Key Points:

- The chaos created by the SEC and Binance gave some investors the opportunity to profit at a time when the entire market was scared.

- Bitcoin was down 5% at the time of the news, while BNB suffered the most.

- The SEC is using the event as leverage to crack down on the crypto industry.

The Securities and Exchange Commission (SEC) and Binance events are one of the hottest topics at the moment. It not only affects the largest exchange in the world but also spreads to the crypto market.

According to Lookonchain data, after the US SEC sued Binance, Cumberland withdrew 67.9 million USDC from Circle and deposited 67.1 million USDC into Coinbase. FalconX received 37 million USDC from Circle and deposited 29.5 million USDC into Binance. The two institutions deposited a total of 96.6 million USDC into the exchange.

In addition to the turmoil occurring in the market, whales or large institutions have also taken advantage of the situation to profit millions of dollars.

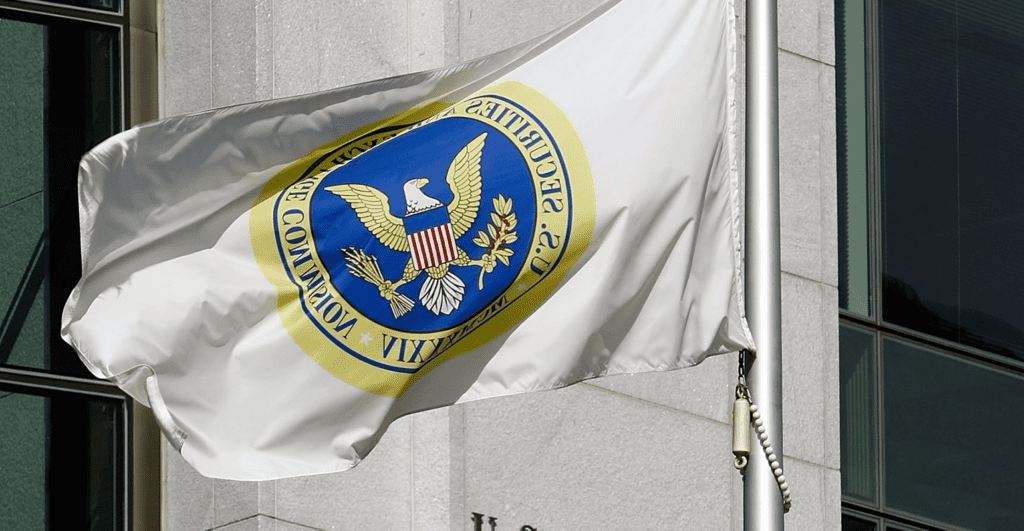

The world’s biggest cryptocurrency exchange, Binance, and its CEO are being sued by the US’s top financial watchdog, which accuses them of generating billions of dollars while significantly endangering investors’ assets.

In a court filing, the SEC accused Binance of mixing “billions of dollars” in client cash and covertly moving them to a different firm owned by its founder and CEO, Changpeng Zhao.

Bitcoin, the world’s largest cryptocurrency, was down 5.5% after plunging to its lowest level since mid-March. Binance’s coin dropped over 10%, hit the hardest by this event.

The accusations filed in federal court in Washington, D.C., are the latest in a series of enforcement proceedings launched by the SEC in an attempt to rein in the cryptocurrency business, which SEC Chair Gary Gensler has referred to as “the wild West.”

The SEC has encouraged some cryptocurrency businesses to strengthen compliance, boost product offerings, and expand internationally, steps that some market observers believe will be expedited by this new action against the world’s biggest cryptocurrency exchange.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News