BaseFEX review is a crypto derivatives exchange that specializes in futures trading.

Currently, it only offers Bitcoin futures trading, but it allows traders to engage in highly-leveraged contracts for different cryptocurrencies valued up to 100x times.

These include perpetual swap contracts for BTC (Bitcoin), ETH (Ethereum), BCH (Bitcoin Cash), XRP (Ripple), BNB (Binance Coin), and EOS Electro-Optical System). All profits and losses on BaseFEX trading are paid in Bitcoin and USDT. However, BaseFEX is looking to expand its services by offering leveraged contracts for other cryptocurrencies and altcoins. This will provide traders with more options and a greater range of investment opportunities. By expanding its portfolio, BaseFEX hopes to attract more traders and investors to its platform and establish itself as a leading player in the crypto derivatives market.

What Is BaseFEX?

BaseFEX is a cryptocurrency derivatives exchange platform. It provides traders with the ability to trade various cryptocurrency futures contracts with leverage. BaseFEX offers a range of features and tools for trading, including a user-friendly interface, advanced trading charts, risk management options, and a customizable trading experience.

BaseFEX is its focus on offering high leverage for trading. Leverage allows traders to multiply their exposure to the price movements of the underlying cryptocurrency without requiring them to hold the full value of the contract. This can potentially amplify profits but also carries higher risks.

How Does BaseFEX Work?

BaseFEX is a cryptocurrency derivatives exchange that operates on a user-friendly online platform:

- Registration: To begin trading on BFEX, users need to create an account by completing the registration process. This typically involves providing personal information and agreeing to the platform’s terms of service.

- Deposit: After registering, users need to deposit funds into their BFEX account. BFEX supports deposits in cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH).

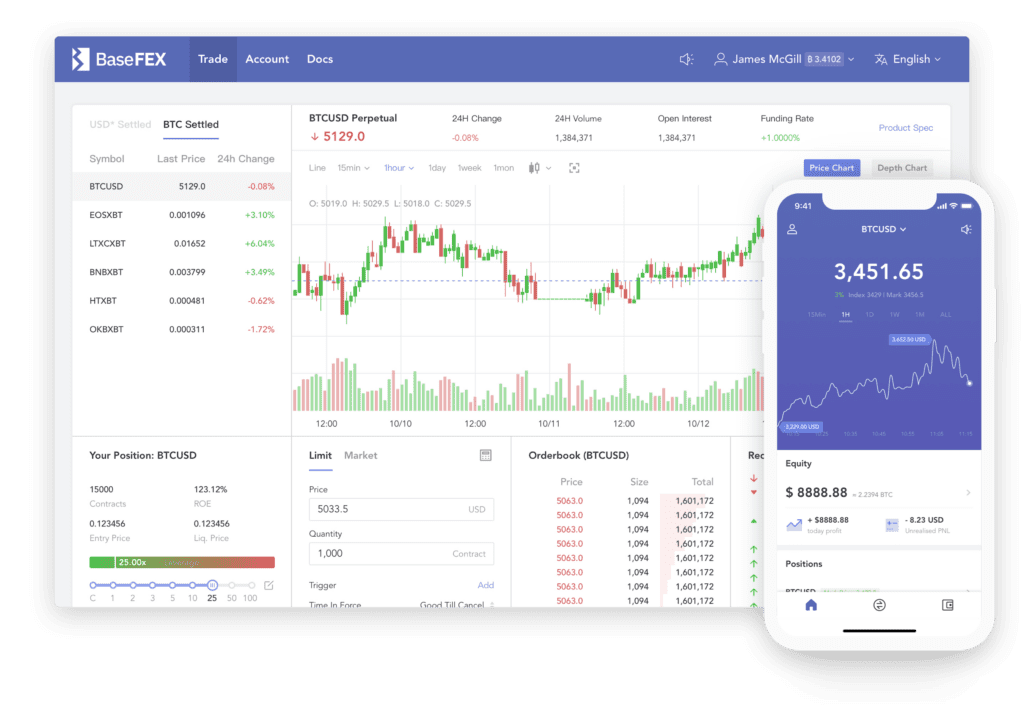

- Trading Interface: Once the account is funded, users can access the trading interface. The interface displays various trading pairs and futures contracts available for trading. Users can choose the desired trading pair and contract based on their preferences.

- Leverage: BFEX allows traders to use leverage, which means they can open positions that are larger than the amount of funds they have in their account. Leverage amplifies both profits and losses, so traders should exercise caution and understand the risks involved.

- Placing Orders: Traders can place different types of orders on BFEX, including market orders, limit orders, stop orders, and more. These orders allow traders to specify the desired price at which they want to enter or exit a position.

- Risk Management: BFEX provides various risk management tools to help traders manage their positions effectively. These tools may include features like stop-loss orders and take-profit orders, which allow users to automatically close positions at predetermined price levels.

- Trading Execution: Once an order is placed, BFEX executes the trade based on the market conditions and the order parameters. The order may be filled immediately if the market conditions allow, or it may remain open until the specified conditions are met.

- Profits and Losses: As the market price of the chosen cryptocurrency futures contract fluctuates, traders can make profits or losses. Traders can monitor their positions and account balance in real-time on the BFEX platform.

- Withdrawals: If traders wish to withdraw their funds from BFEX, they can request a withdrawal to their designated cryptocurrency wallet. The withdrawal process usually involves a security verification step to ensure the safety of the funds.

Features of BaseFEX

BaseFEX offers several features that cater to the needs of cryptocurrency traders:

- Leverage Trading: BFEX provides high leverage options, allowing traders to amplify their exposure to cryptocurrency futures contracts. Traders can potentially generate higher profits by using leverage, but it’s important to note that it also carries higher risk.

- Diverse Range of Cryptocurrency Futures: BFEX supports a wide range of cryptocurrency futures contracts, including popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and others. Traders can choose from various trading pairs and contract durations to suit their trading strategies.

- User-Friendly Trading Interface: BFEX offers an intuitive and user-friendly trading interface, making it accessible for both novice and experienced traders. The interface provides real-time market data, advanced charting tools, and order placement options to facilitate efficient trading.

- Advanced Trading Tools: BFEX equips traders with advanced trading tools and features to enhance their trading experience. These tools may include customizable charts, technical analysis indicators, risk management options, and order types such as market orders, limit orders, and stop orders.

- Security Measures: BFEX prioritizes the security of user funds and employs industry-standard security measures. These measures may include encrypted data transmission, two-factor authentication (2FA), cold storage for cryptocurrencies, and regular security audits.

- Risk Management Tools: BFEX provides risk management tools to help traders mitigate potential losses. These tools may include stop-loss orders, which allow traders to set a specific price level at which their positions will be automatically closed to limit losses.

- Competitive Fee Structure: BFEX offers a competitive fee structure for traders. The platform typically charges trading fees based on the trading volume and may have different fee tiers for different levels of trading activity.

- Responsive Customer Support: BFEX has a customer support team that can assist users with inquiries and issues related to the platform. They aim to provide timely and helpful support to ensure a smooth trading experience.

Pros and Cons

Pros:

- Leverage Trading: BFEX offers high leverage options, allowing traders to amplify their potential profits by trading with borrowed funds.

- Wide Range of Cryptocurrencies: BFEX supports a diverse selection of cryptocurrencies, providing traders with various options for trading futures contracts.

- User-Friendly Interface: BFEX’s user-friendly interface makes it accessible for both experienced and novice traders. It offers intuitive navigation, advanced charting tools, and order placement options.

- Risk Management Tools: BaseFEX provides risk management features like stop-loss orders, enabling traders to manage their risk exposure and protect themselves from significant losses.

