Key Points:

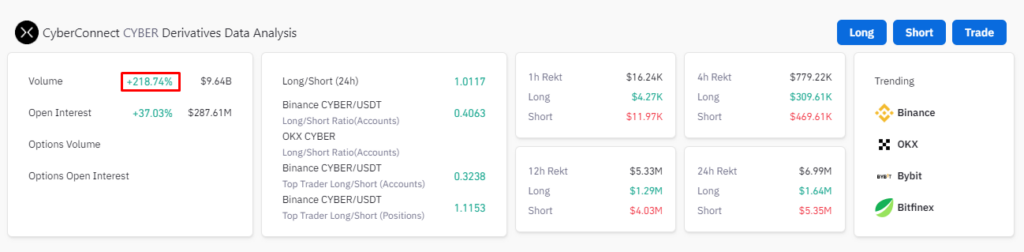

- CYBER perpetual contracts experience massive trading volume increase of 219% in the past 24 hours, second only to BTC and ETH.

- On Binance, CYBER contract’s trading volume is $5.63B, making it the second-most traded asset, surpassing ETH.

- CYBER contract open interest is significantly high, amounting to $287M.

CYBER perpetual contracts see 219% increase, second only to BTC and ETH, with $9.64B trading volume and $287M open interest.

In the past 24 hours, CYBER perpetual contracts have recorded a trading volume of 9.64 billion US dollars, marking a 218% increase, which is second only to BTC and ETH. The trading volume on Binance is a whopping 5.63 billion US dollars, surpassing ETH to become the second-most traded asset. CYBER contract open interest is also significantly high, amounting to $287 million.

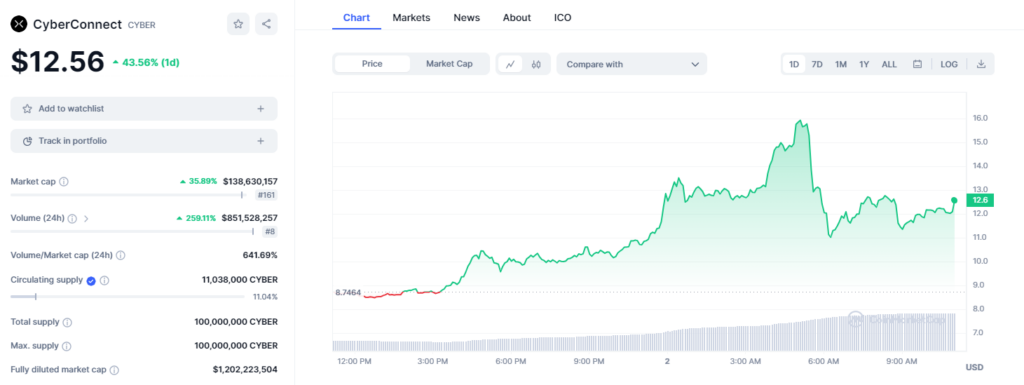

According to Wu Blockchain, Korean traders have been pumping CYBER tokens, which have seen a 150% increase in just seven days. The price of CYBER on Upbit rose to around $16.1, while the price on Binance was $9.3. The annualized funding rate of CYBER U-based contracts was above -500% on major exchanges and -662% on Binance at the time.

As of now, CYBER is trading at $12.56 which is a significant increase of nearly 45% over the last 24 hours, as shown by CoinMarketCap data.

CoinCu reported that DWF Labs has also been increasing its CYBER token holdings, acquiring 170,000 units over the past week and executing a transfer of 170,000 CYBER tokens to the Bithumb exchange within the last 24 hours.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.