Key Points:

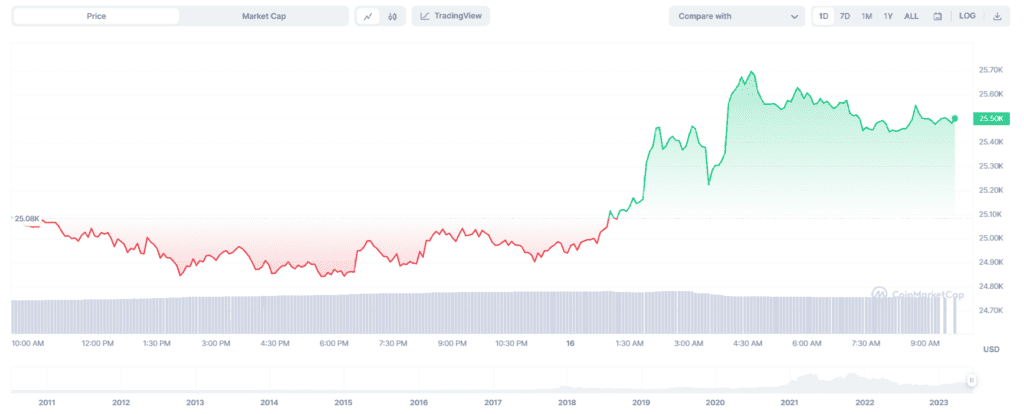

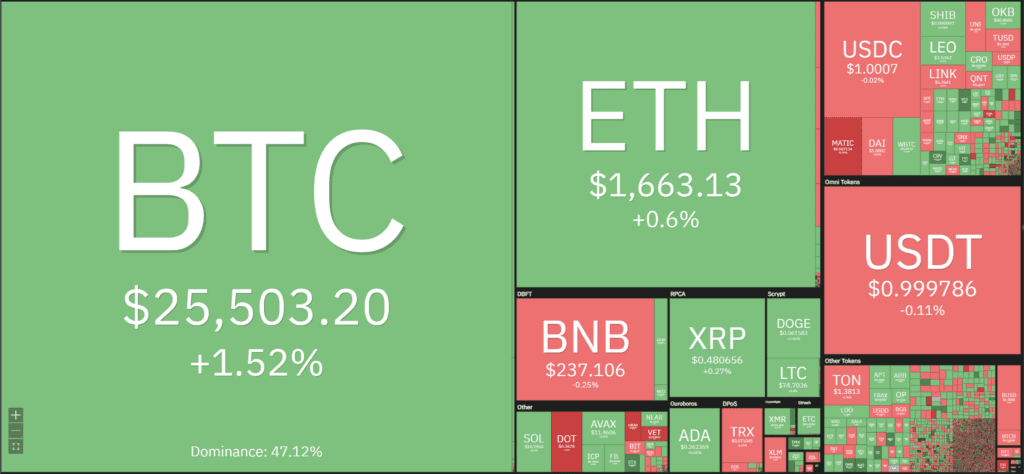

- Bitcoin (BTC) price rebounded slightly to $25,500 after BlackRock filed a Bitcoin ETF application with the SEC.

- The market is still in a state of uncertainty. Investors are still worried about the US economy and monetary policy.

- BlackRock is said to have prepared carefully when filing regarding the SEC’s harsh legal actions with the cryptocurrency market.

The news that BlackRock wanted to create a Bitcoin ETF pushed the BTC price back to $25,500.

