Market Overview (July 24 – July 30): Latest Developments in Cryptocurrency Market

Key Points

- Market overview for the past week included Binance listing Worldcoin (WLD), SEC accusing Binance of facilitating fake trades, Ripple applying for a cryptocurrency license, and Alphapo getting hacked.

- The Federal Reserve announced a rate hike and is closely monitoring data to contain inflation until 2025.

- Upcoming trends to watch in the crypto space include new DEX platforms like Infinex and TraderJoe, the rise of real-world asset-backed cryptocurrencies, and the attention on the Solana ecosystem.

Stay up-to-date with the latest developments in market overview, including Binance’s recent listings, SEC actions, and security concerns. Explore macroeconomic news and upcoming trends to make informed investment decisions.

Last week’s highlights big news

Last week saw a number of significant developments in the market overview, including the launch of new tokens and the introduction of new regulations. Here’s a rundown of some of the top news stories from the past week:

- Binance, listed Worldcoin (WLD) on its platform. The move was seen as a major vote of confidence in the new token, which has been gaining popularity in recent months. Besides, Worldcoin moved to the Optimism network and issued its WLD token. The token was listed on Binance and KuCoin, two of the largest cryptocurrency exchanges in the world.

- The US Securities and Exchange Commission (SEC) accused Binance of facilitating fake trades on its US platform. Binance has said it will appeal the lawsuit filed by the US Commodity Futures Trading Commission (CFTC).

- Ripple, the company behind the XRP cryptocurrency, applied for a cryptocurrency license in the UK and Ireland. The move is seen as a sign of the company’s commitment to expanding its presence in Europe.

- Cryptocurrency payment provider Alphapo was hacked, resulting in the theft of over $23 million in ETH, Tron, and BTC. The incident highlights the ongoing security risks associated with cryptocurrencies.

- Binance France reported a loss of $4.4 million in 2022. The company has been facing regulatory scrutiny in a number of European countries, and recently withdrew from the German market.

- Chainlink co-founder Sergey Nazarov predicted that banks will eventually build their own blockchain systems. He argued that the technology will become increasingly important in the financial sector in the coming years.

- Telegram Bots trend surpassed a market cap of $155 million. The rise of these bots, which are designed to facilitate trading on Telegram, highlights the growing interest in cryptocurrency trading.

- The Avalanche Foundation launched a $50 million investment fund in Real World Asset. The fund is designed to support the development of blockchain-based solutions for real-world applications.

- Binance introduced a new tag warning about high-risk and volatile tokens. The move comes as the exchange faces increasing regulatory pressure in a number of countries.

- Elon Musk’s Twitter name change caused a sudden change in Dogecoin’s price. The incident highlights the role that social media plays in the cryptocurrency market.

- Finally, the SEC’s ongoing dispute with Coinbase over the Bitcoin Spot ETF has continued to attract attention. The SEC has sued Coinbase for ‘operating a securities exchange without registering’, while all Bitcoin Spot ETF applications list Coinbase as the managing and supervising partner.

Macroeconomic

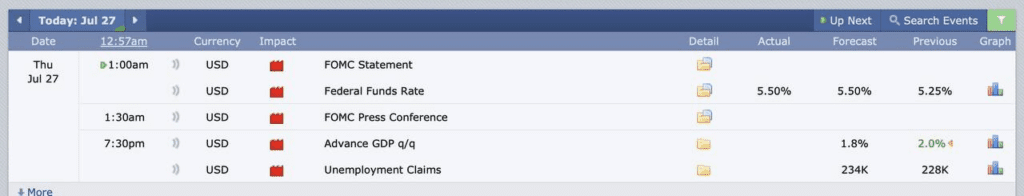

The Federal Reserve has announced a rate hike of +0.25%, bringing the interest rate to its highest level in 22 years at 5.25-5.5%. However, the Fed has not made a decision on future interest rate hikes as it continues to depend on data.

If the data supports it, it is likely that interest rates will increase further. The Fed will also continue to reduce its balance sheet. Chairman Powell has responded by stating that the Fed has not made any decisions for future meetings and will observe new data, including CPI/CPE and unemployment percentage.

Although the Fed always says it needs more data, it has not been specific about how many months of data it needs. This time, the Fed has mentioned 2 CPI/CPE and 2 unemployment data within the next 2 months multiple times, indicating the data the Fed needs. In summary, the Fed’s goal is to contain inflation until 2025.

Notable upcoming trends

Here are some of the most notable upcoming trends in the market overview that investors and enthusiasts should keep an eye on.

- Infinex is a DEX perp platform that is launching along with perp V3. Infinex is being built by Synthetix, a decentralized derivatives liquidity protocol powered by Ethereum. Infinex aims to provide a more user-friendly and efficient trading experience for users.

- TraderJoe is preparing to deploy on Ethereum, the fourth largest version of $JOE, after BNB Chain. TraderJoe is a decentralized yield farming protocol that aims to provide users with high APY returns on their cryptocurrency investments.

- Uniwhale Exchange is a DEX Perp platform that is set to launch on Arbitrum. The platform will allow early users to access the platform on 24/07, and the public on 26/07. Uniwhale Exchange aims to provide users with more liquidity and lower transaction fees.

- The RWA (Real World Asset) trend is still being watched and hyped. RWA is a new type of cryptocurrency that is backed by real-world assets, such as real estate or precious metals. This type of cryptocurrency provides investors with more stability and security.

- The $OP ecosystem is currently operating quite actively with OP Stack and EIP-4844. Some notable projects include $OP, $VELO, and $SONNE. $OP is a decentralized platform that aims to provide users with more control over their financial assets.

- Telegram Bots narratives include $WAGIE, $UNIBOT, $CENIE, $LOOT, $ASAP, $SWIPE, $NBOT, and $FRENS. These Telegram Bots provide users with real-time updates and alerts on cryptocurrency prices and market overview.

- The Solana ecosystem is receiving renewed attention. Solana has generated a lot of attention on social media in the past week. Despite encountering many challenges, the ecosystem remains strong and has grown by over 300%. Solana has some unique features, such as being fast, super cheap, having a strong ecosystem, and most importantly, not being an “Ethereum Killer” like other Layer1s are trying to be. The Solana Foundation is currently sponsoring a $10 million program for AI projects.

This week’s prediction

At the moment, it can be said that we are in the preparation phase for the next bull run cycle. Looking at the history of $BTC, the price will move within a range of 25-50%. This is normal to shake out old holders and create momentum for a new cycle. In fact, if we look at the bigger picture, we can see a long sideways chart trend for many months rather than strong fluctuations.

The 25-50% corrections during the formation of the bull market are normal. Therefore, to be able to change positions during a strong uptrend, we always need enough money to get through this phase. Although currently, we may be at the bottom of $BTC, going all-in regardless will make us lose patience to reach the real uptrend (which is still very long).

If we pay attention, since the FTX crash in January 2022, we have not encountered any serious FUD. Therefore, we can accumulate during the time when BTC is sideways, but we also need to have cash reserves for similar worst-case scenarios. The $25k threshold may still drop if there is an event similar to FTX (no one can predict it). Make sure you always have cash to accumulate.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to DYOR before investing.