Key Points:

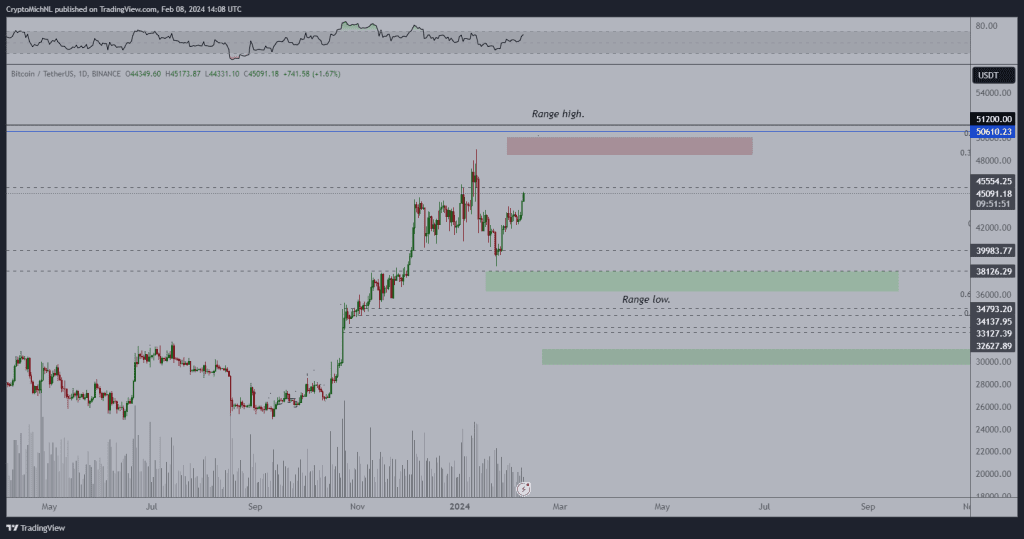

- After SEC’s spot ETF approval, BTC surged to $48,000, then dipped to $38,500 due to sales pressure.

- BTC rebounded, stabilizing at $42,000-$43,000 before a strong comeback, surpassing $45,000 for the first time since January 12.

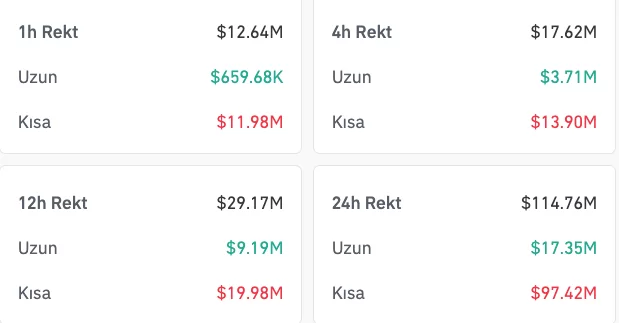

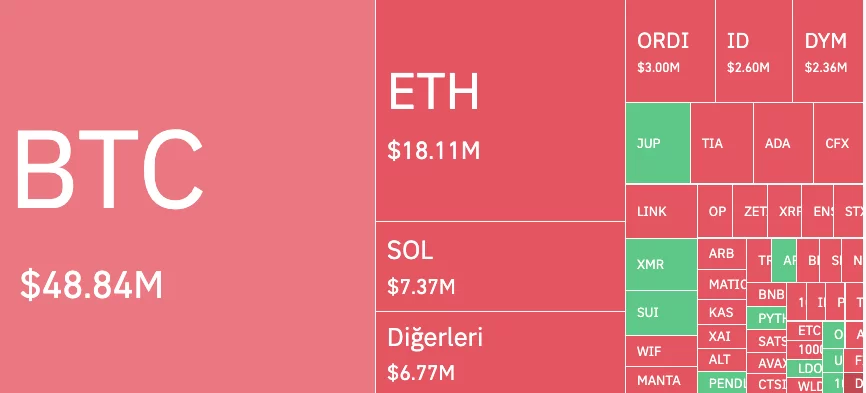

- Coinglass data reveals $114M in crypto futures liquidations in 24 hours, with BTC leading at $48.8M. Analysts assess Bitcoin’s strength and anticipate consolidation between $38,000-$50,000.

Following the SEC’s approval of a spot ETF, Bitcoin price showcased a volatile journey, initially surging to $48,000 before succumbing to sales pressure and falling to $38,500. Despite the setback, Bitcoin demonstrated resilience, initiating a recovery and consolidating within the $42,000-$43,000 range.

In a significant rebound, Bitcoin price made a robust debut, surpassing $44,000 and breaking the $45,000 level for the first time since January 12. At the time of reporting, Bitcoin stands at $45,189.

Coinglass data reveals notable market activity, with almost $114 million in crypto futures positions liquidated within the last 24 hours. Short positions accounted for $97 million, while long positions totaled $17 million. Bitcoin led the list of liquidated short positions with $48.8 million, constituting 50% of the total. Ethereum (ETH) followed with $57.76 million, and Solana (SOL) secured the third position.

Commenting on Bitcoin price’s surge above $45,000, analyst Michael van de Poppe emphasized the cryptocurrency’s strength, noting its return to organic growth. He stated that, at this juncture, both positive and negative impacts of the spot ETF approval had been factored into Bitcoin price’s pricing.

Van de Poppe outlined the defined range and consolidation expectations for Bitcoin, ranging between $38,000 and $50,000. Highlighting the pricing in of both positive and negative impacts of the ETF approval, he indicated that the market was returning to “regular, organic growth.”

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |