3AC Founder: Traditional Ideas Like “Shadow Banking” Is The Crypto Market’s Worst Failure

Key Points:

- According to the 3AC Founder, the inclusion of old notions such as “shadow banking” is to blame for the majority of recent failures in the encryption sector.

- He believes that the next bull market will be led by individuals who are aware of these difficulties, and that the underlying crypto infrastructure represents a new paradigm in and of itself.

3AC Founder said that one of the main factors behind these mistakes is the influx of traditional financial ideas, such as “shadow banking” and the “internalization of processes”.

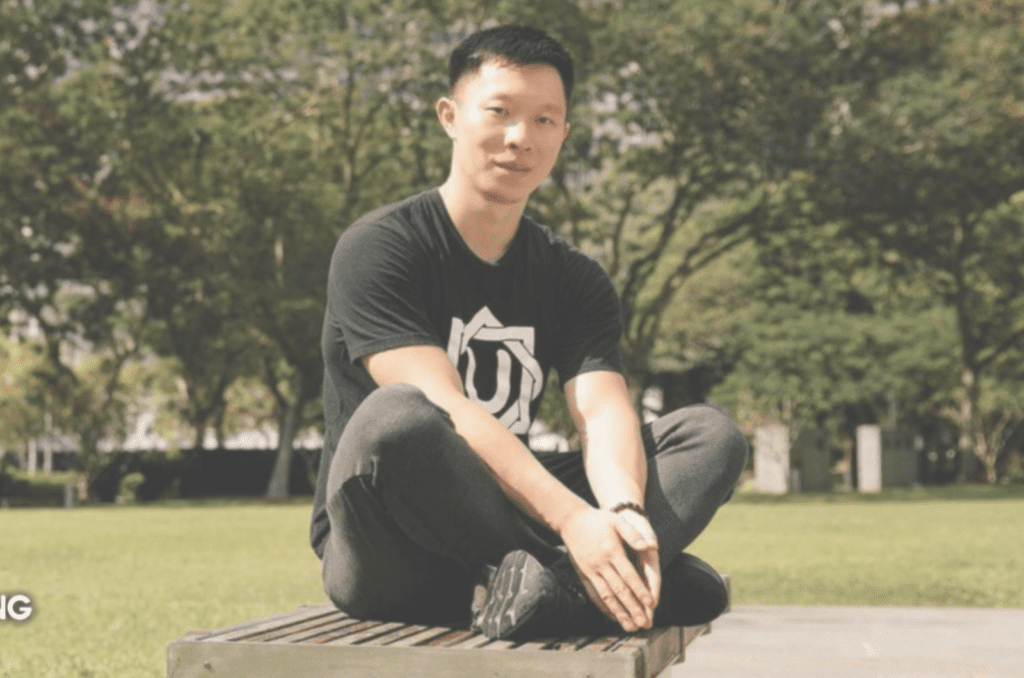

Zhu Su, the founder of Three Arrows Capital (3AC), recently took to Twitter to address some of the causes for the cryptocurrency industry’s recent blunders. The 3AC creator indicated his agreement with the present state of the cryptocurrency industry. It is said that crypto investors are facing a financial catastrophe since there is no intraday market for funding the large daily settlement imbalances that occur naturally in the system. Crypto markets, on the other hand, manage this far better.

In response to the comment, Zhu Su, the founder of 3AC stated on Twitter that most recent mistakes in the cryptocurrency industry are due to the introduction of traditional ideas, such as “shadow banking” and “internalization of processes,” that the next bull market will be driven by people who recognize these issues, and that the underlying crypto infrastructure itself is a new paradigm.

Nonetheless, some cryptocurrency experts have claimed that these old notions may still be utilized in the digital asset environment, although with some adjustments. Others have proposed that the term “shadow banking” be redefined to encompass the decentralized lending systems that have grown in popularity in the crypto realm. Similarly, the concept of internalizing procedures might be applied to the blockchain ecosystem, where smart contracts can automate many formerly manual operations.

It is apparent that the convergence of traditional banking and cryptocurrencies is a hotly discussed issue within the business. While some say that classical notions have no place in the realm of digital assets, others contend that they may be altered to meet the specific difficulties and opportunities given by cryptocurrencies and blockchain technology. Finally, the success of cryptocurrencies will be determined by innovators and investors’ ability to strike a balance between the old and the new, combining the best practices of both worlds to build a more robust and resilient financial system.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Chubbi

Coincu News