Key Points:

- The US Federal Reserve’s instant payments system, FedNow, has added Hedera’s (HBAR) Dropp payment platform.

- Currently, Dropp allows small-sized payments in HBAR, USD, and USDC.

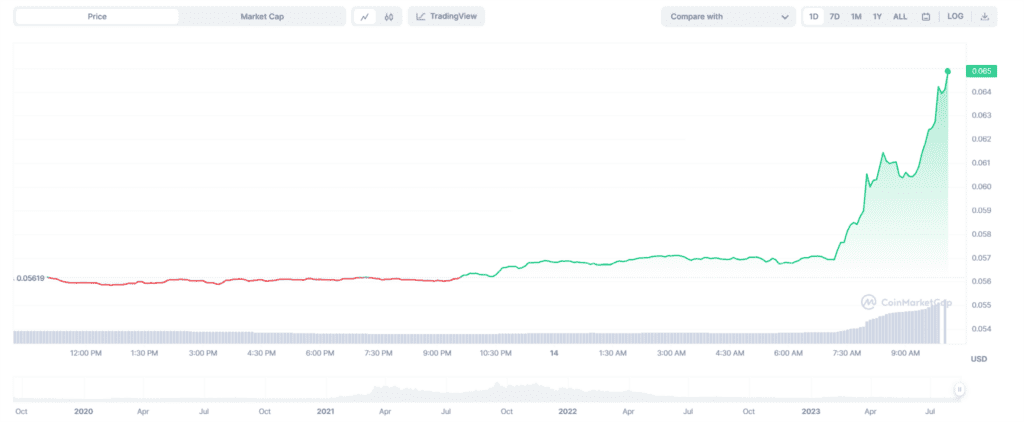

- Hedera’s native HBAR tokens surged 16% after the news.

The US Federal Reserve’s instant payments system, FedNow, has added Hedera’s (HBAR) Dropp payment platform to its list of service providers.

Dropp plans to partner with banks that use FedNow Services to provide merchants with an innovative option for year-round, end-of-day real-time and instant payments services, providing the ability to direct access to money from customers for high-value transactions. The platform will also enable retail-level instant payments for everyday purchases by joining FedNow.

Currently, Dropp allows micropayments for small-value transactions in both HBAR, USD, and USDC. Merchants save money and grow their businesses, while consumers get convenient access to life-enriching products and services. In addition, Dropp allows for NFT storage, transactions, transfers, and viewing of NFT transaction history and details and associated fees.

Dropp, a cost-effective digital micropayment transaction platform, has officially launched on the Hedera Hashgraph blockchain. It is built on high throughput, low latency distributed ledger technology for instant payments. Dropp currently uses ACH to fund consumer wallets and make payments to merchants at the end of the day.

Hedera’s HBAR token also benefited from this positive news causing it to spike 16% in the last 24h. But HBAR also received substantial attention from the community earlier as Lunar Crush, a social media activity monitoring platform around cryptocurrencies, reported a staggering 200% increase in the index, Hedera’s social interactions in the last week.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.