DODO is a decentralized exchange that bills itself as a liquidity protocol driven by the Proactive Market Maker (PMM) algorithm and designed to maximize capital efficiency. This highly rated DEX has been rapidly gaining acceptance and popularity and is expected to dominate completely completely completely completely completely in 2021. Let’s find out details about this project with Coincu through this DODO Review article.

This DODO crypto review will provide you with all the information you want regarding this strong DeFi technology. We’ll review everything there is to know about the exchange and its controlling token, DODO. We will also discuss the protocol’s characteristics and the advantages of a decentralized exchange.

What is DODO?

DODO is a DeFi protocol that provides on-chain liquidity at a stable price through a PMM algorithm.

The PMM algorithm offers a better liquidity pool at a stable price, unlike automated market makers (AMM). This is because the mechanism of PMM pricing imitates human pricing and operates through oracles – the link between real-time data and blockchains.

DODO protocol runs on the Ethereum network and is the solution for continuous on-chain liquidity providers. The DEX contract-fillable liquidity is comparable and similar to centralized exchanges (CEXs). Also, the price stability of the DEX is linked to the real-time market prices for the assets.

Compared to AMM functions, through PMM, DODO exchange offers a better solution to some shortfalls. The DEX uses the real market prices for assets to give enough liquidity to maintain the liquidity providers’ portfolios. Furthermore, DODO reduces price slippage and eliminates impermanent loss through the rewards of arbitrage trading.

In terms of transaction execution, trading crypto on the DODO exchange is exceptionally efficient, with deep liquidity and little slippage. DODO crypto trading seems comparable to trading on high-performance centralized exchanges like FTX and Binance in terms of deal execution.

In comparison to AMM functions, the method utilized by the PMM algorithm imitates more “human” pricing and works through oracles, connecting real-time data with the blockchain. In a subsequent part, we shall delve further into the protocol’s inner workings.

The DODO exchange was formed in August 2020 by three blockchain industry experts: Mingda Lei, Diane Dai, and Qi Wang.

DODO’s platform has some very remarkable supporters and partners, which makes sense. After seeing the tremendous effect that Decentralized Exchanges like Uniswap and SushiSwap had on the market, when DODO appeared, claiming to be like that, but better, a next-generation DEX, heads were turned, and the likes of Pantera, Binance, Coinbase, Alameda, and others gained interest. Now, the DODO Review article will go in-depth about how the project works.

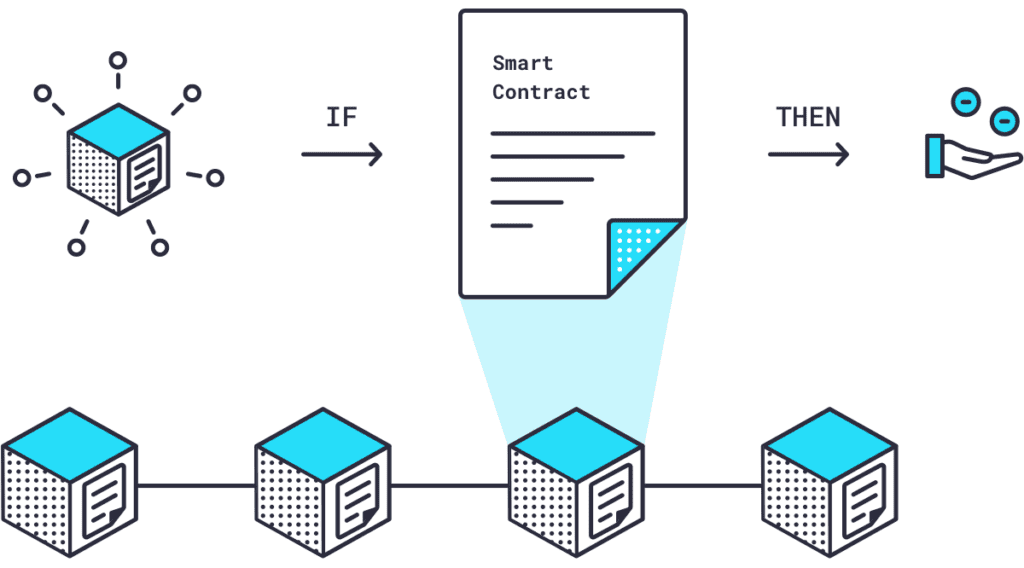

How does it work?

