Key Points:

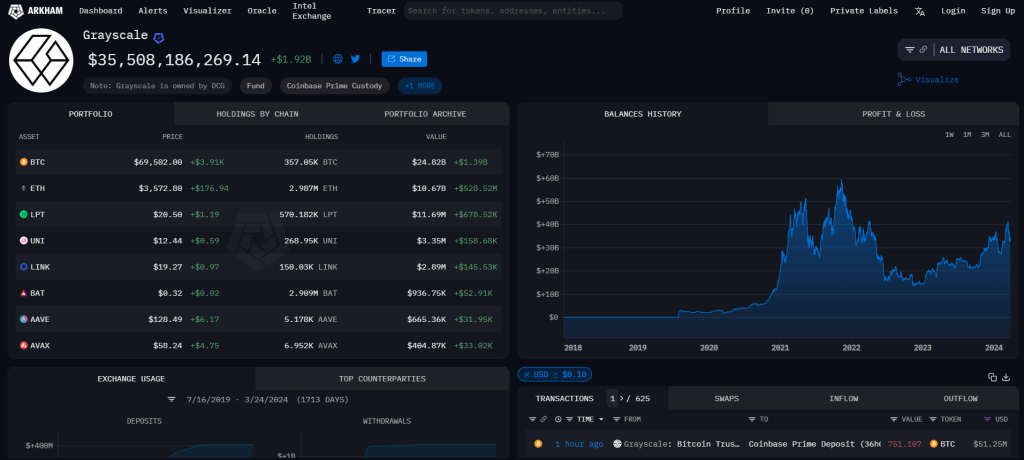

- Grayscale moves approximately 4,368 BTC to Coinbase Prime, totaling over $300 million.

- An additional 1,469 BTC, valued around $100 million, is transferred to two other addresses.

- The large-scale movement of Bitcoin by Grayscale sparks intrigue and speculation within the crypto community.

Grayscale transferred a substantial amount of Bitcoin (BTC) to various addresses.

Approximately 4,368 BTC, valued at over $300 million, was transferred to Coinbase Prime, one of the leading cryptocurrency exchanges.

This sizable transfer highlights Grayscale’s active involvement in the Bitcoin market, signaling potential strategic maneuvers or portfolio adjustments. Such movements often attract attention from investors and analysts, prompting speculation about the firm’s intentions and the broader market implications.

In addition to the transfer to Coinbase Prime, Grayscale also sent a total of 1,469 BTC, equivalent to approximately $100 million, to two other addresses. While the specific recipients of these transfers were not disclosed, such movements of significant funds can impact market dynamics and investor sentiment.

Read more: What is Bitcoin Halving? Why is this event of interest?

Grayscale’s Bitcoin Moves Spark Speculation and Interest

The transfer of such large amounts of Bitcoin underscores the continued institutional interest and investment activity in the cryptocurrency space. Institutions like Grayscale play a crucial role in shaping the market landscape, influencing prices, and contributing to overall market liquidity.

Grayscale’s decision to allocate a portion of its Bitcoin holdings to Coinbase Prime may indicate its confidence in the exchange’s infrastructure and services. Coinbase Prime is known for its robust security measures and regulatory compliance, making it a preferred platform for institutional investors seeking exposure to digital assets.

Grayscale’s recent Bitcoin transfers represent a noteworthy development in the cryptocurrency market, reflecting the ongoing evolution and maturation of institutional participation. As the industry continues to attract greater institutional interest, such movements are likely to become increasingly common, impacting market dynamics and shaping investor sentiment.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |