Key Points:

- Azuki Elementals NFT series experienced a setback as its floor price plummeted, sparking NFT community discussions.

- Notable buyers invested millions in Azuki Elementals, reflecting ongoing interest in NFTs as digital asset investment.

- Despite the decline in price and admission of failure, Azuki still generated a substantial revenue of $37 million.

Azuki Elementals NFT series has experienced a significant setback as its floor price plummeted to 1.65 ETH, falling below the initial issue price of 2 ETH.

The entire Azuki brand NFT series witnessed a sharp decline, with the floor price dropping to 10 ETH, marking a staggering 24-hour decrease of 31%. This disappointing turn of events has raised concerns within the digital collectibles community.

One of Azuki’s co-founders acknowledged the failure of the minting experience, stating that it did not meet the expected standard. This admission highlights the challenges faced by the team in delivering a satisfactory user experience and meeting the high expectations of collectors and investors.

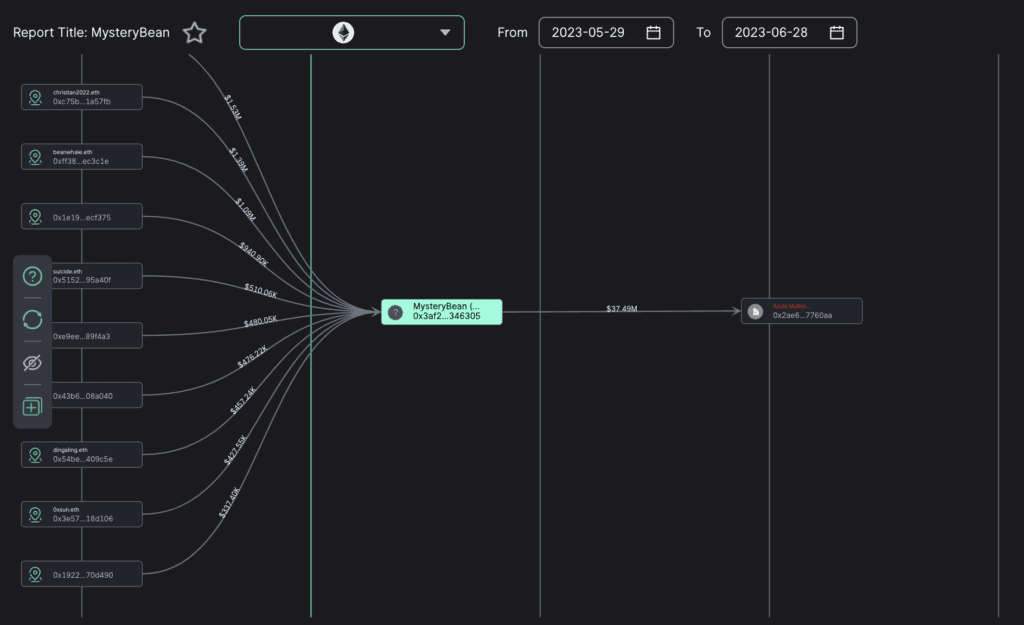

Despite the decline in prices and the admission of failure, the Azuki official team (0x3A…6305) managed to generate substantial revenue through the sale of Azuki Elementals. They received 20,000 ETH, which amounts to approximately $37 million. Shortly after, the funds were transferred to the Azuki team’s multi-signature address (0x2a…60AA). This transfer of funds signals the team’s continued commitment to navigating the challenges and striving for future success.

Notable individual buyers emerged during the sale of Azuki Elementals, reflecting the ongoing interest in the NFT market. Among them, luggis.eth stands out as the largest buyer, investing a substantial $1.53 million in Azuki Elementals.

Other significant buyers include christian2022.eth, who purchased Azuki Elementals for $1.39 million, beanwhale.eth, who acquired them for $1.09 million, and suicide.eth, who invested $0.51 million. These sizable transactions demonstrate the continued appeal of NFTs as a form of digital asset investment.

The decline in Azuki Elementals’ floor price and the admission of minting failure have sparked discussions within the NFT community about the challenges faced by projects aiming to deliver unique and compelling digital collectibles. Collectors and investors are eagerly observing how the Azuki team will address the concerns and improve their offerings moving forward.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Annie

Coincu News