DODO’s PMM algorithm reduces price slippage and charges extremely low transaction costs. Order execution on the platform is comparable to that of centralized exchanges. The DODO ecosystem, like other DEXs, is still dominated by liquidity providers and arbitrageurs. Nonetheless, the technique eliminates all risk factors for temporary loss.

DODO’s unique PMM replaces the AMM capability seen in other DEXs. The PMM algorithm is used to assist in flattening the price curve in the liquidity market.

The PMM provides sufficient liquidity by pooling money at market pricing.

The DODO PMM algorithm’s new equation is functional to indicate the market price of a digital asset, R is the risk factor, and P is the market price of DODO.

The protocol is constructed with a direct link between the market price and that of the platform based on the established algorithm. As the market price falls, the protocol automatically makes changes. This assists the DEX in attracting arbitrage in order to ensure the stability of the liquidity providers’ portfolios.

DODO’s PPM algorithm may ensure the following:

- Reasonable price.

- Price slippage has been reduced.

- Increased use of finances.

- Exposure to a single danger.

- Permanent loss is eliminated.

DODO will use pricing feeds from Chainlink’s oracles as part of its relationship with Chainlink in August 2020. Because of the real-time market pricing, the algorithm can avoid large price disparities between itself and the assets in the actual market.

Keep in mind that as liquidity grows, so does the accompanying risk. As a result, the building of a liquidity pool will necessarily reduce the R factor.

Since Chainlink price data serves as the foundation for DODO exchange pricing, there may be a flaw with such relational trust.

This means that a possible failure or breach in Chainkink’s nodes will result in inaccurate information being translated to the DODO platform. As a consequence, market pricing based on inaccurate data might result in considerable losses for liquidity providers in the DODO ecosystem.

This methodology quickly reduces liquidity away from the market price, eliminating arbitrage possibilities and resulting in a more efficient exchange system.

The DODO crypto exchange’s PMM architecture promotes arbitrage trading that ensures the exchange price matches the market price. This goal is not unique, but the PMM is distinct because it alters the price curve, allowing it to attain an efficient liquidity structure.

Since DODO has been available since mid-2020, we have a solid track record demonstrating that this model is better than the old AMM approach. The PMM model has shown that it offers adequate liquidity for an infinite number of trading pairs and helps liquidity providers.

In summary, the PMM approach reduces the danger of temporary loss, attracting liquidity suppliers to the platform. The concept also exploits acknowledged shortcomings in conventional order-book-based and AMM exchanges, such as reliance on human input to run, being too costly to operate, or being unable to supply the requisite liquidity to operate.

In the spirit of full disclosure, the PMM model contains weaknesses, but they are fewer and less serious than the defects in the AMM model. The PMM architecture is unsuitable for arbitrage traders, and DODO relies largely on Chainlink oracles for pricing, exposing the DODO platform to a single point of failure risk if the oracle fails.

Now that we’ve covered the DODO market maker protocol let’s look at the features and functions.

Features

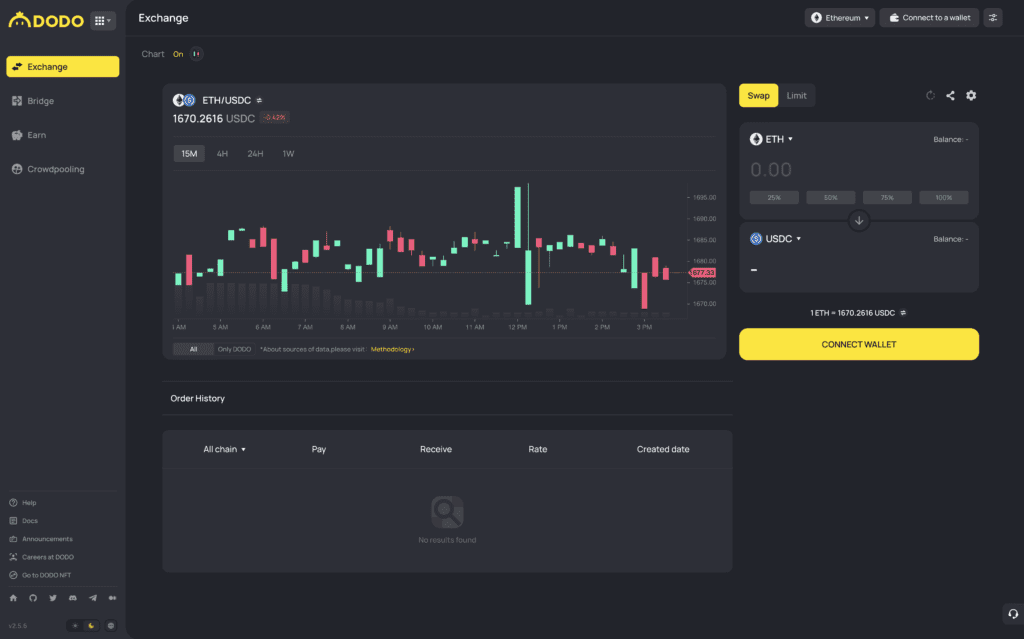

Exchange

DODO provides decentralized on-chain asset trading, with order execution that is equivalent to that of centralized exchanges. DODO’s key capability is the exchange feature.

DODO allows for the exchange of two arbitrary tokens on the same network. This function provides the best pricing to traders by automatically determining the appropriate order routing from pooled liquidity sources. Moreover, users that conduct deals may earn DODO tokens by engaging in trade mining.

Utilizing the Swap function on DODO is simple; as previously said, slippage is always beneficial, and adequate liquidity isn’t a problem for the common trader.

Utilizing the Swap function on DODO is simple; as previously said, slippage is always beneficial, and adequate liquidity isn’t a problem for the common trader.

Vending Machine

The DODO vending machine uses DODO’s PMM technology to enable anybody with a wallet to build a liquidity market. The DODO Vending Machine will provide a decentralized, non-custodial, and open liquidity market for the asset selected by the user.

This feature is highly unique and completely permissionless, which means that anybody with a wallet may create trading venues without fear of censorship or intervention from the platform, making token distribution and market-making fair and available to all.

This functionality is very useful for blockchain developers or project teams that wish to bring a token to market but lack the finances to offer the liquidity required to launch their token on a conventional AMM.

Crowdpooling

Crowdpooling is an equal-opportunity token launch platform that enables consumers to access projects in the most equitable manner possible directly.

The Crowdpooling function allows projects to launch liquidity markets and distribute tokens equally, eliminating the possibility of frontrunning from early investors and those with insider information and being vulnerable to bot meddling.

The platform offers two forms of Crowdpooling, which are:

- Fixed-Price CP: This sort of Crowdpooling will auction the token assets at a fixed price.

- Variable-Price CP: With this sort of Crowdpooling, a predefined pricing curve specifies the price of a token asset. When more tokens are released, the price will rise. At the outset, all players will get tokens proportionate to their pool shares.

Because of DODO’s Initial Offering feature, new enterprises may raise capital with a free listing, launching liquid marketplaces with extra security offered by the liquidity protection period.

Private Pool

This tool, like the Vending Machine, includes choices for sophisticated investors. Moreover, Private Pool provides additional delight for expert market makers that need more than the Vending Machine.

Users may enjoy the following benefits from Private Pool:

- The price curve may be changed indefinitely.

- Deposits or withdrawals are just one way.

