Bitcoin Investment Soars With $187 Million Inflows In A Week, Beating Expectations

Key Points:

- Digital asset investment inflows correct 9 weeks of outflows, with Bitcoin as the primary beneficiary.

- High profile ETP issuers filing for physically backed ETFs with US SEC contribute to renewed positive sentiment.

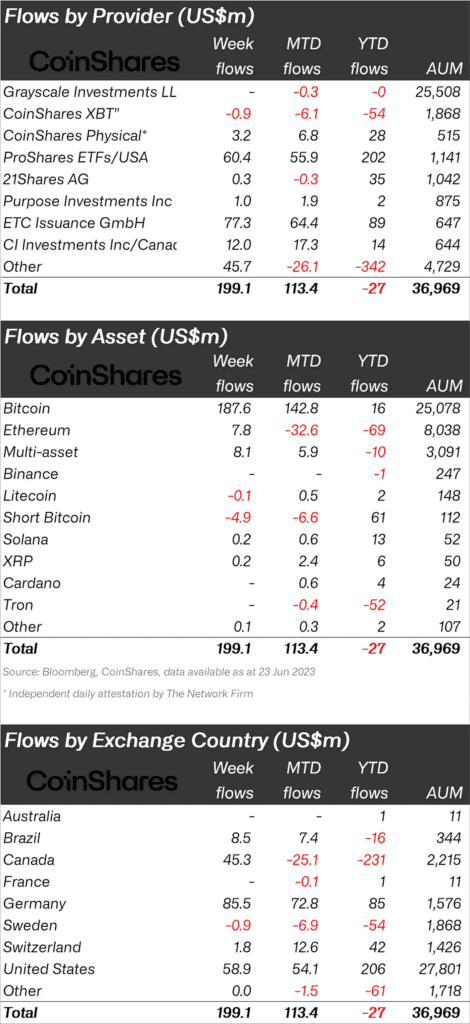

Digital assets saw the biggest weekly inflows since July 2022, totaling US$199m. This corrected almost half of the nine consecutive weeks of outflows. Bitcoin was the biggest beneficiary, receiving US$187m in inflows last week.

According to Coinshare, digital asset investment products saw the largest weekly inflows since July 2022, totaling $199 million. Bitcoin was the primary beneficiary, receiving $187 million in inflows last week. The renewed positive sentiment is believed to be due to high-profile ETP issuers filing for physically-backed ETFs with the US Securities & Exchange Commission.

Total assets under management (AuM) have reached $37 billion, their highest since before the collapse of 3 Arrows Capital. Ethereum saw minor inflows of $7.8 million, representing just 0.1% of AuM relative to Bitcoin’s inflows at 0.7%, suggesting a lower appetite for Ethereum compared to Bitcoin at present.

The turn in sentiment did not trickle down to altcoins, with only minor inflows into XRP and Solana totaling $0.24 million and $0.17 million, respectively. However, the improved sentiment did encourage some investors to buy multi-asset investment ETPs, with $8 million in inflows last week.

This surge in digital asset investment products can be attributed to filing physically-backed ETFs with the US Securities & Exchange Commission. This renewed positive sentiment is a welcome change after nine consecutive weeks of outflows. The increased inflows for Bitcoin is a clear indication of its dominance in the market, with Ethereum lagging behind. However, it is worth noting that the appetite for Ethereum is still present despite the lower inflows. The lack of inflows in altcoins suggests that investors are still cautious when it comes to investing in these assets.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News