Key Points:

- The Seychelles courts granted CoinFLEX permission to restructure.

- According to the exchange, trade in locked assets will continue until the Seychelles court publishes the official court order.

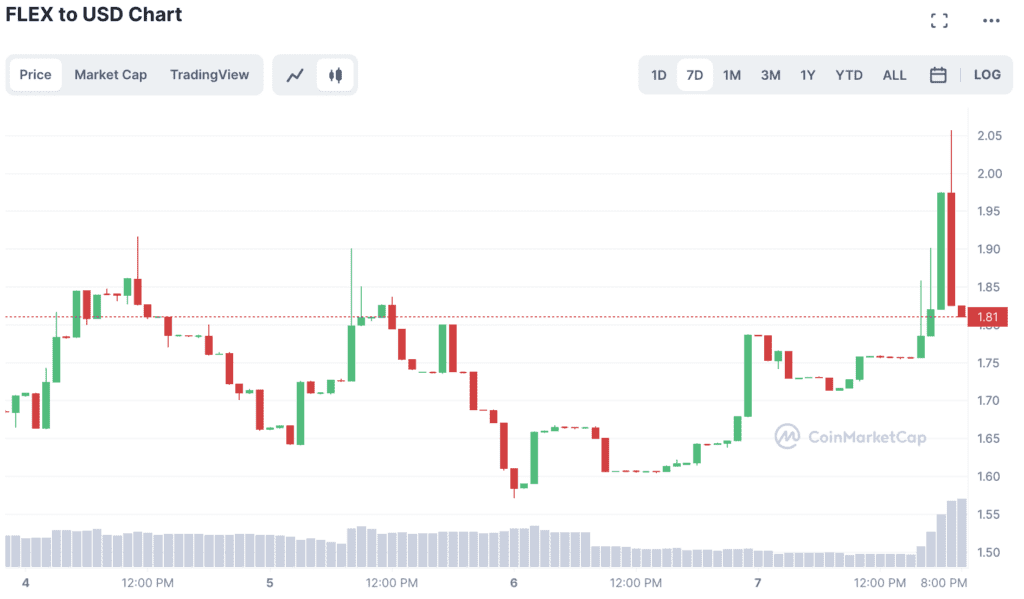

- FLEX, the native token of the exchange, has increased by more than 15%.

The Seychelles courts approved a restructuring plan for the cryptocurrency futures exchange CoinFLEX.

In August, CoinFLEX filed for restructuring in Seychelles as part of its attempt to better its financial status. The exchange’s restructuring plans have also been approved by creditors.

Withdrawals from the crypto futures market CoinFLEX were halted in July while the business proceeded to negotiate a recovery token with investors.

CoinFLEX claimed in September that it would hold 65% of the firm and that Series A investors would lose their stock shares in the planned restructuring.

“You are all creditors, and every vote matters, however big or small. We have, from an early stage, been in discussions with what we have been calling the “large creditor group” and who are referred to in the term sheet as the “Ad Hoc group.” This group of creditors represents a significant proportion of the creditors by value and has been helpful in making sure that an agreement was reached in the interest of all stakeholders. We thank them for their hard work and professionalism these past few months,” the exchange said in a statement in September.

The corporate team will receive 15% as an employee share option plan (ESOP) that will vest over time.

In a statement, the exchange said that trading in locked assets, such as LUSD and LETH, will continue until the Seychelles court publishes the official court ruling.

CoinFLEX said that they want to execute the restructure fast and would not resume Locked Assets trading until 24 hours following the publication of the court judgment in order to notify all locked asset holders.

Responding to this news, FLEX, the native token of the exchange, jumped over 15% but then dropped to $1.8.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News