Key Points:

- Venture capitalists invested $10.7 billion, a 68% drop from 2022’s $33.3 billion.

- Funding shift to early-stage startups amid macroeconomic uncertainties and regulatory concerns.

- Despite the slowdown, 2023 ranks as the third-highest year for total crypto investment.

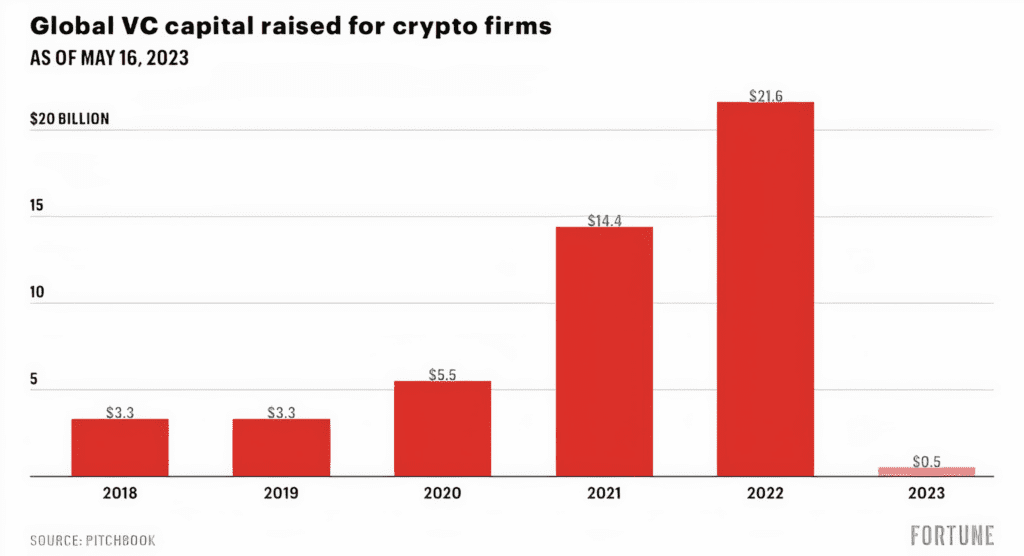

In 2023, the Crypto VC Funding landscape experienced a notable shift as venture capitalists injected $10.7 billion into the industry, marking a substantial 68% decrease from the previous year’s staggering $33.3 billion.

The decline was particularly evident in the second half of the year, despite a November resurgence in funding.

The distribution of investments across startup stages underwent a noteworthy change, with pre-seed, seed, and Series A startups securing a larger share compared to mid and later-stage deals. This trend highlights a strategic shift in investor focus toward early-stage ventures.

Within the diverse verticals of the crypto space, NFT/gaming, infrastructure, and web3 maintained their dominance in terms of deal count. However, sectors such as data, trading, and enterprise witnessed a decline in deal activity, reflecting changing investor preferences.

2023’s $10.7B Plunge Sparks Industry Resilience

Abhishek Saxena, Principal Lead at Polygon Ventures, attributed the significant funding drop to macroeconomic uncertainties, regulatory concerns, and the lingering impact of recent crypto failures. Despite expectations, the funding contraction served as a necessary correction, prompting the industry to reassess priorities and foster resilience.

While 2023 marked a substantial funding pullback, it still ranks as the third-highest year in total investment, surpassing the funding levels of prior bear markets. The year witnessed a total of 1,819 deals, a 32% decrease from 2022, but consistently higher than monthly deals in 2020 and close to the 2021 figure.

The investment landscape in 2023 reinforces the industry’s ability to weather challenges, with a continued emphasis on supporting early-stage ventures and maintaining resilience in the face of evolving market dynamics.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.