Key Points:

- BlackRock and Fidelity’s Bitcoin ETFs hold a combined total of $8.3 billion in BTC.

- Despite outflows from the Grayscale Bitcoin Trust, new ETFs have added an average of $125 million in Bitcoin daily over the past month.

BlackRock and Fidelity hold $8.3bn in BTC. Despite outflows from GBTC, new ETFs added $125m in BTC daily, impacting Bitcoin’s price.

BlackRock and Fidelity have amassed a combined total of 171,705 BTC, worth $8.3 billion, through their spot Bitcoin Exchange Traded Funds (ETFs).

BlackRock And Fidelity Hold $8.3B in Bitcoin ETFs

BlackRock’s fund has even ascended to the top five of all ETFs, including non-crypto, based on 2024 inflows. This places it on par with industry-leading indexing giants like the iShares Core S&P 500 ETF and the Vanguard S&P 500 ETF.

The approval to launch a new crypto investment vehicle caused excitement a month ago. The process of bringing a spot bitcoin ETF to the U.S. market took over a decade, but on Jan. 11, ten such products started trading.

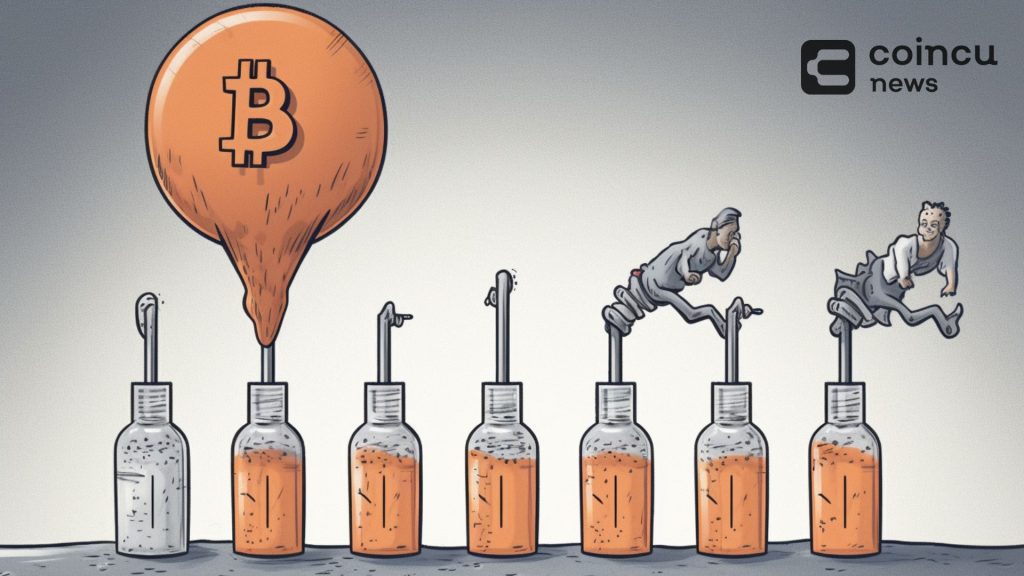

Despite heavy outflows from the Grayscale Bitcoin Trust, the new ETFs have added an average net $125 million worth of Bitcoin each day over the past four weeks.

Readmore: Fidelity Spot Ethereum ETF Has New Deadline For SEC On March 5

Rapid Accumulation of Bitcoin Funds: A Positive Effect or Market Volatility?

In a month, bitcoin funds excluding GBTC have accumulated over $11 billion worth of Bitcoin. Three ETFs – BlackRock’s IBIT, Fidelity’s FBTC, and Ark 21’s ARKB – have surpassed the $1 billion mark in assets under management (AUM).

By the end of Monday, IBIT was nearing $5 billion in AUM, and FBTC was just shy of $4 billion. This rapid accumulation is impacting Bitcoin’s price, which, after an initial decline following the first day of trading, has recently rebounded, reaching a multi-year high above $50,000.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |