Persistence Review: Decentralized Commodity Trading Solution For Retail Investors

In this Persistence review post, we’ll take a closer look at Persistence, a blockchain platform that aims to bridge the gap between decentralized and traditional finance.

Introduction

What is Persistence?

Persistence is a blockchain that is part of the Cosmos ecosystem. Its main objective is to create an ecosystem of financial products that cater to both retail investors and large financial institutions. The primary aim is to bridge the gap between decentralized and traditional finance while supporting decentralized finance (DeFi) applications in the form of non-fungible tokens (NFTs).

The Persistence ecosystem is built on a Tendermint-based layer-1 chain, which is a high-performance consensus engine for building blockchains. It is designed to provide Persistence blockchain security, speed, and efficiency.

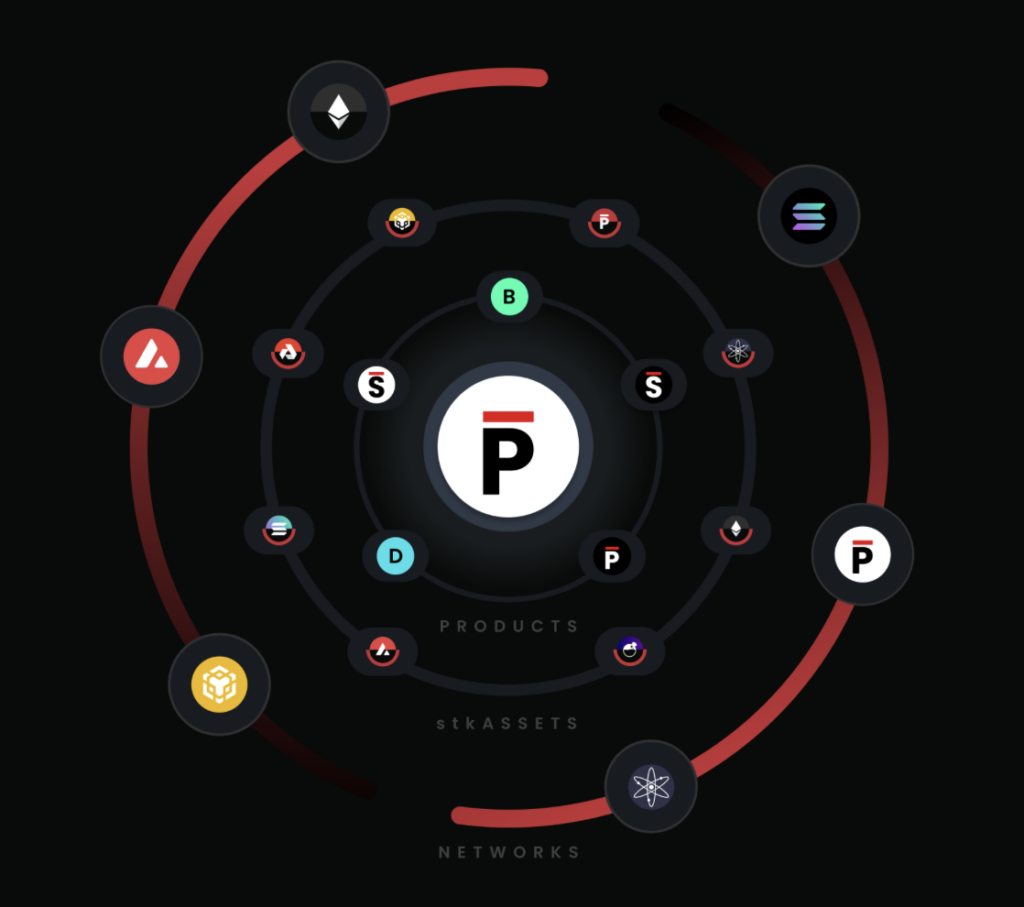

The product suite that has been and is being developed by Persistence includes several key products. One such product is pStake, which is designed to serve as a liquidity generator for staking. Asset Mantle is another product that is geared toward the NFT market. AUDIT.one is a staking tool that helps users manage their staking activities. pLend is a debt interaction tool to facilitate the lending of assets. Lastly, Comdex is a decentralized commodity exchange that provides a platform for trading commodities without intermediaries.

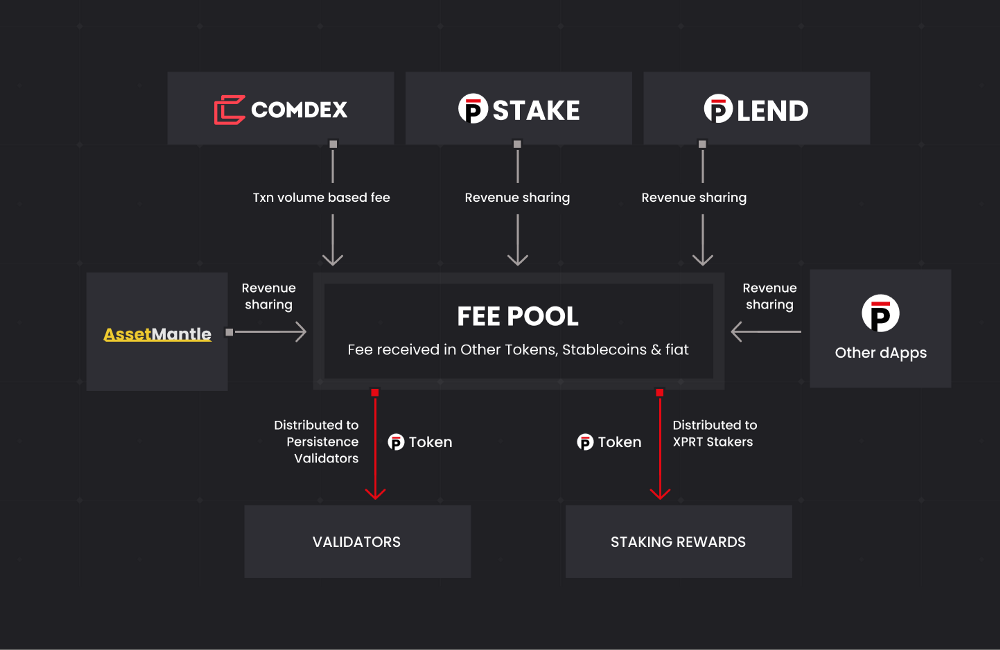

These products work together to create an ecosystem of decentralized applications that add value to XPRT. The XPRT token is the native token of the Persistence network, and it is used to pay for transaction fees, staking, and other activities on the network.

Asset-Based Lending

Asset-Based Lending involves loaning money to borrowers who provide collateral in the form of their assets such as invoices, accounts receivables, inventory, property, etc. The first application of Asset-Based Lending in the Persistence ecosystem is through Comdex, which is a decentralized commodities trading and trade financing platform that facilitates the entire trader journey, connecting buyers and sellers of physical commodities and providing receivable financing to sellers.

Securitization of Debt (Pooling of debt)

On the other hand, Securitization of Debt refers to the process where a primary financier merges or pools multiple steady cash-flow generating assets into one or more asset pools, generating returns from the underlying income-generating assets. In the Persistence ecosystem, the primary financier originates multiple loans for sellers who request financing on the Comdex platform, using invoices as collateral. These loans are then grouped into tranches or pools based on factors like risk and type of primary financier. The Persistence dApp, a cryptonative user-facing application, enables stablecoin holders and liquidity providers to lend their stablecoins to these liquidity pools to generate yields.

Persistence Products

The Persistence ecosystem offers a range of products designed to cater to the needs of businesses and investment funds. One of their most successful offerings is Comdex, which is a decentralized commodity trading solution. This app covers the entire transaction process, including buyer/seller connection, transaction confirmation, and payment.

pStake is another product that aims to unlock staking liquidity on chains operating under Proof-of-Stake mechanisms, allowing users to increase profit opportunities from staking tokens. With over $450 billion staked across the market, this product has significant potential for growth.

AUDIT.one provides a staking solution (Staking-as-a-Service) for companies and investment funds, and currently supports over $250 million in assets across more than 10 different networks.

Asset Mantle, a product in development, will be an NFT marketplace that allows users to create their own NFT store and transact NFTs in different networks, from electronic paintings to tickets and music.

Another product in development is pLend, which is a stablecoin product created from collateralizing real-world assets.

Persistance Token (XPRT)

XPRT will carry a variety of use cases within the Persistence ecosystem, including governance of the Persistence main chain, and participating in staking to contribute to network security and its role as a work token.

XPRT holders can participate in protocol governance by issuing proposals and voting on various factors that will impact the broader Persistence ecosystem.

As the Persistence chain runs on delegated Proof-of-Stake based Tendermint PBFT consensus engine, staking is integral to ensuring a secure and robust network.

Persistence has onboarded some of the world’s top validators, distributed globally. XPRT token holders will be able to delegate their tokens to our network validators for staking. Stakers will receive rewards in the form of XPRT in return for contributing to the security of the network.

Work Token

XPRT is a work token that derives its value from economic activity within and outside the Persistence ecosystem. The following are some ways in which XPRT can gain value:

Within the ecosystem, modular dApps like pSTAKE and smart contract-based applications for borrowing and lending will leverage the Core-1 chain infrastructure to build use-cases for stkASSETs. This will result in more transactions and higher transaction fees on the Persistence chain. XPRT stakers will also benefit from the fees generated by these dApps.

The Inter-Blockchain Communication (IBC) ecosystem within Persistence is expected to incorporate thousands of App-chains, which need not be interconnected with each other on a one-to-one basis. IBC transactions from app-chains within Persistence will be routed through the Persistence Core-1 chain, making it the hub for IBC in the ecosystem. This will result in additional transaction fees being accrued on the Core-1 chain.

Outside the Persistence ecosystem, IBC-enabled stkASSETs for various Proof-of-Stake (PoS) chains within the Cosmos ecosystem will be hosted on the Persistence chain. These assets will flow within and outside the Persistence ecosystem through the Core-1 chain, generating further transaction fees.

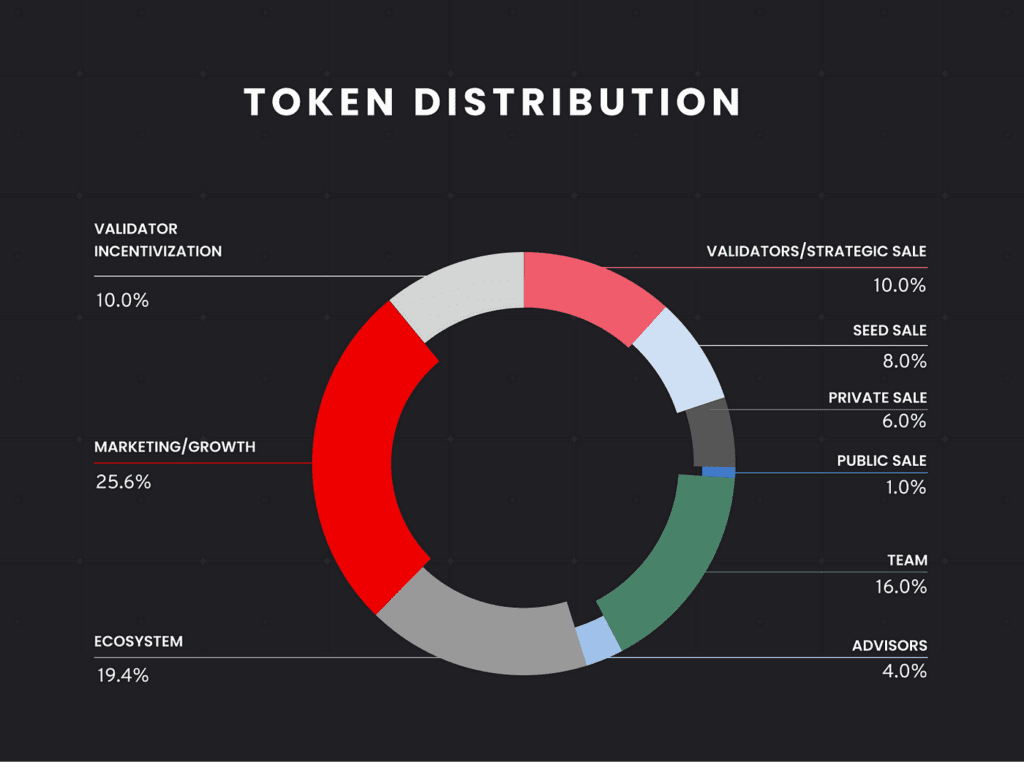

XPRT Token Distribution

The XPRT token distribution model and release schedule have been meticulously planned to facilitate the long-term growth of a robust and engaged participant ecosystem.

At genesis, 100 million XPRT will be minted and gradually released over 42 months as follows:

- Marketing & Growth: 25.6% or 25,600,000 XPRT;

- Ecosystem Development & Growth: 19.4% or 19,400,000 XPRT;

- Team: 16% or 16,000,000 XPRT;

- Seed and Private Sale: 14% or 14,000,000 XPRT;

- Validator Incentivization: 10% equivalent to 10,000,000 XPRT;

- Validators & Strategic Sale: 10% equivalent to 10,000,000 XPRT;

- Advisors: 4% equivalent to 4,000,000 XPRT;

- Public Sale: 1% is equivalent to 1,000,000 XPRT.

The initial circulating supply of XPRT will be 9,100,000 (9.1% of the total supply). The circulating supply will gradually increase in-line with the release schedule detailed above.

The public sale will occur at a price close to the private sale price, providing those who missed the private sale the opportunity to purchase XPRT tokens at a price similar to the private sale.

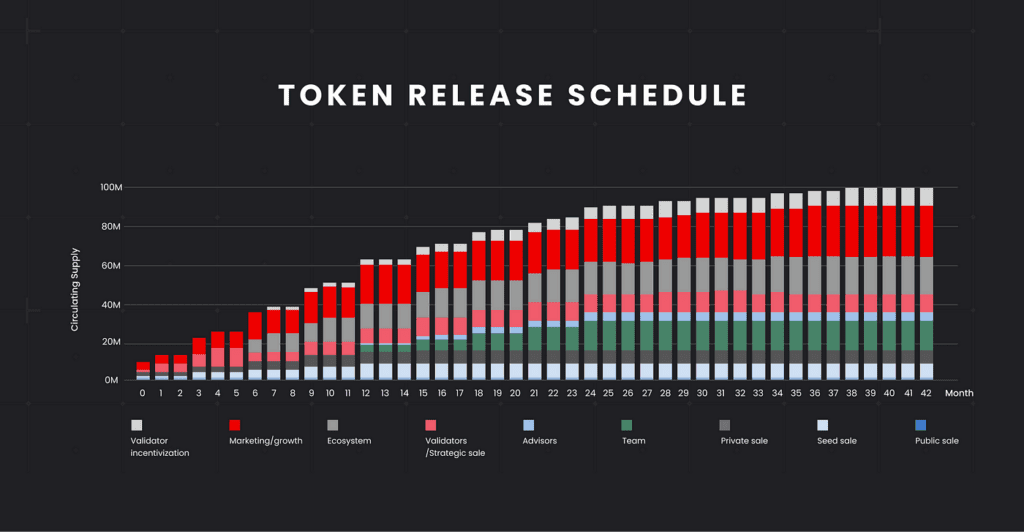

XPRT Token Release Schedule

During the public sale of XPRT tokens, there will be no lockup period for the tokens purchased. This means that all XPRT tokens sold during the public sale will be unlocked upon distribution.

The XPRT Token Release Chart below shows the details of when tokens will be unlocked for each category:

- Marketing & Growth (25,600,000 XPRT): 4,000,000 XPRT will be unlocked at listing, followed by 4,000,000 XPRT unlocking every 3 months from June 2021 to December 2021. Then, 3,600,000 XPRT will be unlocked in March 2022, followed by 1,500,000 XPRT unlocking every 6 months from July 2022 to March 2024.

