Key Points:

- RFP issued for Uniswap V4 front-end development, focusing on user experience.

- $300,000 budget with a willingness to consider proposals exceeding by 25%.

Uniswap Foundation has unveiled its vision for Uniswap V4, releasing a Request for Proposal (RFP) aimed at constructing an innovative front-end for Pool Launchers and Liquidity Providers (LP).

The foundation seeks an adept engineering team with a keen focus on user experience to spearhead the development, operation, and maintenance of a specialized platform catering to new pool launchers and liquidity.

The chosen team is tasked with delivering the Uniswap V4 interface, crafting comprehensive user documentation, and providing educational materials. Additionally, the team must ensure an initial 2-year hosting and maintenance commitment for the front-end interface. Continuous refinement and optimization of the interface form a crucial aspect of the project’s long-term goals.

With a dedicated budget of $300,000 allocated by the Uniswap Foundation for this ambitious two-year initiative, the foundation is open to proposals that exceed the budget by up to 25%.

Uniswap V2 Still Dominates: $1.8B TVL After 2.5 Years!

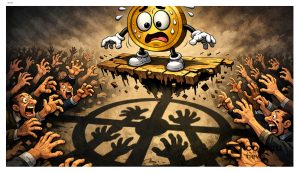

Despite Uniswap V3 being in existence for 2.5 years, Uniswap V2 continues to oversee a substantial $1.8 billion in Total Value Locked (TVL). Dune Analytics data reveals that over 90% of new Uniswap pools are still generated on V2. This persistence is attributed to the straightforward liquidity provision process on V2 and the perceived higher returns by some liquidity providers on V3.

The Uniswap Foundation’s solution aims to seamlessly integrate Uniswap V2’s prevalent use cases into V4, simultaneously reducing entry barriers for new token issuers and liquidity providers. This strategic move seeks to modernize Uniswap’s ecosystem while addressing the evolving preferences of token issuers and liquidity providers.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |