance referendum.

Tornado Cash is the most recent DeFi protocol to examine treasury management in the present weak market. Because of the drop in cryptocurrency prices, the value of their treasuries has plummeted dramatically. This scenario has resulted in governance suggestions on various projects with the goal of diversifying their treasuries.

Lido Finance, the liquid staking powerhouse, is considering selling $17 million in ETH to help the firm through the present market conditions. The project’s treasury solely contains its native token, which is down more than 90%.

Fei Protocol, a stablecoin issuer, has also voted to sell some of its treasury tokens, including Curve, Convex, and Aave, for the Dai stablecoin. The move was made to raise the stablecoin’s treasury share.

Furthermore, MakerDAO is proceeding with plans to invest $500 million of its treasury in stocks, despite the fact that this is not due to falling prices (since its treasury largely comprises stablecoins).

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Patrick

CoinCu News