Key Points:

- Large number of Bitcoin and Ethereum options set to expire soon.

- Bitcoin dominating market due to anticipation of ETF passing.

- Inverted implied volatility for major-term of Bitcoin and Ethereum.

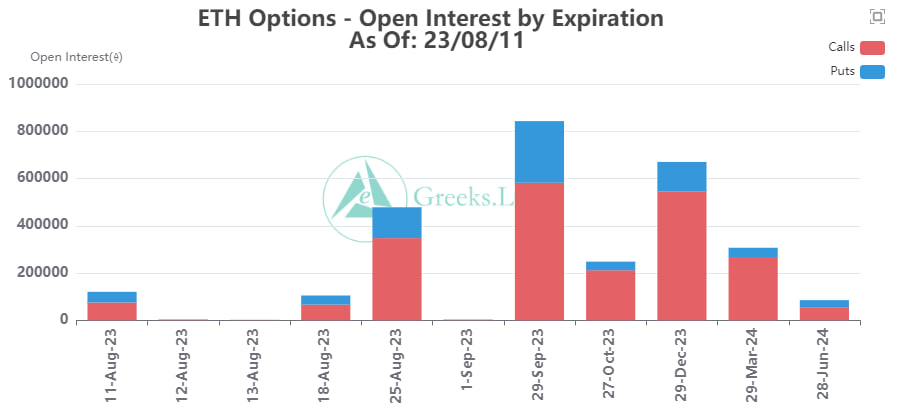

According to August 11 Options Data, a large number of Bitcoin (17k) and Ethereum (121k) options are set to expire soon. Bitcoin had a dominating week in the market, as investors were focused on mainstream cryptocurrencies, anticipating the passing of an ETF.

There are significant options data set to expire on August 11, which is causing quite a stir in the market. Specifically, there are 17,000 BTC options with a Put Call Ratio of 0.42 and a max pain point of $29,500, as well as 121,000 ETH options with a Put Call Ratio of 0.60 and a max pain of $1,850.

This information was sourced from a tweet by Greeks.live. The notional value of these options is a whopping $510 million and $220 million, respectively. This week, BTC has been dominating the market, with many investors anticipating the passing of an ETF. This has resulted in lower ETH deliveries than last week.

The implied volatility of both BTC and ETH has been frequently inverted this year, and this week, it has resurfaced for three days. Currently, ETH weekly ATM option IV is only 22%, which is quite low.

A few years ago, there was a joke about BTC volatility being lower than the Chinese stock market. It seems that this joke may become a reality in the near future, as BTC volatility continues to decrease. With the upcoming expiration of these options, many investors are watching the market closely to see what will happen next.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.