Key Points:

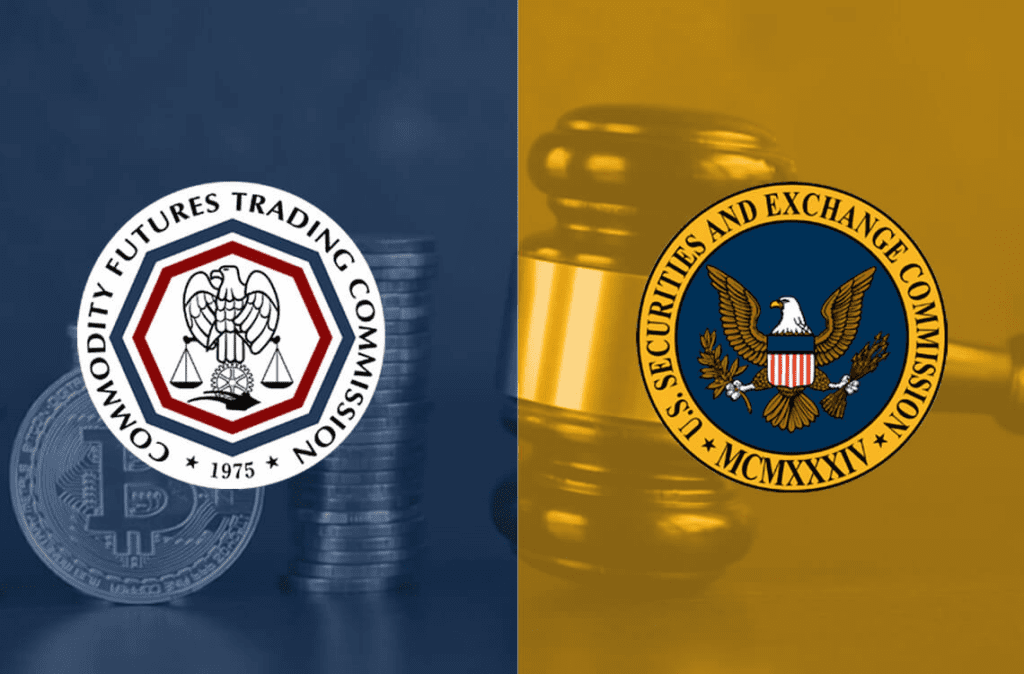

- Republicans in the US House of Representatives have published a draft bill regulating the SEC and CFTC’s regulatory responsibilities for the cryptocurrency industry.

- A clear division of powers will provide regulatory certainty for digital asset companies.

- While it has yet to be formally submitted to parliament, the initial response to the bill from industry has been positive.

US Republican representatives are seeking to divide the powers of the SEC and CFTC over the cryptocurrency industry in a new draft of the law.

As reported by Blockwork, US Republican Representative Patrick McHenry and Pennsylvania Republican Representative Glenn Thompson introduced draft legislation on Friday, focusing on token classification, CFTC, and SEC jurisdictions, and available encryption for transactions.

The draft proposes a more precise division of crypto regulatory powers between the US Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), providing certainty about regulation for digital asset companies.

The bill establishes a process for token issuers to claim their currency to be treated as a commodity as long as the project is fully decentralized. The CFTC will be tasked with overseeing digital goods, but the SEC could attempt to classify tokens as securities if the agency can successfully make that case.

The draft also allows for the trading of digital goods on the secondary market and allows digital asset trading platforms to register as alternative trading systems.

The chairs of the House Committees on Agriculture and Financial Services, Reps. McHenry and Thompson, think the present regulations surrounding cryptocurrencies stifle innovation and fall short of “adequate consumer protection”. Although the draft has yet to be formally submitted to parliament, the initial response from the industry has been positive.

The Securities and Exchange Commission and the Commodity Futures Trading Commission have launched a total of more than 100 enforcement actions against crypto asset market participants. However, if the bill is passed, it is possible to expect the issuance of a specific rule on the cryptocurrency industry soon.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News