Key Points:

- Public voices privacy fears in UK digital pound consultation.

- Government proposes platform model, allowing private companies direct user relationships.

- Legislation in the works to embed privacy safeguards in digital pound’s design.

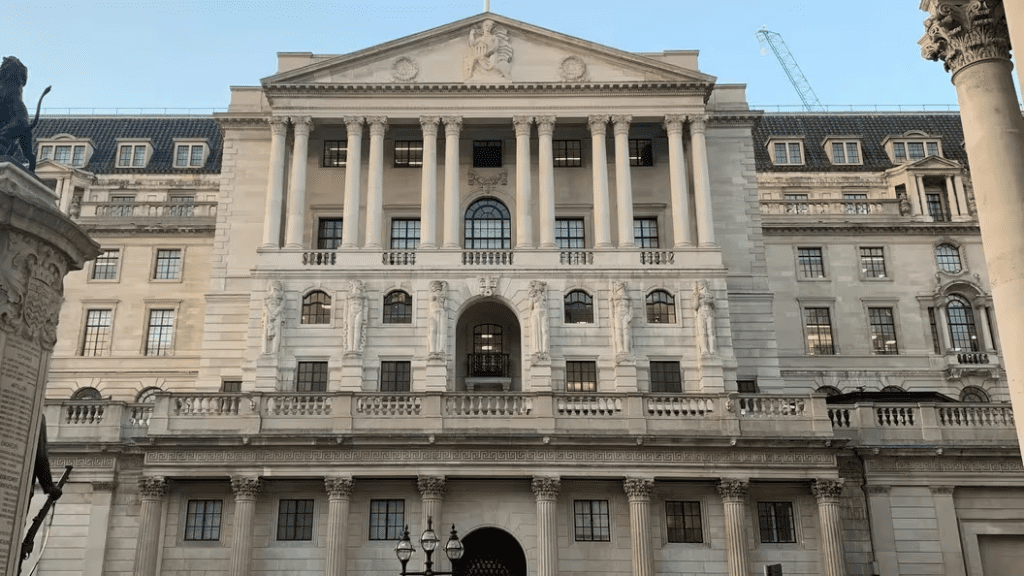

UK’s digital pound consultation results have highlighted public apprehensions regarding privacy concerns.

Addressing these worries, experts endorse the British government’s proposed platform model, anticipating it to be a robust solution backed by upcoming legislation.

The public’s unease over privacy issues with the digital pound has spurred the government to explore innovative solutions. The platform model, as envisioned by British policymakers, introduces a paradigm shift by allowing private companies to establish direct commercial relationships with customers. In this model, the central bank plays a pivotal role by providing the core infrastructure and maintaining the ledger of the digital pound.

The distinctive feature of this model lies in its departure from the conventional government-centric approach, empowering private entities to manage customer interactions directly. Experts view this shift as a strategic move to enhance user privacy and foster a more dynamic and responsive digital currency ecosystem.

UK’s Digital Pound Solution Aims to Revolutionize Privacy

Moreover, the British government is taking proactive measures to address privacy concerns associated with the digital pound. Legislation is in the pipeline, intending to safeguard personal privacy and integrate privacy protection considerations into the digital pound’s design phase. This proactive stance underscores the government’s commitment to establishing a secure and privacy-centric digital currency framework.

As part of the government’s commitment to transparency and public engagement, further consultations with the public are promised before finalizing the fate of the digital. This iterative approach aligns with the government’s dedication to inclusivity and ensuring that the concerns and insights of the public are thoroughly considered in shaping the future of the digital. The ongoing dialogue emphasizes the importance of collaborative decision-making and addresses the evolving landscape of digital currencies in the UK.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |