Key Points:

- Algofi, the largest DeFi protocol in the Algorand ecosystem, will be shutting down due to the inability to maintain the high standards they believe the community deserves.

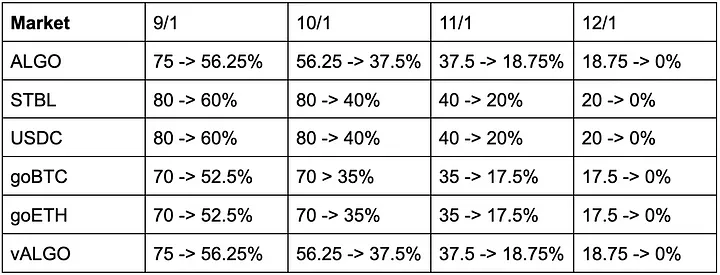

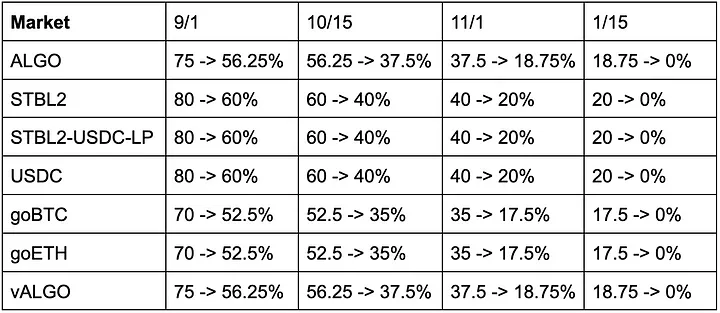

- V1 and V2 Lending will be reducing collateral factors of several markets over several months to ensure liquidity migrates off.

Algofi, the largest DeFi protocol in Algorand, will shut down due to the inability to maintain standards. Collateral factors of lending will be reduced.

Algofi, the largest DeFi protocol in the Algorand ecosystem, announced that it would be shutting down. The platform will go into “withdrawal-only mode” and close all of its social media accounts except for its Discord. Algofi raised $2.8 million in 2021, with participation from Coinbase, Y Combinator, Jump Crypto, and others.

The team has recently made the decision to begin winding down the protocol due to the inability to provide the necessary support to maintain the protocol at the high standards which they believe the community deserves. The team will begin sunsetting the platform and put the platform in withdrawal-only mode shortly.

The primary objective in the future is to ensure that these steps are carried out safely, clearly communicated, and timely. The Algofi team encourages anyone with questions about the plan to reach out to the community Discord, where they will be active. They will sunset other social media platforms to ensure seamless, unified communication.

The Algofi platform was designed to improve existing decentralized finance infrastructure using Algorand’s strong technology stack to build fast, scalable, and affordable products. The team achieved this goal by building alongside the community, who provided invaluable feedback. A confluence of events has no longer made building and maintaining the Algofi platform to the highest standards a viable path for the company. Due to this, the team has decided to begin sunsetting the platform.

In addition to Algofi’s shutdown, V1 and V2 Lending will be reducing collateral factors of the ALGO, vALGO, STBL, USDC, goBTC, and goETH markets over several months to ensure liquidity migrates off. Governance Protocol’s current Liquidity Mining programs will be halted, and no future proposals will be enacted. Further announcements on handling the voting escrow/locking mechanism are forthcoming.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.