Key Points:

- CFTC Chair Rostin Behnam is asking for tougher measures, which he mentioned two years ago.

- Behnam also expressed support for the recent SEC actions.

- He argued that Bitcoin is a commodity and is not controlled by the United States.

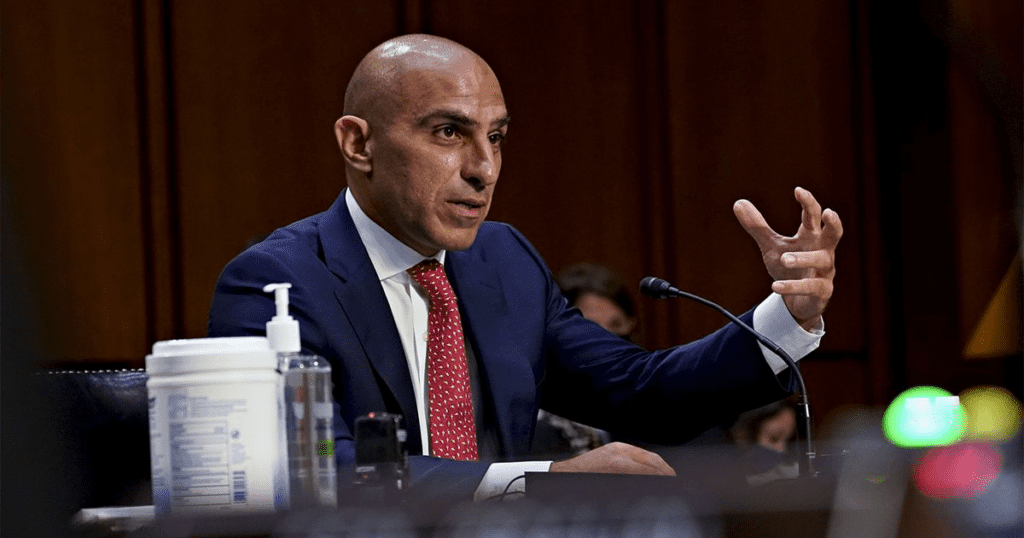

Commodity Futures Trading Commission (CFTC) Chair Rostin Behnam highlighted to the House Agriculture Committee the need for congressional action to address the lack of federal regulation of the digital asset market.

After the SEC’s legal moves against Binance and Coinbase, the House Agricultural Committee met on Tuesday morning. The conference, which included two-panel discussions, was meant to address crypto spot market regulation.

Behnam’s speech focused on crypto token categorization, the present enforcement trend, and the need for regulatory clarification. This week, the SEC made a point of designating more than ten token securities in its Binance and Coinbase claims.

Behnam’s remarks were mostly focused on the categorization of crypto tokens, the prevalent tendency of regulating via enforcement, and the critical need for regulatory clarity. Importantly, in its recent litigation against Binance and Coinbase, the SEC classed over ten tokens as securities.

During his questioning of Behnam, South Dakota Republican Dusty Johnson expressed suspicion, saying:

“There are some who argue ‘the SEC’s got this.’”

Yet, Johnson raised an important point: Does the SEC have complete control over digital assets?

Behnam stated:

“This is not a zero-sum game. For anything that the CFTC might get in legislative or legal authority, I’m not taking it from someone else. There is a regulatory vacuum, there is a gap in regulation over digital commodity assets.”

Behnam contended that the SEC should have authority over assets labeled as securities. He did, however, underline that the biggest coin, Bitcoin, is a commodity as ruled by a US court, and it is uncontrolled under US law.

Behnam has also underlined the necessity for clear crypto rules, which he addressed two years ago.

“Since my Senate confirmation hearing almost two years ago, I have consistently highlighted the need for Congressional action to address the lack of federal regulation over the digital commodity market. I have been clear in testimony before Congress as well as in other public statements that bringing this volatile market out of the shadows and into the regulatory fold would protect customers, ensure market resilience and stability, and prevent contagion to the traditional financial system.”

The CFTC has requested a 10% increase in the yearly budget, from $365 million to $411.14 million, although the agency has long battled for additional money with little success from Congress. Legislation that would pave the road for digital assets to become commodities would also give the CFTC greater ability to regulate them directly than it already has.

The failures of FTX, Celsius, Voyager, and Terra-Luna last year heightened the urgency felt by regulators and policymakers to raise guardrail assets in case the market developed to a scale that may damage the rest of the US and worldwide financial sectors.

To that end, Glenn Thompson, and Patrick McHenry, Chairs of the House Agricultural and Financial Services Committees, proposed new legislation last week.

If approved, the proposal would give the CFTC new jurisdiction and require the SEC and CFTC to design a more clear roadmap for digital assets to become commodities.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News