The crypto trading firm founded by SBF is Voyager Digital’s second-largest borrower after Three Arrows Capital, according to a Chapter 11 bankruptcy filing.

Alameda Research is Voyager’s 2nd largest borrower

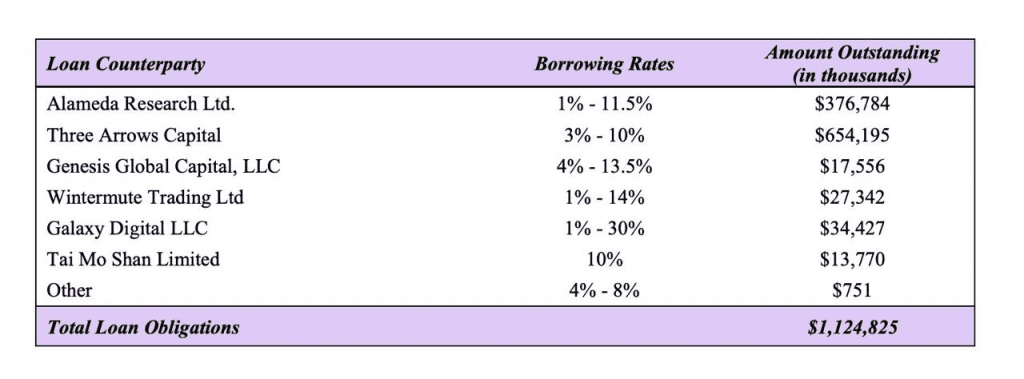

According to Voyager Digital’s Chapter 11 bankruptcy filing, Alameda Research, the company formed by crypto millionaire Sam Bankman-Fried that last month issued a $500 million line of credit to the cryptocurrency broker, owes the company $377 million.

It’s an unexpected revelation that’s come to light by way of a bankruptcy that’s seemed like a foregone conclusion since Voyager disclosed that hedge fund Three Arrows Capital owes it more than $600 million.

Alameda Research owes Voyager $377 million at an interest rate of 1% to 5%, according to a chart on page 13 of the bankruptcy filing, which was presented in a New York district court today. On page 119 of the petition is a list of company’s greatest unsecured claims, which includes a $75 million unsecured loan.

Alameda’s debt makes it company’s second largest borrower after the insolvent Three Arrows Capital, which also goes by 3AC.

When the extent of 3AC’s trouble became clear, largely because of $200 million it lost in the Terra collapse in May, its lenders began to realize that huge 3AC loans on their books were about to go into default. Then, on Wednesday last week, a British Virgin Islands court ordered 3AC to liquidate. That means 3AC must cease all operations and allow the court to oversee the selling of its assets to offset what it owes creditors, including Voyager Digital.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Foxy

Coincu News