Key Points:

- DWF Labs injects 2.05M FETs into Binance, valued at US$3.87M, consolidating all FET positions.

- During a strategic deposit period (Feb 29 – Mar 3), DWF Labs invests in 3.05M tokens at 0.2 US dollars each. If liquidated, a potential profit of US$4.56M beckons.

- DWF Labs’ calculated steps signal confidence in Binance, showcasing market insight and positioning the company as a player ready to capitalize on dynamic digital asset landscapes.

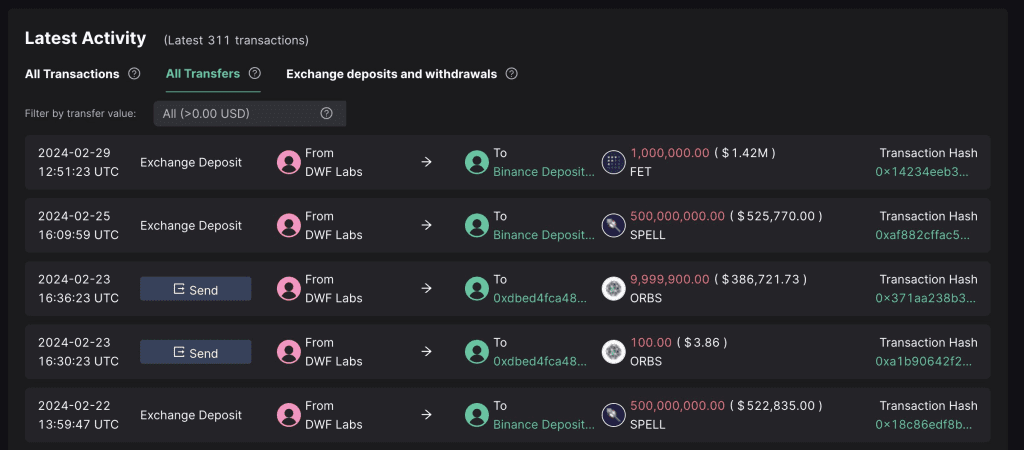

DWF Labs has recently recharged a staggering 2.05 million FETs to Binance, with an estimated market value of US$3.87 million.

This substantial deposit comes as part of a broader initiative by DWF Labs, culminating in the comprehensive transfer of all their FET positions within the renowned cryptocurrency exchange.

The significant transaction unfolded between February 29th and March 3rd, during which DWF made a series of calculated moves, depositing a total of 3.05 million tokens into Binance. Remarkably, these tokens were acquired at a cost of just 0.2 US dollars each, showcasing a keen financial acumen.

DWF Labs’ Bold Move Boosts Binance Portfolio

The total worth of this deposit, valued at US$3.87 million, positions DWF strategically within the volatile cryptocurrency market. The decision to recharge FETs and consolidate their holdings on Binance suggests a confident outlook on the platform’s performance.

Readmore: Popular Bitcoin ETFs: Exploring the Pros and Cons

What adds an extra layer of intrigue to this financial maneuver is the potential profit margin. If DWF Labs decides to liquidate their entire FET portfolio, the estimated profit stands at an impressive US$4.56 million. This revelation further underscores the company’s adept navigation of the cryptocurrency landscape, showcasing their ability to leverage market conditions for maximum gain.

The news of DWF Labs’ strategic deposit and profit potential is expected to resonate across the cryptocurrency community, drawing attention to the company’s financial prowess and decision-making acumen. As the market eagerly watches these developments, DWF Labs positions itself as a key player, ready to capitalize on the ever-evolving dynamics of the digital asset landscape.

Readmore: Private: Binance Referral Code 2024: Refer Friends And Get 100 USDT Trading Fee Credit Each.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |