Key Points:

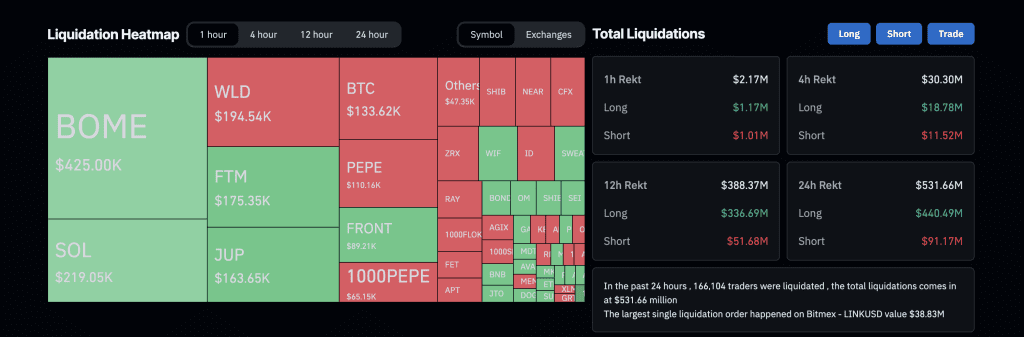

- The crypto market liquidation experienced a significant amount, witnessing over $500 million in liquidated positions as Bitcoin faced steep declines.

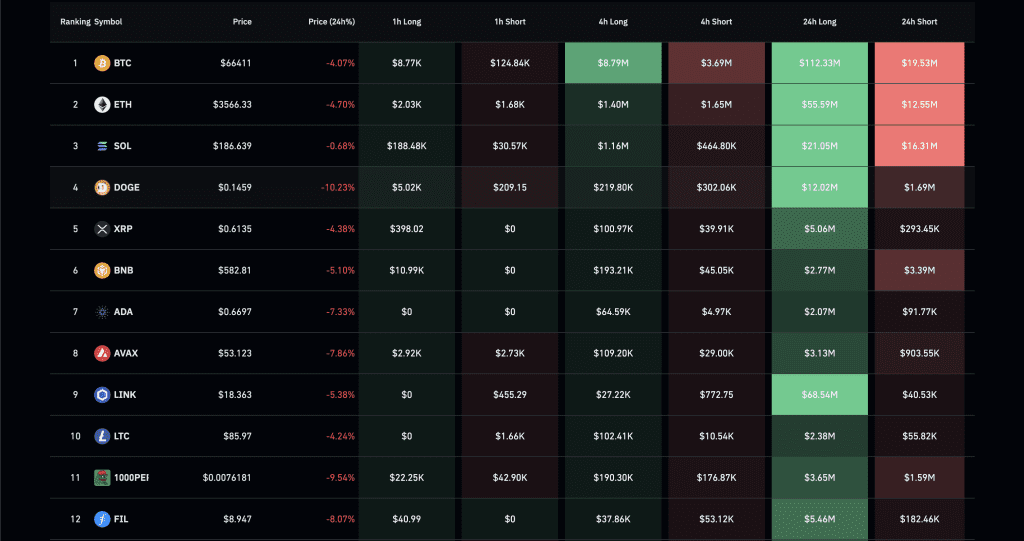

- Bitcoin fell below $65,000 within 24 hours, with SEI, FLOKI, and WIF seeing the most substantial drops, each plummeting over 20%.

- Despite the sell-off, derivatives data suggests underlying strength in the market.

The cryptocurrency market has been rattled by a significant downturn, witnessing over $500 million in liquidated positions amid a sharp decline in Bitcoin and other digital assets.

Crypto Market Liquidation Reaches Over $500 Million As Bitcoin Plunges

According to Coinglass data, Bitcoin plummeted below the $65,000 mark within the last 24 hours, with SEI, FLOKI, and WIF experiencing the most substantial declines, each dropping by more than 20%. The total crypto market liquidation volume amounted to $4531 million, with long orders totaling $440 million.

This massive liquidation has raised concerns about the sustainability of the recent bullish rally. The crypto market liquidation heatmap depicts widespread turmoil, with Bitcoin and Ethereum bearing the brunt of the sell-offs. Bitcoin alone witnessed a staggering $131 million liquidation event, suggesting widespread overleveraging among bullish investors.

Derivatives Strength Amidst Crypto Market Volatility

The accompanying Bitcoin chart reveals a stark price correction, with the cryptocurrency breaching key support levels after a prolonged upward trajectory. Previously, Bitcoin had found robust support at around $65,000, but its current descent indicates a shift in market sentiment from bullish to bearish.

Despite profit-taking and a cooling-off of the meme coin frenzy, derivatives data indicates underlying strength in the market, with funding rates experiencing a decline post-selloff. Notably, Bitcoin and Ethereum options continue to attract strong volumes, with traders favoring higher calls over puts.

As the crypto market grapples with heightened volatility and uncertainty, investors remain cautious amid fears of further downside potential.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |