Key Points:

- Digital asset investments see a surge, totaling an astounding $2.45 billion weekly and an impressive $5.2 billion year-to-date.

- The United States commands 99% of the inflows, indicating a rising interest in Bitcoin spot-based ETFs.

- The data suggests a worldwide shift in investor sentiment towards the maturing digital asset market.

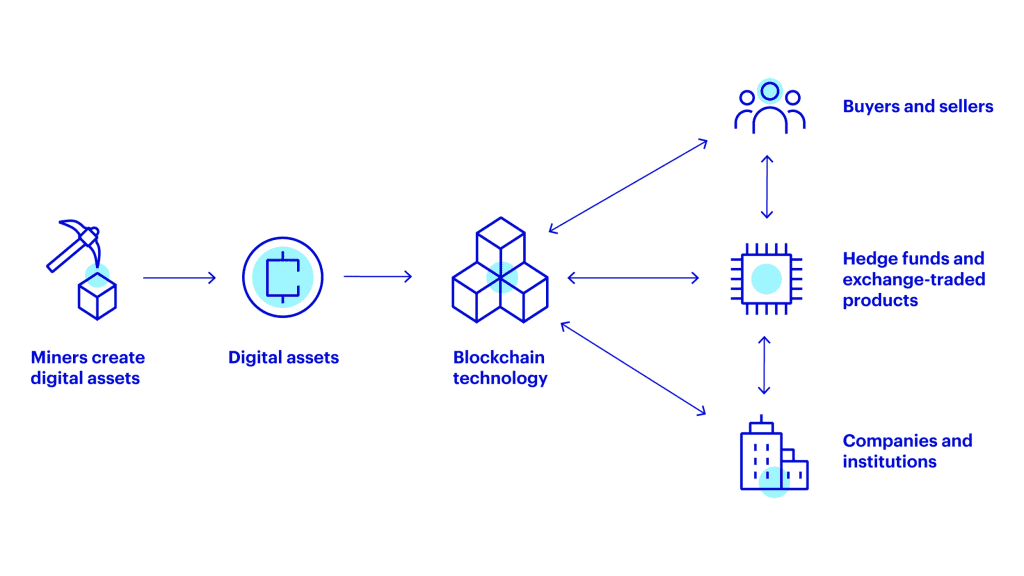

Digital asset investment products have witnessed unprecedented weekly inflows, reaching an impressive total of US$2.45 billion.

The momentum doesn’t stop there, as the year-to-date inflows have now soared to an astonishing US$5.2 billion. These substantial figures underscore the growing enthusiasm and confidence in the digital asset market.

Weekly Inflows Hit $2.45B, YTD Surpasses $5.2B!

The data reveals a clear frontrunner in this surge, with the United States taking the lead and dominating a staggering 99% of the total inflows. This dominance is a significant indicator of the increasing interest in investment products linked to Bitcoin spot-based exchange-traded funds (ETFs). The spotlight on the United States suggests a robust appetite for digital asset investments within the country, particularly in the context of Bitcoin-related investment opportunities.

The record-breaking weekly inflows and the notable year-to-date figures showcase a shift in investor sentiment towards digital assets. This influx of capital not only demonstrates a heightened awareness of the potential returns in the digital asset space but also indicates a maturing market that is increasingly gaining the trust of institutional and retail investors alike.

U.S. Leads with 99% Inflows in $5.2B Crypto Investment Splash!

The specific focus on Bitcoin spot-based ETFs in the United States reflects a strategic move by investors to leverage the opportunities presented by the world’s leading cryptocurrency. The allure of Bitcoin, coupled with the ease of access through ETFs, seems to be a winning combination for those seeking exposure to the digital asset market.

As the digital asset landscape continues to evolve, these record-breaking inflows underscore the industry’s resilience and its ability to attract significant investments. The data paints a compelling picture of a thriving digital asset market, with the United States firmly positioned at the forefront of this financial revolution. Investors and market enthusiasts alike will be keenly watching as the momentum in digital asset investments unfolds in the coming months.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |