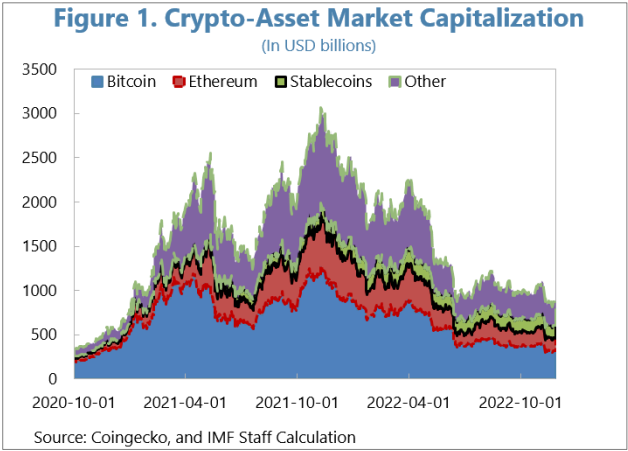

IMF And G20 Report Highlights Risks Of Crypto Assets With Market Value at $3.4 Trillion

Key Points:

- The market value of crypto assets hit an all-time high of $3.4 trillion in January 2023, with Bitcoin accounting for 45% of that value.

- Crypto assets have the potential to revolutionize financial services but also pose significant risks to financial stability, consumer protection, and anti-money laundering efforts.

- One of the key concerns is the potential for crypto to facilitate illicit activities such as money laundering, terrorist financing, and tax evasion.

A recent report from the International Monetary Fund (IMF) and the Group of 20 (G20) has highlighted the macro-financial implications of crypto assets, shedding light on the potential benefits and risks associated with their use.

The report, titled “Macrofinancial Implications of Crypto Assets,” notes that the total market value of crypto assets reached an all-time high of $3.4 trillion in January 2023, with Bitcoin accounting for nearly 45% of that value. While crypto have the potential to revolutionize financial services and increase efficiency, the report cautions that they also pose significant risks to financial stability, consumer protection, and anti-money laundering efforts.

One of the key concerns highlighted by the report is the potential for crypto assets to facilitate illicit activities, such as money laundering, terrorist financing, and tax evasion. The report notes that the anonymity of crypto transactions makes them particularly vulnerable to misuse, and highlights the need for strong regulatory frameworks and international cooperation to mitigate these risks.

Another area of concern highlighted by the report is the potential for crypto assets to disrupt traditional financial institutions and markets. While crypto assets can increase access to financial services and reduce costs, they also pose a threat to the stability of traditional financial systems. The report notes that the growing popularity of stablecoins, which are designed to maintain a stable value relative to traditional currencies, could exacerbate these risks by blurring the line between crypto and traditional financial instruments.

Despite these risks, the report acknowledges that cryptos have the potential to improve financial services and promote financial inclusion. The report suggests that policymakers should adopt a balanced approach to regulating crypto assets, focusing on promoting innovation while mitigating the risks associated with their use.

Overall, the report emphasizes the need for a coordinated global response to the challenges posed by crypto assets. As the use of crypto assets continues to grow, it will be increasingly important for regulators and policymakers to work together to ensure that they are used in a safe and responsible manner.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News