Key Points:

- Nonfarm, important data determines US interest rate hike strategy in March.

- Nonfarm rates showing signs of decreasing is considered a negative signal, so the FED will likely continue raising interest rates.

The monetary policies of the Fed always have a significant influence on the price of the Crypto market. In the context of investors excited about the Fed’s following interest rate information, the US Nonfarm data tonight on March 10 is also remarkable.

NonFarm or full name is Nonfarm Payrolls (abbreviated: NFP) is the payroll in the US nonfarm sector, part of the Employment Report released by the US Department of Labor.

This news mainly covers the number of new jobs created in the country last month. This is critical economic information because it shows the strength of the business world and the progress of jobs.

When there is strong employment growth, that can help strengthen the dollar and drive up prices in the market. Therefore, Nonfarm can increase or decrease the price of currencies, securities, and trading contracts.

During the hearing, Mr. Powell offered several points to reaffirm his message that higher and faster rate hikes are likely. However, he also stressed that the decision was made based on upcoming data and data ahead of the US central bank’s policy meeting in the next two weeks.

Nonfarm will be one of the critical metrics leading to the US central bank’s interest rate decision in March. If Nonfarm and unemployment are both low, the market will view this as a negative economy, leading to the USD price falling.

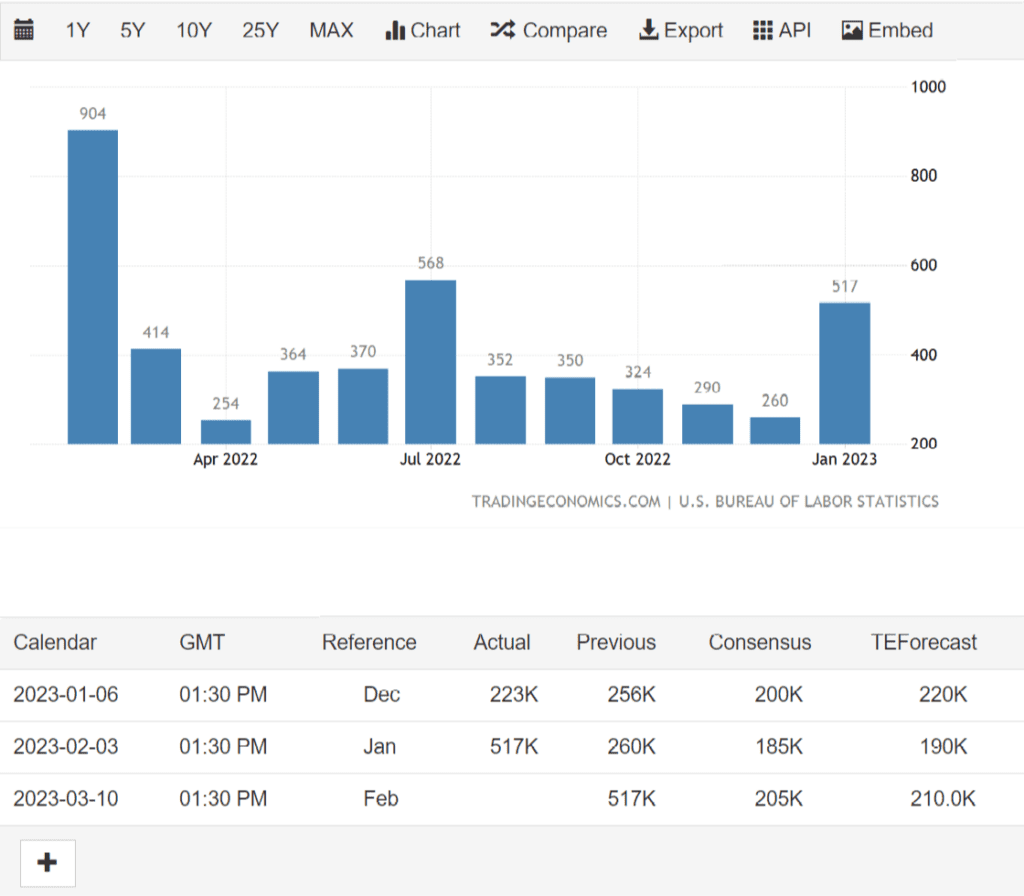

According to the forecast, Employment growth estimates for February ranged from 78,000 to 325,000. Average hourly earnings are expected to grow 0.3%, unchanged from January’s gain. Annual wage growth is expected to rise from 4.4% to 4.7%. Unemployment remained at a low of 3.4% last month, the lowest since May 1969.

The unemployment rate has shown improvement, so Nonfarm is the remaining important factor. However, the number of jobs created: was about 224,000 in February, down sharply from 517,000 the previous month. According to the forecast, this indicator will decrease tonight but will likely still be higher than forecast.

This may significantly impact the Fed’s intense action in raising interest rates and keeping interest rates to handle the inflation problem. This is entirely detrimental to financial markets such as crypto gold and stocks.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News