Key Points:

- Stanford’s student-run Blyth Fund invests 7% in Bitcoin, embracing the crypto revolution.

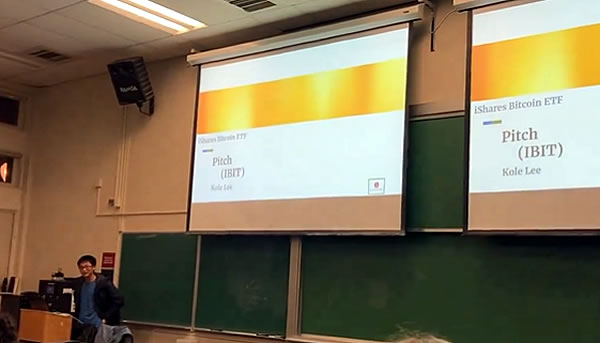

- Computer Science Major, Kole Lee, sways the fund with a $45,000 BTC purchase, emphasizing ETF potential.

- BlackRock follows suit, filing for Bitcoin exposure in a $36.5B high-yield fund, highlighting growing institutional interest.

Stanford University’s Blyth Fund has allocated up to 7% of its portfolio to Bitcoin (BTC) investments.

The decision, announced by Computer Science Major and Stanford Blockchain Club leader Kole Lee on March 5, follows his persuasive pitch to the fund in February.

Lee disclosed that Stanford’s Endowment purchased Bitcoin at $45,000, emphasizing that he also proposed BlackRock’s IBIT ETF to the Blyth Fund. His compelling arguments centered on three key factors: ETF inflows, crypto market cycles, and positioning Bitcoin as a hedge against “monetary chaos and war.”

Stanford’s Blyth Fund Dives into Bitcoin with 7% Portfolio Share

Read more: Coinbase Ventures Review: The Most Dynamic Investment Fund

Established in 1978 in honor of renowned banker Charles Blyth, the student-run Blyth Fund manages a substantial portion of Stanford’s Endowment. Traditionally focused on stocks, bonds, and other assets, the fund has now embraced BTC as part of its diverse investment strategy.

Speaking to Cointelegraph, Lee highlighted the Blyth Fund’s commitment to empowering its members to invest within their expertise and passions. He saw the ETF as an ideal avenue for Blyth to venture into Bitcoin.

Lee speculates that surpassing Bitcoin’s all-time high of $69,000 will trigger the covering of billions in shorts, fueling excitement and potentially leading to a volatile move to the upside.

BlackRock Eyes Bitcoin Exposure in $36.5B High-Yield Fund

Readmore: BlackRock Spot Ethereum ETF Is Now Delayed By SEC To Extend Approval Period

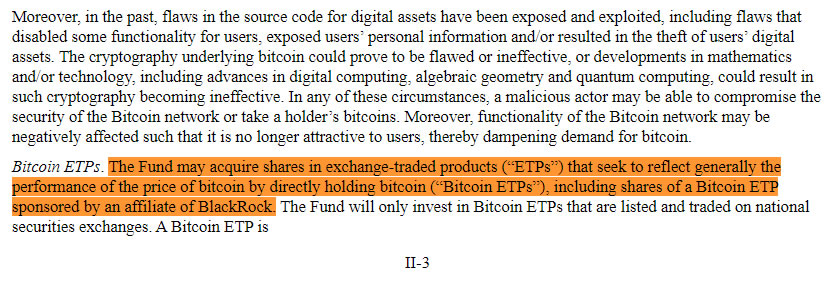

Simultaneously, asset manager BlackRock submitted an amendment to the Securities and Exchange Commission on March 4, indicating its intention to include Bitcoin exposure in its Strategic Income Opportunities Fund (BSIIX). The filing outlines plans to acquire shares in exchange-traded products (ETPs) directly holding Bitcoin, underscoring BlackRock’s growing interest in cryptocurrency.

With the recently launched IBIT becoming the top-performing among new Bitcoin ETFs, accumulating over $11 billion in assets and attracting a $420 million inflow on March 4, BlackRock’s move further signals the institutional embrace of Bitcoin as a mainstream investment.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |