Key Points:

- The funding rate for BCH contracts falls while Venus sees a surge in lending activity with high APY rates.

Over $2M worth of BCH lent, with over half from a single user. All borrowed funds sent to Binance.

Suspicions arise regarding potential short action. Traders and analysts monitor closely.

The annualized funding rate of BCH perpetual contracts has taken a sharp downturn across all major exchanges.

Simultaneously, the Venus platform has witnessed a significant increase in the Annual Percentage Yield (APY) for BCH deposits, reaching an impressive 120%, while the APY for loans has surged to about 192%. These contrasting trends have sparked interest and raised questions within the crypto community.

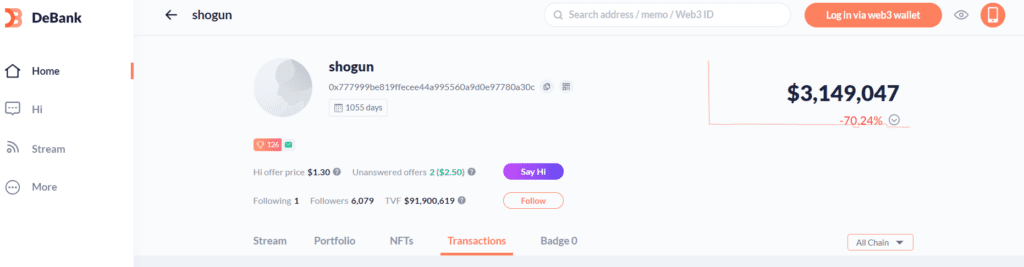

Venus platform has seen a substantial influx of BCH lending activity, with a total value of 2.03 million USD worth of BCH being lent. Over half of this amount originated from a single user address: 0x777999be819ffecee44a995560a9d0e97780a30c. However, concerns have arisen as all of the borrowed funds were swiftly transferred to Binance, a leading cryptocurrency exchange. This sequence of events has led some to suspect a deliberate short action.

The negative annualized funding rate for BCH perpetual contracts has captured the attention of traders and investors. The funding rate plays a crucial role in maintaining equilibrium in perpetual contracts, as it ensures fair compensation for traders with opposing positions. A negative funding rate indicates that short-sellers receive payouts from long positions, potentially indicating bearish sentiment in the market.

Venus has seen a surge in popularity due to its enticing APY rates. With a 120% APY for BCH deposits and a 192% APY for loans, Venus has attracted significant attention from crypto enthusiasts seeking higher yields. Such substantial returns are rare, even in the volatile world of cryptocurrencies, and have likely contributed to the increased lending activity on the platform.

The concentration of BCH lending activity from a single user address, coupled with the immediate transfer of funds to Binance, has raised eyebrows among industry observers. While it is important to note that these actions are not inherently nefarious, suspicions have emerged regarding potential short-selling strategies. Traders and analysts are closely monitoring the situation, seeking further insights to confirm or dispel these suspicions.

As the crypto market continues to evolve, the fluctuating funding rates and the allure of high APYs on platforms like Venus highlight the complexities and opportunities within the industry. Market participants will undoubtedly keep a watchful eye on these developments to gain a deeper understanding of the implications and potential market movements in the near future.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Annie

Coincu News