Key points:

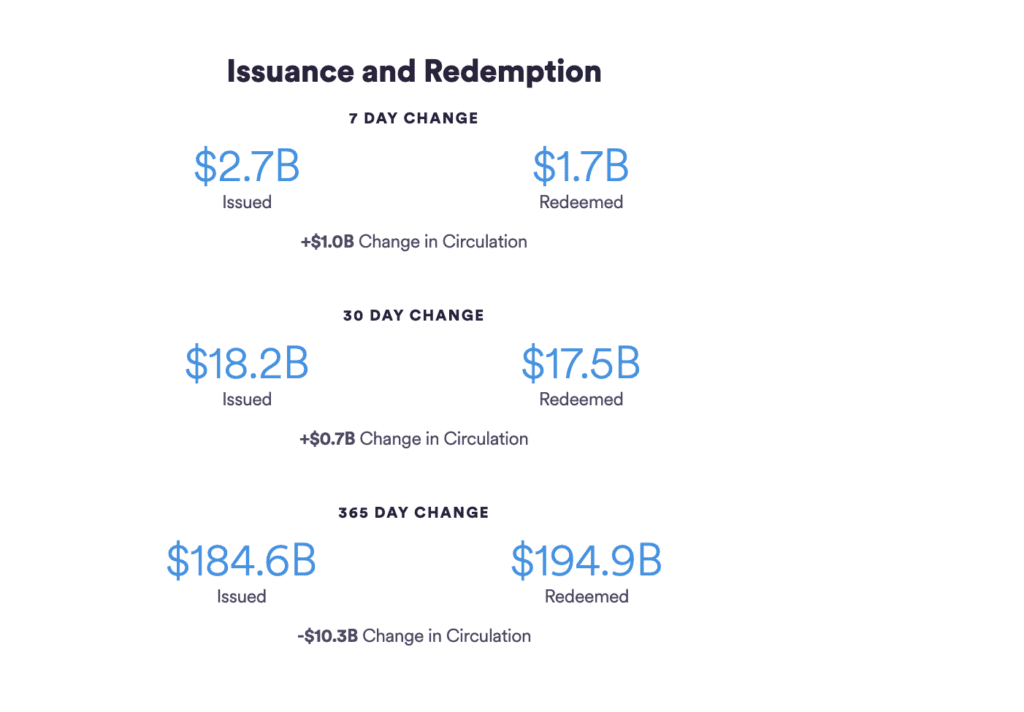

- According to official data, from February 23 to March 2, USDC’s Circle increased circulation by about 1 billion USD.

- Circle’s Stablecoin now reaches 44 billion dollars in total circulation and ranked second in the largest queuing Stablecoin.

- Yesterday, the company also informed its customers about the effects of the Silvergate crisis.

On March 5, according to official data, from February 23 to March 2, Circle issued a total of 2.7 billion USDC, acquired $ 1.7 billion, and increased circulation of about $1 billion.

As of March 2, the total circulation of USDC was $44 billion and reserves of $43.2 billion, including $11.4 billion in cash and $31.9 billion of short-term US Treasury bonds.

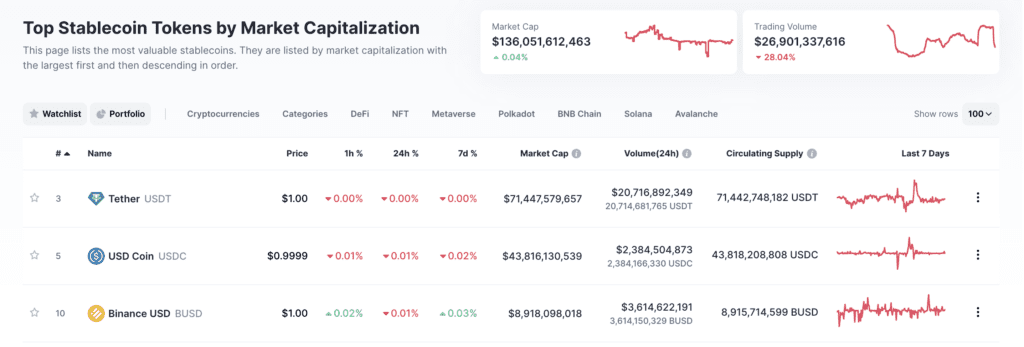

Stablecoin has witnessed a drastic market share with many strategies and activities. BUSD has a capitalization of about $5 billion in just 2 weeks, from $16 billion to $11 billion, after the SEC event of Paxos. USDT and USDC are Stablecoin benefits from this event as capitalization increases to about $2 billion per type.

The growing USDC market share maybe because it is widely used on strongly developing layers like Arbitrum and Optimism, attracting most of the trading volume.

However, USDC is still the second largest Stablecoin by total assets, but it is getting closer to Tether. Tether is still the largest Stablecoin publisher so far, with a full supply of $71.5 billion, according to CoinMarketcap.

In Circle’s recent announcement to its customers about the effects of the Silvergate crisis, because its primary tool is the Silvergate exchange network (SEN) suspended, Circle should be transferred to service providers replace.

According to the statement, Circle withdrew a “small percentage” USD Coin (USDC) storage at Silvergate for other bank partners. Circle emphasized that a few USDC customers used Silvergate and its associated services. Circle also revealed that they started to “narrow” to interact with Silvergate in 2022 when signals of “trouble and risks” became apparent.

Meanwhile, Circle emphasized that the bank is having difficulty ensuring that no customer deposits are affected by the potential liquidity crisis.

With the worry of being “touched” by legal agencies, Circle has recently denied rumors of receiving Wells notifications from the US Securities and Securities Commission (SEC).

Rumors have been motivated by NYDFS’s recent action against Paxos, causing the company to suspend the release of Stablecoin Binance USD (BusD). Paxos may also face actions from SEC because it has received Wells’s notice.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News