- Uninterrupted liquidity availability with a price range of 0 to infinity.

- The discovery of the active price.

- Price market that is consistent.

- Avoidance of negative risks.

- The typical AMM model is being reversed.

Using the setting choices, Private Pool assists users in becoming personal market makers. With the given parameters, you have numerous options for planning your trade patterns. The protocol allows its users to establish and run their own on-chain liquidity pools.

Pegged Pool

Anybody may offer liquidity acceptable for synthetic assets in this pool, but the pool’s characteristics cannot be changed once it is created.

Mining

Liquidity Mining

The DODO platform includes liquidity mining, which refers to decentralized market making. It is all about providing liquidity to DEXs through cryptocurrencies. DODO’s liquidity mining has no lock-up term and may be redeemed at any moment. Also, awards are accrued every block.

Combiner Harvest Mining

Users of this mining DODO platform are exposed to potential and trending initiatives that are eager to engage with the platform. Vetted projects may form liquidity pools, and liquidity providers in these pools will also get DODO incentive tokens.

NFT Vault

The DODO NFT Vault is a non-standard cryptocurrency pricing invention and liquidity initiative. Users may donate in the NFT Vault using either new or current NFTs. There is also the option of keeping the NFTs unique or fractionalizing them. By selecting the latter option, the NFTs are divided into multiple bits. As a result, they may be represented as fungible tokens.

Utilizing the Vault necessitates the creation of a comparable liquidity pool for the NFT. This will aid in establishing the necessary market flexibility and efficiency for trading NFTs bits. The protocol’s PMM algorithm powers the whole process.

Bridge

There are four such bridges on the DODO platform: Arbitrum bridge, BSC bridge, cBridge, and Polygon bridge.

Fees

Trading fees

When it comes to centralized exchanges, many of them levy what is known as taker fees from takers and maker fees from makers. Takers are those who remove liquidity from the order book by accepting previously placed orders, whereas makers are those who put such orders. The primary option is to just charge “flat” fees. Flat fees imply that the exchange charges the same fee to both the taker and the manufacturer.

Several decentralized exchanges do not charge any trading fees at all. This is, in fact, one of the main justifications used by DEX advocates to explain why centralized exchanges are dying.

The exchange is also one of the DEXs that does not impose trading fees.

Withdrawal fees

The exchange, like other decentralized exchanges, does not impose any transfer or withdrawal fees apart from network fees, in our opinion. The network fees are paid to the miners of the relevant cryptocurrency/blockchain, not to the exchange. Network prices fluctuate each day, depending on network congestion.

In general, having to pay merely network fees should be deemed lower than the worldwide industry average when it comes to charge levels for crypto withdrawals.

Security

Everyone who uses or is preparing to utilize a platform is concerned about its security. As a result, multiple security audits have been conducted by various firms, including SlowMist, PechShield, Certik, Beosin, and TrailofBits. Like all smart contracts, Crowdpooling contracts, and audited DODO Vending Machine, these are some well-known blockchain security firms that maintain the platform safer.

Since this is a decentralized network, it is the user’s responsibility to utilize the platform responsibly, not the platform itself. Although DODO is protected via the underlying blockchain protocols it employs, when it comes to DeFi, all of the security that comes with self-custody applies.

Conclusion of DODO Review

The DODO protocol has unquestionably made significant contributions to decentralized finance. The adoption of the PMM algorithm has generated a distinct departure from the AMM’s normal feel. Traders and investors will be better satisfied with the new technology throughout their transactions on decentralized exchanges.

Additionally, the platform offers a simple and fast layout that allows users to navigate and get information quickly. Trading, staking, and liquidity contribution on the DODO protocol are simple to grasp.

The DODO exchange is beneficial for both liquidity providers and traders, and it has made significant contributions to decentralized finance. Moreover, the platform offers a quick and simple user interface that provides user accessibility and ease of navigation. Hopefully the DODO Review article has helped you understand more about the project.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News