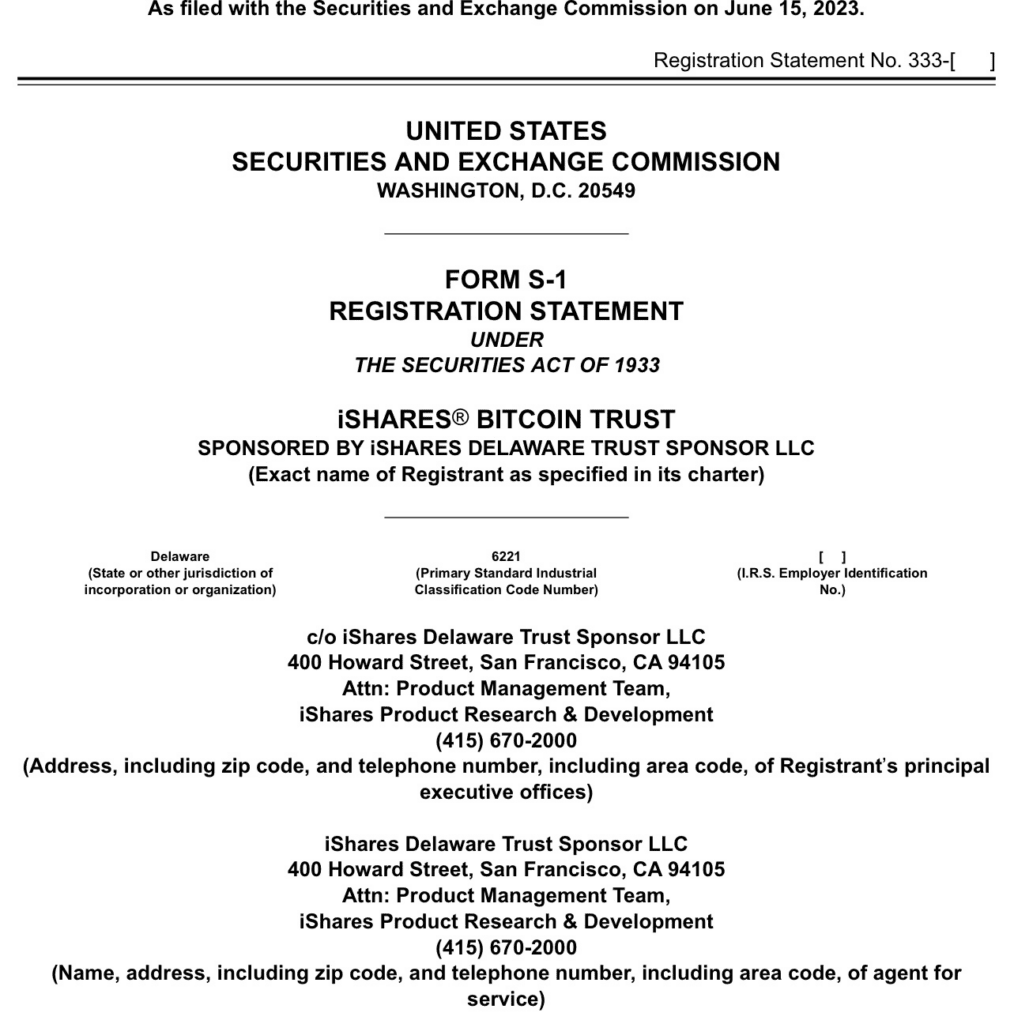

True to previous rumors, the world’s largest asset management fund, BlackRock, late June 15 filed an application to establish a Bitcoin ETF with the US Securities and Exchange Commission (SEC). Specifically, the organization under the name of the Bitcoin ETF is the iShares investment unit of BlackRock, with the official name for the fund being iShares Bitcoin Trust.

BTC price recorded a slight bounce to $25,700 in an hour after the iShares unit of fund manager BlackRock (BLK) filed paperwork Thursday afternoon with the US Securities and Exchange Commission (SEC) ) to form a spot bitcoin (BTC) ETF before correcting back to the current $25,500.

But BlackRock’s announcement stoked optimism about the possibility of a spot bitcoin ETF, even after the SEC has rejected multiple applications over the past 18 months.

Despite licensing a range of Bitcoin futures ETFs, such as ProShares, Valkyrie, and VanEck, by the end of 2021, the SEC has yet to approve any physical BTC-based Bitcoin ETFs. Explaining this, SEC Chairman Gary Gensler said futures contracts are a more regulated financial product, limiting risks for investors, while Bitcoin spot trading could be better.

And yet, the most obvious obstacle to the aforementioned Bitcoin ETF proposal is that the Securities and Exchange Commission is suing Coinbase for allegedly listing several cryptocurrencies that have been declared securities without notifying the SEC.

However, BlackRock must have been prepared to announce its ambition to create a Bitcoin Spot ETF. That is not to mention the weight in the US financial industry of this $ 10 trillion wealth management group and the political connections of BlackRock CEO Larry Fink.

The cryptocurrency market is still gloomy, along with the US monetary policy and the crackdown by US regulators, especially the intense lawsuit of the SEC with the two largest exchanges in the market. Binance and Coinbase.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News