- Ecosystem Development & Growth (19,400,000 XPRT): 4,000,000 XPRT will be unlocked 1 month after listing (April 2021), followed by 3,000,000 XPRT unlocking every 3 months from July 2021 to January 2022. Then, 1,600,000 XPRT will be unlocked in July 2022, followed by 1,600,000 XPRT unlocking every 6 months from January 2023 to January 2024.

- Team Members (16,000,000 XPRT): 3,200,000 XPRT will be unlocked 1 year after listing (March 2022), followed by 3,200,000 XPRT unlocking every 3 months until 2 years after listing (March 2023).

- Early Supporters / Investors (25,000,000 XPRT):

- Seed Sale: 1,600,000 XPRT will be unlocked at listing, followed by 1,600,000 XPRT unlocking every 3 months from June 2021 to March 2022.

- Private Sale: 1,500,000 XPRT will be unlocked at listing, followed by 1,500,000 XPRT unlocking every 3 months from June 2021 to December 2021.

- Public Sale: 1,000,000 XPRT will be unlocked at listing.

- Validators & Strategic Sale: 1,000,000 XPRT will be unlocked at listing, followed by 1,800,000 XPRT unlocking every 3 months from June 2021 to June 2022.

- Validator Incentivization (10,000,000 XPRT): 200,000 XPRT will be unlocked 3 months after listing (June 2021), followed by 200,000 XPRT unlocking every month from July 2021 to September 2024. Then, every 6 months from March 2022 to September 2023, 400,000 XPRT will be unlocked alongside the 200,000 XPRT (total of 600,000 XPRT per 6-monthly unlock).

- Advisors (4,000,000 XPRT): 800,000 XPRT will be unlocked 1 year after listing (March 2022), followed by 800,000 XPRT unlocking every 3 months until March 2023.

Staking and XPRT Supply

Like other Tendermint-based chains, the token supply of XPRT will experience inflation up to a certain point in the future to enable staking rewards. The inflation rate will be 35% for the first year, and it will halve every two years with a target bonding rate of 67% of XPRT to ensure network security. If the bonding rate is maintained at 67%, the maximum supply of XPRT, which is around 403,000,000 XPRT, will be reached by 2035.

By staking their XPRT tokens, holders can benefit from attractive staking rewards, which increase network security. As the inflation rate halves every two years, early stakers will receive the best staking yields.

XPRT is the entire ecosystem’s foundation, so staking XPRT to safeguard the chain will provide stakers with significant exposure to various dApps in the ecosystem.

Pros and Cons

| Pros | Cons |

| Supports both retail investors and large financial institutions | Token supply of XPRT will experience inflation up to a certain point in the future to enable staking rewards |

| Bridges the gap between decentralized and traditional finance | The inflation rate is 35% for the first year, and it will halve every two years with a target bonding rate of 67% of XPRT to ensure network security |

| Comdex is a successful decentralized commodity trading solution | |

| pStake unlocks staking liquidity on chains operating under Proof-of-Stake mechanisms, allowing users to increase profit opportunities from staking tokens | |

| AUDIT.one provides a staking solution (Staking-as-a-Service) for companies and investment funds | |

| pLend is a stablecoin product created from collateralizing real-world assets | |

Roadmap

Persistence’s most recent published roadmap was in 2021, and no roadmap is currently available for 2023 on their website. In 2021, Persistence announced that its development team would prioritize completing five protocols within the ecosystem. However, two of the five protocols were not yet finalized, so the team focused on completing those first.

Conclusion – Persistence Review

In conclusion, Persistence is a promising blockchain platform with a range of products designed to cater to the needs of businesses and investment funds while bridging the gap between decentralized and traditional finance. Its successful offerings such as Comdex, pStake, and AUDIT.one have significant potential for growth, and its future products such as Asset Mantle and pLend show promise in the NFT and stablecoin markets.

With XPRT tokens, holders can participate in protocol governance and benefit from attractive staking rewards, which increase network security. Overall, Persistence is an ecosystem of decentralized applications that add value to XPRT and the broader blockchain community.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.