Key Points:

- The world’s largest cryptocurrency options exchange Deribit has announced that it will launch bitcoin futures and options contracts in June 2024.

- According to the platform, this launch plan will meet the high demand of customers after Bitcoin Halving in April 2024.

- The platform’s customers requested to list them earlier to facilitate trading these contracts prior to listing.

According to CoinDesk, crypto options trading platform Deribit announced that it will launch BTC options and futures contracts expiring on June 2024, precisely at 08:00 UTC, Thursday, June 22, to meet the high demand of customers.

According to Deribit, the world’s largest crypto options exchange by trading volume and open interest, preparations for the same have already begun, with investors looking to bitcoin futures and options that expire two months after the critical event is known to have a significant impact on the price of cryptocurrencies.

Crypto futures contracts are agreements between traders to buy or sell a particular asset at a possible price and on a specified date. Crypto options contracts provide the contract holder with the right but not the obligation to buy or sell an asset at a predefined price and date.

Futures can be used to protect against potential market volatility. The basic purpose of options is to mitigate or lower the portfolio’s risk exposure. To make a leveraged optimistic or bearish wager on the underlying asset at a lesser cost, knowledgeable traders frequently purchase options or futures.

According to Derbit, preparations for the halving have already begun, with investors looking for bitcoin futures and options expiring two months after the milestone, which is known to significantly impact the price of bitcoin and the entire cryptocurrency market.

“Normally, Deribit would introduce the June 2024 options and futures next week at the June 2023 quarterly expiry. However, with the halving expected in April, clients have requested us to list them earlier to facilitate the trading of these contracts ahead of the regular listing date,” Deribit’s Chief Commercial Officer Luuk Strijers told CoinDesk.

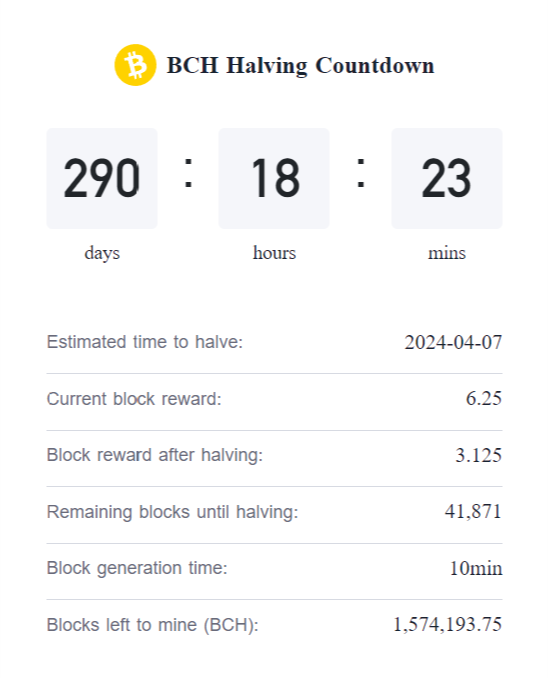

ViaWallet data shows 290 days and 18 hours before the next Bitcoin halving, and the estimated halving time is April 27. The current block reward is 6.25 BTC, which will drop to 3.125 BTC after the halving.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News