According to a crypto trader, USDC, the second-largest stablecoin, is in serious jeopardy. The Fed’s aggressive approach has resulted in a crypto market sell-off.

Circle’s stablecoin, on the other hand, is fast losing ground, according to Geralt Davidson. Furthermore, the stablecoin’s market value has dropped significantly with no signs of recovery.

Geralt Davidson shows how the top 1% of addresses’ USDC supply has consistently declined. It demonstrates that the whales are selling their USD Coins. The Tornado Cash decision, according to Davidson, came at a poor time for the firm.

Tornado Cash was sanctioned by the US Treasury’s Office of Foreign Assets Control for money laundering operations. Circle has frozen all of its tokens on Tornado Cash.

Companies such as Tether, unlike Circle, did not freeze USDT on Tornado Cash addresses. According to Davidson, Circle’s decision has resulted in a loss of faith in the organization.

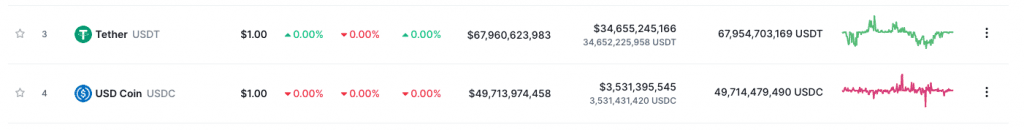

The volume of USDC on exchanges was extremely similar to the amount of USDT in February 2022. According to certain analysts, USDC will dethrone USDT as the best stablecoin by October 10, 2022. However, the second largest stablecoin is presently nowhere near competing with USDT. The market capitalization of USDT is approaching $67.9 billion, while that of USDC is $49.7 billion.

USD Coin just experienced a huge setback when Binance delisted USDC from its platform and suspended deposits. Instead, the platform allowed a 1:1 conversion of its customers’ USD Coin to BUSD. WazirX, India’s largest crypto exchange, followed Binance in delisting USD Coin.

With the Fed continuing to pursue hawkish policies, the lack of trust in USDC may be a problem for the stablecoin.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Harold

CoinCu News