Key Points:

- Curve TVL (Total Value Locked) plummeted from $3.266 billion on July 30 to $1.869 billion today.

- Several pools on Curve were attacked with an estimated $52 million in damage.

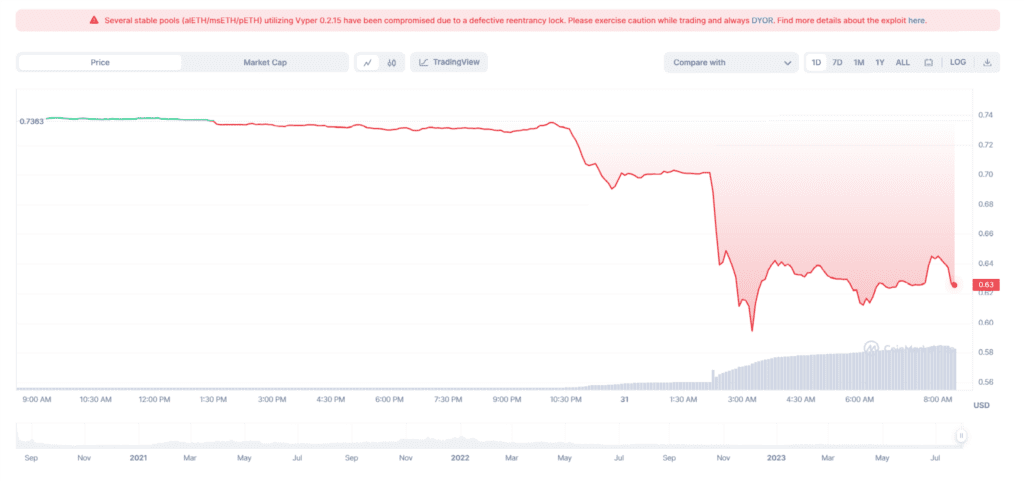

- CRV price dropped more than 17% to $0.58 and then returned to $0.63 at present.

According to DefiLlama data, as a result of the attack, Curve TVL ( Total Value Locked) fell from $3.266 billion on July 30 to $1.869 billion. As of now, the 24-hour drop is 42.78%.

Earlier today, Curve Finance announced that the stablecoin pool alETH/msETH/pETH was hacked due to a Vyper recursive critical bug. According to the security agency’s monitoring, the Curve Finance attack caused $52 million in damage.

Curve operates 232 different pools, but only those using the Vyper versions above are at risk. According to the monitoring of security agency PeckShield, up to now, the Curve Finance stablecoin pool hack has caused damage on Alchemix, JPEG’d, MetronomeDAO, deBridge, Ellipsis Team and CRV/ETH.

The story started not only from this week, but even from last week (July 21), when Conic Finance was drained of assets because there was some connection with LP Token on Curve Finance. After that, the Conic Finance Project received an investment of $ 1 million from Michael Egorov (founder of Curve Finance) to fix the losses after the exploit 1 week ago.

The shares from the Curve team, currently Volatile pools, and pools related to stETH,frxETH, cbETH, rETH, and sETH are still safe. White hat hackers stepped in to protect other pools’ assets earlier today.

The Curve then also confirmed that the above liquidity pools had problems related to the Vyper programming language versions 0.2.15, 0.2.16, and 0.3.0. Both the project and the Vyper developer claim to be investigating the cause and urge affected parties to contact them directly.

CRV price dropped more than 17% to $0.58 and then returned to $0.63 at present. The CRV price drop has the community worried it could force the Curve founder to liquidate a $70 million loan position on Aave.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.