Key Points:

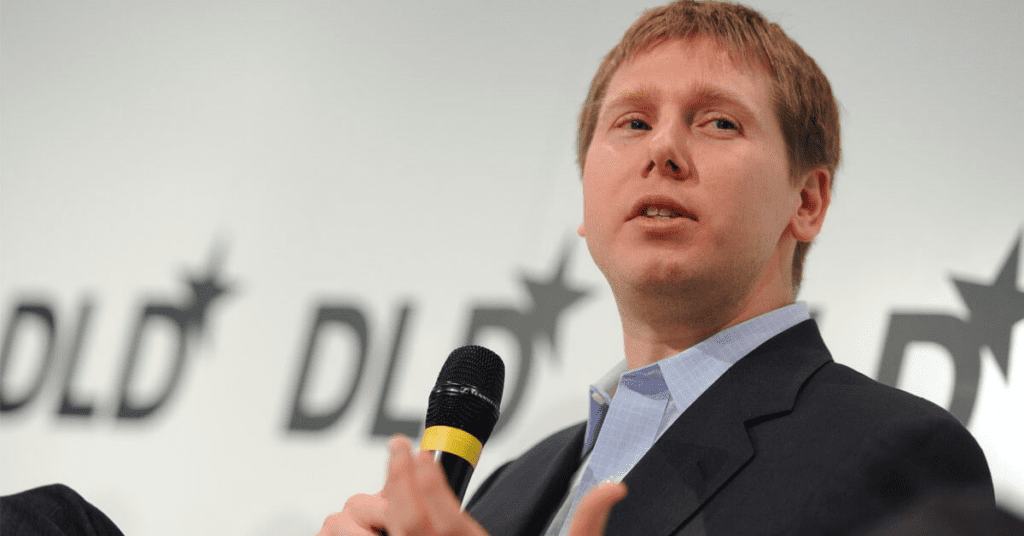

- Barry Silbert wrote a letter to shareholders to share the current situation of DCG and Genesis.

- The action comes after he was asked to resign by Gemini’s chief executive.

- Genesis is decommissioned, and DCG has no decision-making power over Genesis’ restructuring.

In the latest development from the contagion of the fall of FTX surrounding DCG and its subsidiary Genesis, DCG co-founder, and CEO Barry Silbert wrote a letter to shareholders east to share the current situation of DCG and Genesis.

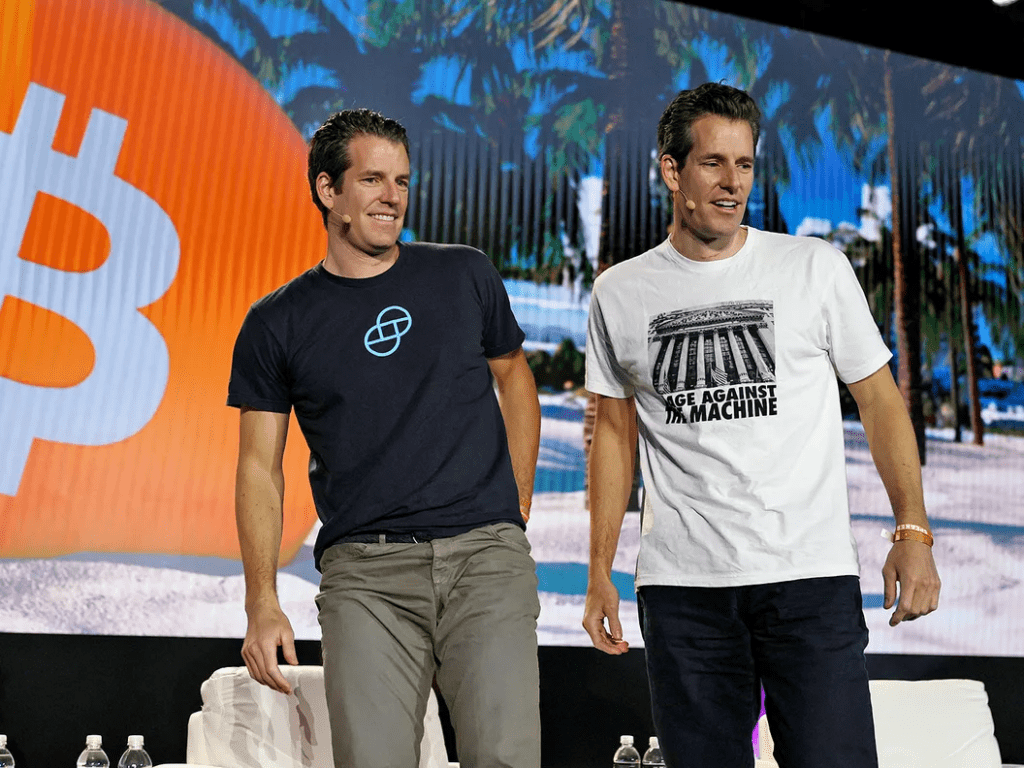

This action by Barry Silbert comes after Cameron Winklevoss, Gemini co-founder, announced in an open letter to the DCG board of directors that on behalf of users of Gemini’s Earn 340,000 product, he had requested DCG’s board of directors removed Barry Silbert and appointed a new CEO.

It is known that the relationship between the two founders of DCG and Gemini broke down after Genesis announced to stop withdrawing money in November 2022. This locked the funds belonging to investors in the Earning product and Gemini’s money, leaving Gemini struggling to find a way to get its customers’ money back.

Currently, Gemini Earn program has also stopped working, and Gemini’s side has issued a request to return all locked assets to Gemini.

In the body of the letter, DCG CEO Barry Silbert introduced more details about Genesis Capital’s lending division in a letter to investors. He noted that DCG has laid off employees and closed its crypto asset management headquarters.

He also asserted that funds had never been mixed between DCG subsidiaries and that its relationship with Three Arrows Capital was limited to a loan and transaction agreement, which the company further invested in some products of Grayscale.

During the Q&A session, Silbert addressed the controversy surrounding Genesis and its client Gemini. He said DCG borrowed from Genesis Capital, but “these loans are made on a free basis and are priced at prevailing market rates.”

DCG and Genesis Capital have a $1.1 billion promissory note maturing in 2032, and DCG currently owes Genesis $447.5 million and 4,550 bitcoins, worth about $78 million.

Regarding DCG’s role in the restructuring of Genesis Capital, Silbert said that due to the debts and promissory notes that DCG owes Genesis Capital, DCG executives, including those on the Genesis board of directors, do not have decision-making power regarding the restructuring of Genesis Capital.

“Because of the outstanding loans and the promissory note that DCG owes to Genesis Capital, DCG executives, including those on the Genesis board, have no decision-making authority related to any restructuring of Genesis Capital.”

He said.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Foxy

Coincu News