According to statistics, Ethereum’s Chain PoW with GPU support generated around $19 billion in revenue last year for ETH miners. But these revenue streams are in jeopardy as Ethereum is expected to transition to a PoS blockchain through the “Merge” upgrade in September.

Miners can revolt against the new upgrade by continuing to mine on the old PoW ETH after the hard fork chain split.

A recent hedge fund Galois Capital survey revealed that 33.1% of respondents believe that Merge will create two parallel blockchains: ETH1 (PoW) and ETH2 (PoS). On the other hand, most respondents (53.7%) expect Ethereum chain to transition smoothly from PoW to PoS.

Is ETH1 PoW “illogical”?

Controversial hard forks are nothing new. The current ETH chain was born in 2016 following a controversial hard fork that reversed a $60 million mining attack that resulted in a chain split between ETH and Ethereum Classic (ETC).

However, this view is controversial for Ethereum Classic and ETH1. Since Ethereum Classic is already a PoW chain, creating a similar chain (ETH1) would not be “appropriate,” according to some Redditors.

Other comments on Reddit explained why ETH1 would fail:

- ETH1 will not attract users.

- Decentralized finance and the NFT sector will collapse in the PoW chain.

- Traders will dump ETH1 tokens to stake more ETH.

Meanwhile, most respondents to the Galois Capital survey also believe that exchanges and projects (especially Tether) will support ETH2 instead of ETH1 in the event of a hard fork.

What does that mean for ETC?

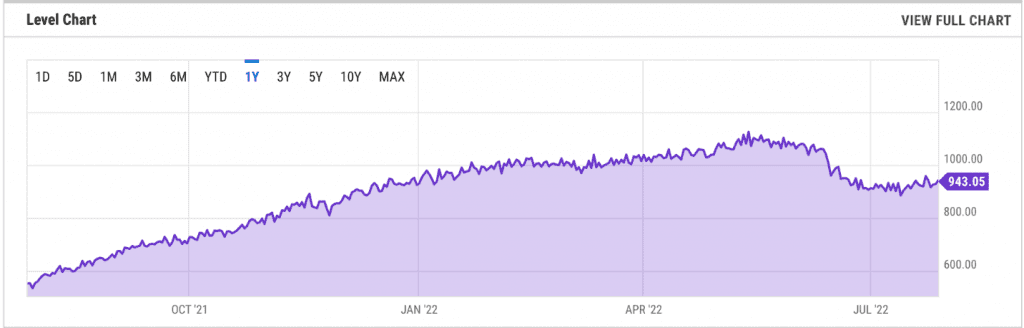

After hitting a record high in May 2022, the ETH network’s hashrate is trending downward, indicating that miners are pausing or closing mining rigs in the weeks leading up to the Merge.

On the other hand, it is possible that they have converted to stakers on the ETH PoS chain.

According to Tom’s Hardware GPU Price Index, the trend of miners exiting the Ethereum Network is reflected in the recent increase in GPU sales on the secondary market (compared to lower demand).

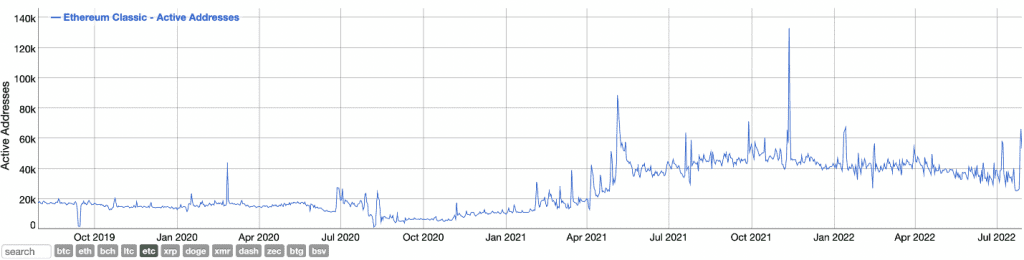

At the same time, the number of threads on social networks about the miners’ strategy after the Merge also increased. Perhaps they will switch to more profitable PoW chains. According to WhatToMine.com data, ETC is the most popular among miners as of July 29 due to a 116% weekly return.

At the same time, the price of ETC increased by more than 200% in July.

But that cannot overshadow the fact that Ethereum Classic is a small project compared to Ethereum. As of July 30, ETC has more than 53,000 daily active addresses compared to ETH’s 763,000.

Such a large spread shows that the current explosive ETC price is purely speculative as Ethereum Classic is still underused and is only popular with a few projects. Therefore, ETC is at risk of experiencing a “sell the news” event after the Merge. At the same time, a potential ETH1 PoW chain could also push down ETC demand.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News