- Security Measures: BaseFEX emphasizes the security of user funds and employs measures such as encryption, 2FA, and cold storage to safeguard customer assets.

- Competitive Fees: BaseFEX aims to offer competitive fee structures for trading, making it potentially cost-effective for active traders.

Cons:

- Leverage Risks: While leverage can amplify potential profits, it also increases the risk of losses. Trading with leverage requires careful risk management and can result in substantial losses if not used responsibly.

- Limited Availability: BaseFEX’s availability might be limited in certain regions. It’s important to check if the platform is accessible in your jurisdiction before attempting to use it.

- Regulatory Considerations: Cryptocurrency derivatives trading is subject to regulatory oversight in various jurisdictions. Traders should be aware of the legal and regulatory implications of engaging in such activities in their respective countries.

- Volatility and Market Risk: The cryptocurrency market is highly volatile, which can result in rapid price fluctuations. Traders should be prepared for significant price swings and understand the potential risks associated with trading in a volatile market.

- Technical Issues: Like any online platform, BaseFEX may encounter technical issues, such as system outages or delays. These issues can disrupt trading activities and potentially lead to missed opportunities or inconveniences.

- Learning Curve: Trading on BaseFEX requires a certain level of understanding of cryptocurrency markets, derivatives trading, and risk management strategies. Novice traders may need to invest time and effort in learning these concepts before engaging in active trading.

BaseFEX Fees

BaseFEX charges fees for various services and transactions on its platform. Here is a general overview of the fees you may encounter when using BaseFEX:

- Trading Fees: BaseFEX charges trading fees for executed trades on the platform. The fee structure is typically based on a tiered system, where the fee percentage decreases as your trading volume increases. The specific fee percentages may vary depending on the trading pair and contract type. It’s recommended to visit the BaseFEX website or consult their fee schedule for detailed information on current trading fees.

- Funding Fees: When depositing or withdrawing funds from your BaseFEX account, you may encounter funding fees. These fees are typically associated with cryptocurrency transactions and are subject to network fees and market conditions. The specific fees can vary depending on the cryptocurrency being deposited or withdrawn.

- Overnight Funding Fees: BaseFEX may charge overnight funding fees for holding leveraged positions overnight. These fees are calculated based on the size of the position and the funding rate of the particular contract. The funding rate is influenced by market demand and can vary from positive to negative. Positive funding rates result in traders receiving payments, while negative funding rates result in traders paying fees.

BaseFEX Customer Service

BaseFEX provides customer support services to assist users with inquiries and issues related to the platform. Here is an overview of BaseFEX’s customer service options:

- Support Tickets: Users can submit support tickets through the BaseFEX website or platform. By submitting a support ticket, users can describe their issue or inquiry in detail and receive a response from the BaseFEX support team.

- Email Support: BaseFEX offers email support for users who prefer to communicate via email. Users can send their questions or concerns to the designated support email address provided by BaseFEX. The support team will respond to the email inquiries as promptly as possible.

- Live Chat: BaseFEX features a live chat support option, allowing users to engage in real-time conversations with the customer support team. Live chat can be accessed through the BaseFEX website or platform. This option enables users to receive immediate assistance for urgent matters or time-sensitive inquiries.

Conclusion

BaseFEX is a cryptocurrency derivatives exchange platform that offers traders the ability to trade a variety of cryptocurrency futures contracts with leverage. It provides a user-friendly interface, a wide range of cryptocurrencies to trade, and risk management tools such as stop-loss orders. BaseFEX emphasizes security measures to protect user funds and offers competitive fee structures.

However, it’s important to consider the potential risks associated with trading on BaseFEX or any other cryptocurrency derivatives exchange. Leverage trading can amplify both profits and losses, and the cryptocurrency market is highly volatile. It’s crucial to have a good understanding of trading concepts, risk management strategies, and the specific terms and conditions of BaseFEX before engaging in trading activities.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Annie

Coincu New