Key Points:

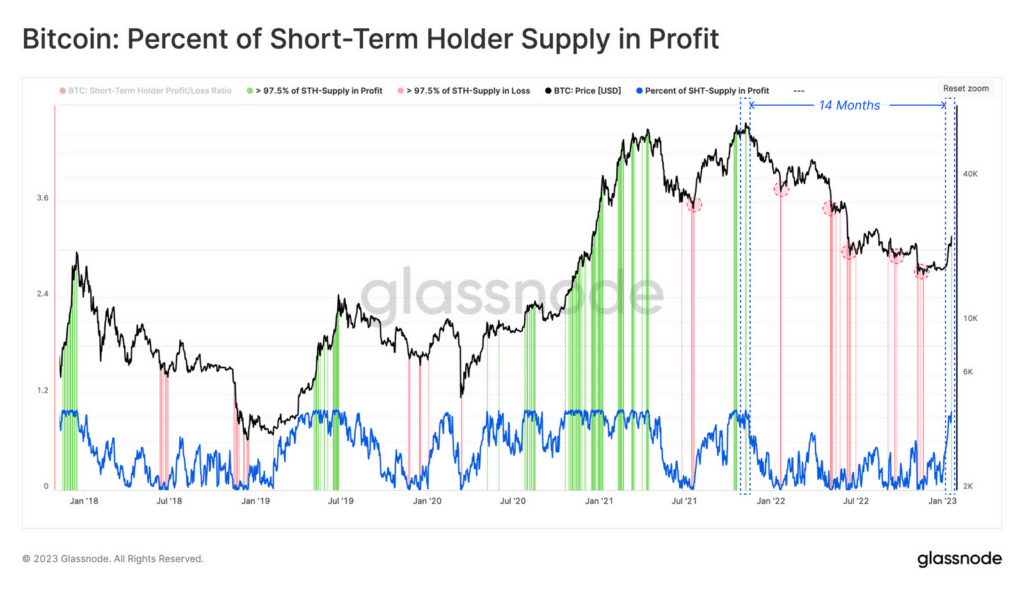

- Glassnode indicated the fact of the recent Bitcoin situation that historically 97.5% of STHs have had unrealized gains indicating that sell pressure is imminent.

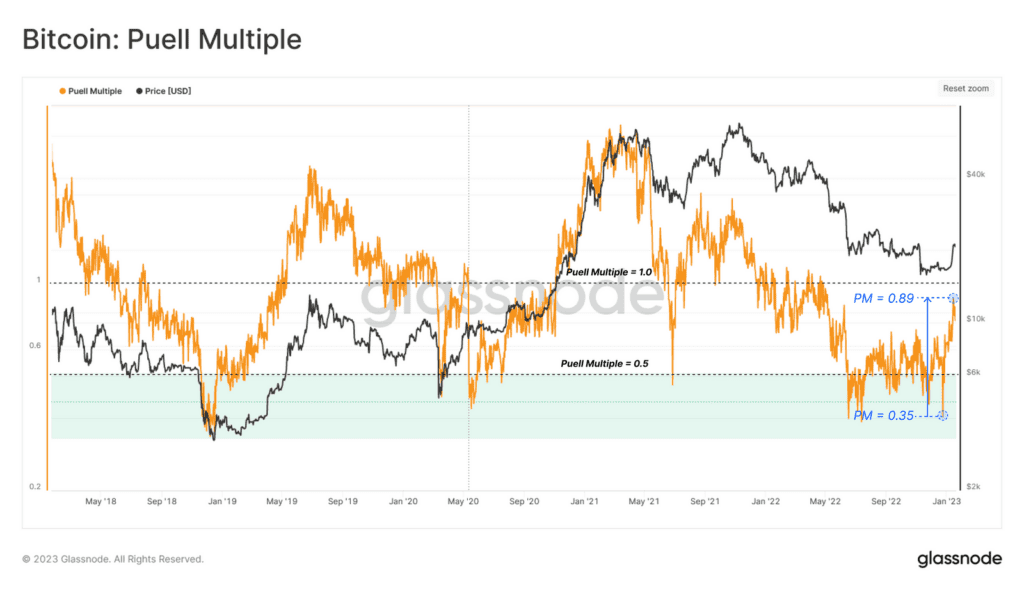

- Besides, miners are also selling Bitcoin as a result of the recent price increase.

According to market intelligence firm Glassnode, Bitcoin (BTC) may soon encounter sell-side pressure from short-term holders (STHs) anxious to capitalize on the king cryptocurrency’s current price increase.

As stated in a new analytics analysis from Glassnode, Bitcoin’s recent run above $23,000 placed 97.5% of its short-term investors into the green at one point during the week, which hasn’t happened since the biggest crypto asset by market cap reached its all-time high in November 2021.

Glassnode indicated the fact that historically 97.5% of STHs have had unrealized gains indicates that sell pressure is imminent.

Interestingly, during bear markets, when > 97.5% of the acquired supply by new investors is in loss ???? the chance of seller exhaustion rises exponentially. Conversely, when > 97.5% of short-term holder supply is in profit, these players tend to seize the opportunity and exit at break-even or profit ????.

The recent surge to $23K has pushed this metric to > 97.5% in profit for the first time since the ATH in November 2021. Given this substantial spike in profitability, the probability of sell pressure sourced from STHs is likely to grow accordingly.

According to Glassnode, the spending volume of these newer holders through the Spent Volume Age Bands (SVAB) (30D-EMA) metric showed how this spike in profitability has driven the cohort’s spending volume well above the long-term declining trend.

Therefore, the sustainability of the current rally can be considered a balance between inflowing and newly deployed demand, meeting the supply drawn out of investor wallets by these higher prices. Besides, miners are also selling Bitcoin as a result of the recent price increase.

With a notable recovery in miner USD-denominated revenues, the resulting behavior shift has switched from accumulation of +8.5k BTC/month, to distribution of -1.6k BTC/month. Miners have spent some -5.6k BTC since 8-Jan and have experienced a net balance decline YTD.

Other indicators, though, show a different image. The intelligence business observes that the volume of Bitcoin that hasn’t moved in more than six months has increased by more than 301,000 since early December, demonstrating holders’ commitment.

BTC is trading for $22,608 at the time of writing, which is down 0.16% over the past 24 hours.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News